All the tools you

need for

your

website

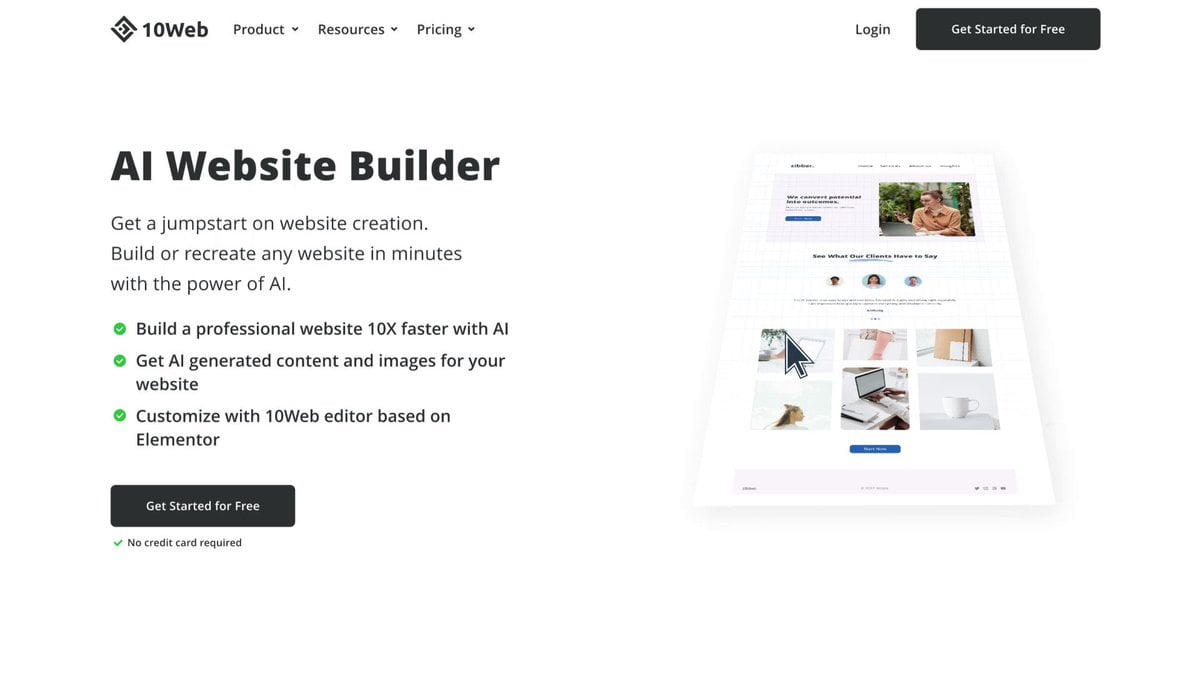

AI Website

Builder

Build or recreate any

website

with AI and get

AI generated

content

and images in minutes.

Customize it with 10Web editor based on Elementor.

AI Ecommerce

Website Builder

Build your Ecommerce business

with the help

of AI. Easily sell

and grow anywhere, everywhere.

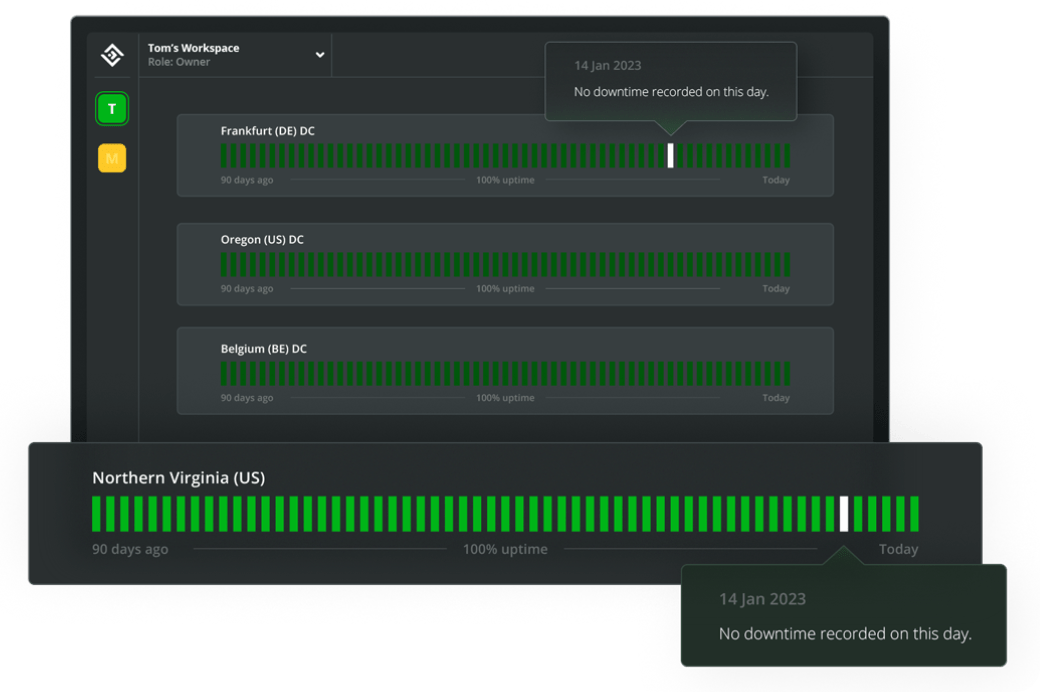

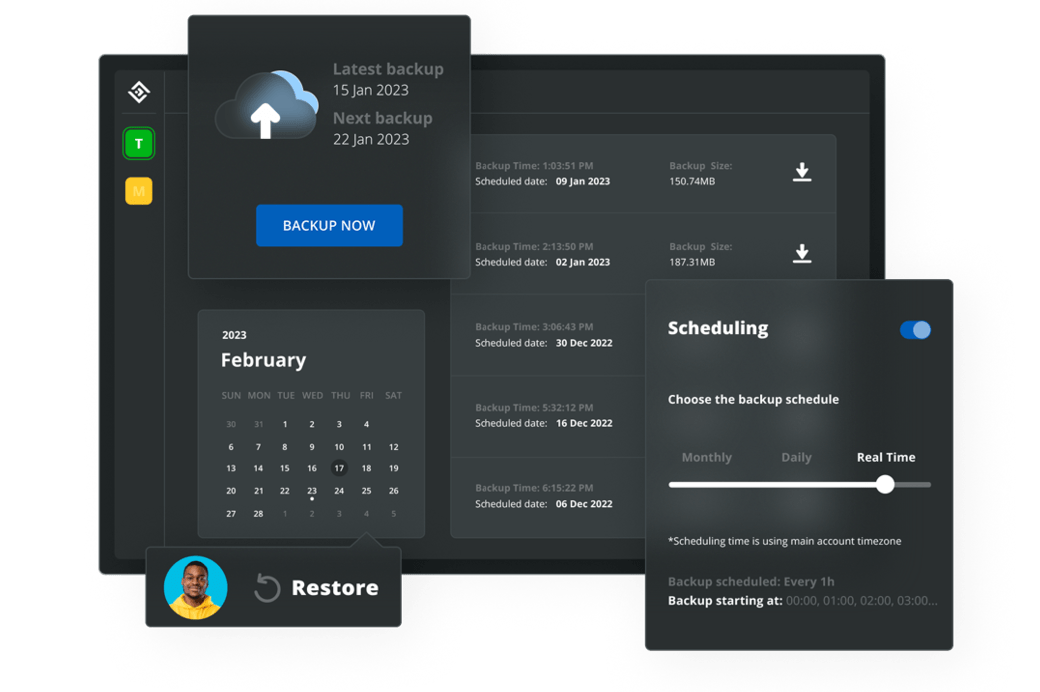

Automated

Hosting

Host your website on the fastest, fully automated hosting

for

WordPress

that’s powered

by Google Cloud.

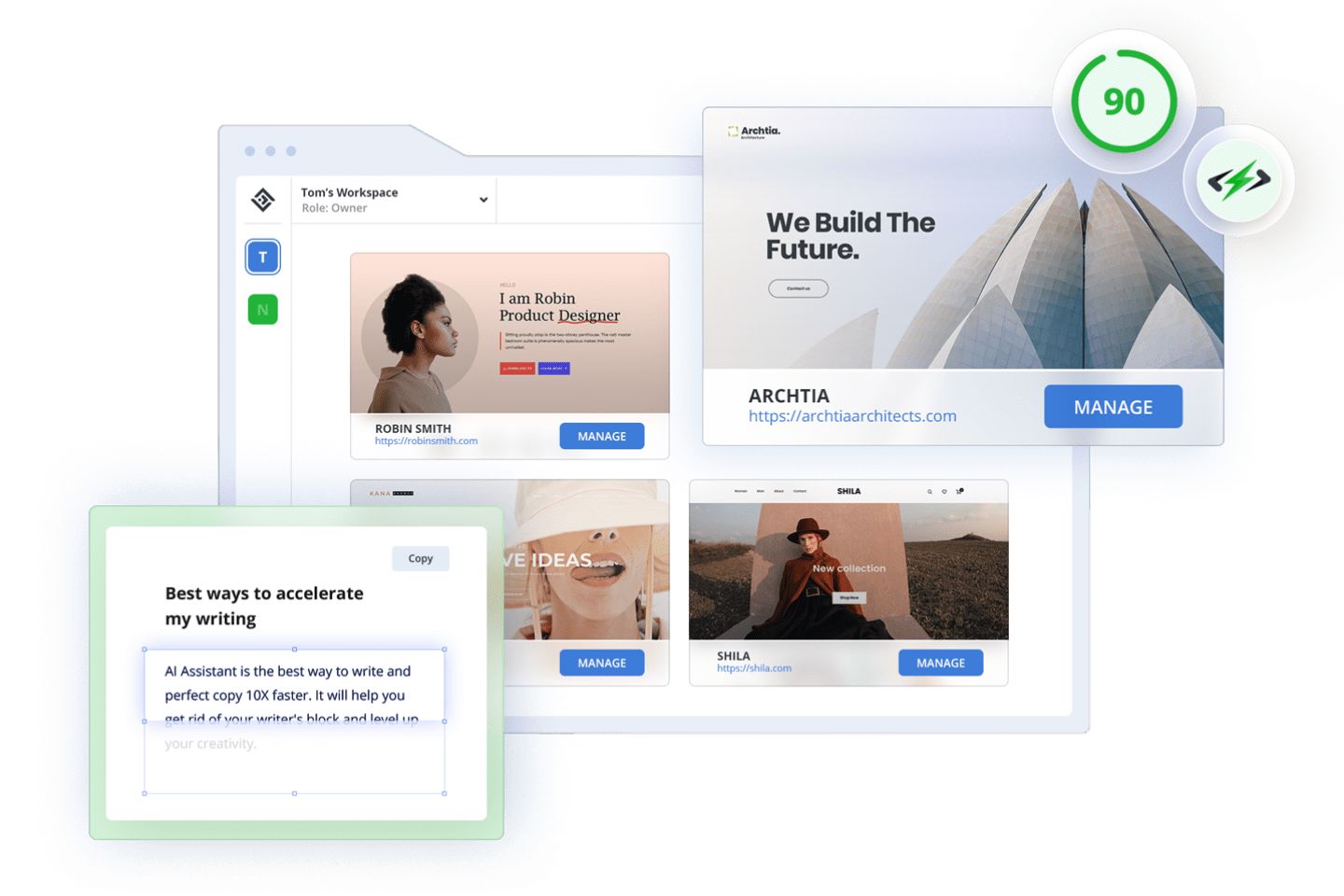

PageSpeed

Booster

Optimize your website

to receive

a

90+ PageSpeed score, improved Core

Web Vitals, and better performance.

Build

a professional website with

the

help of AI

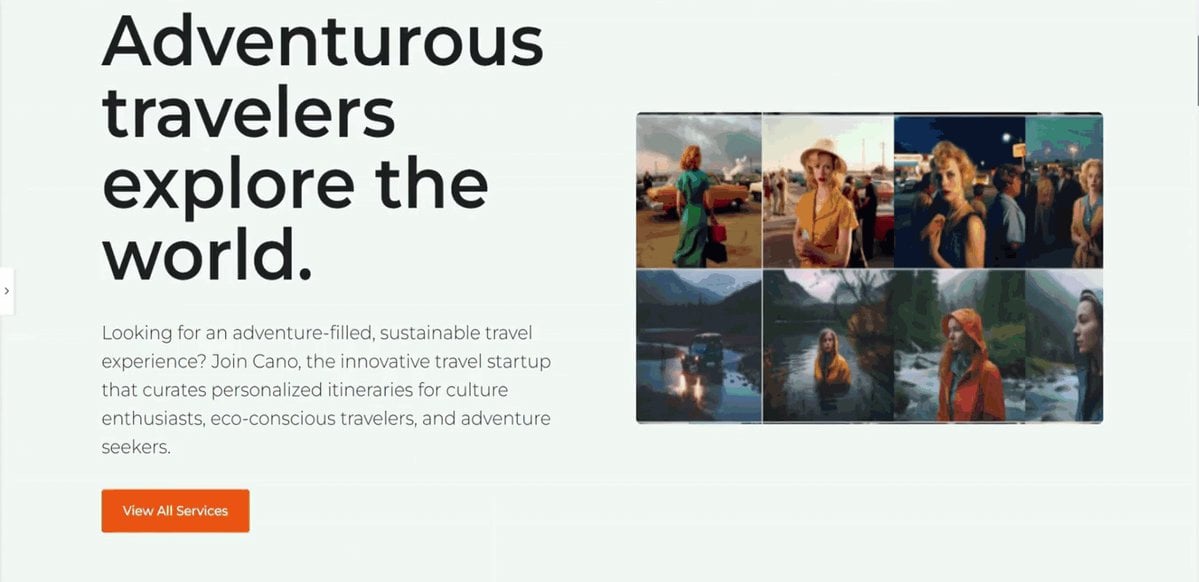

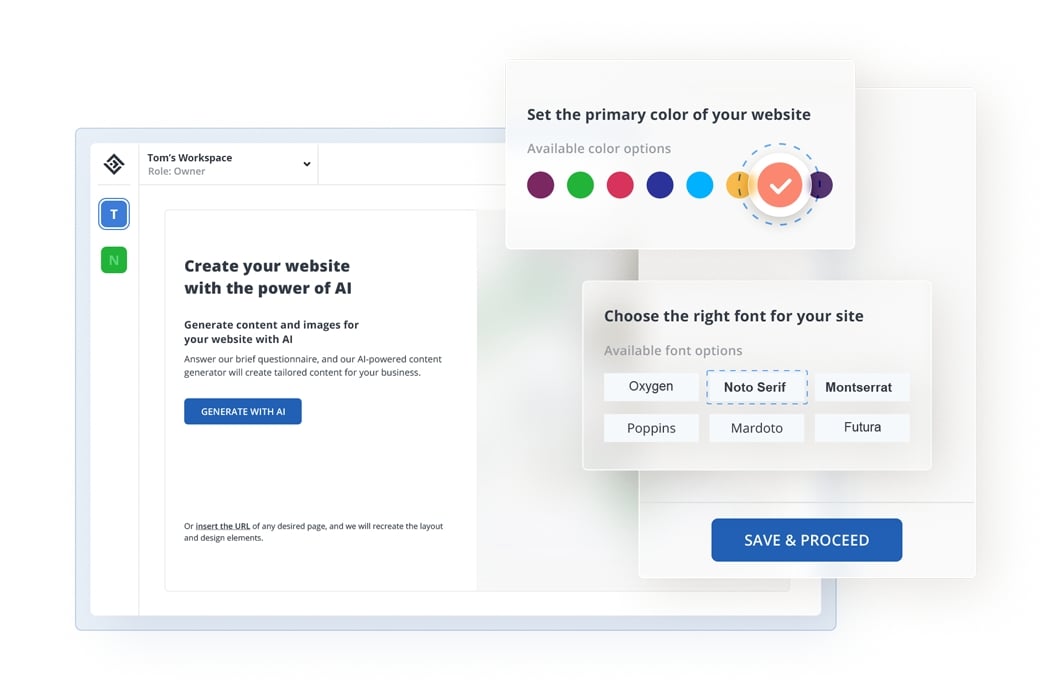

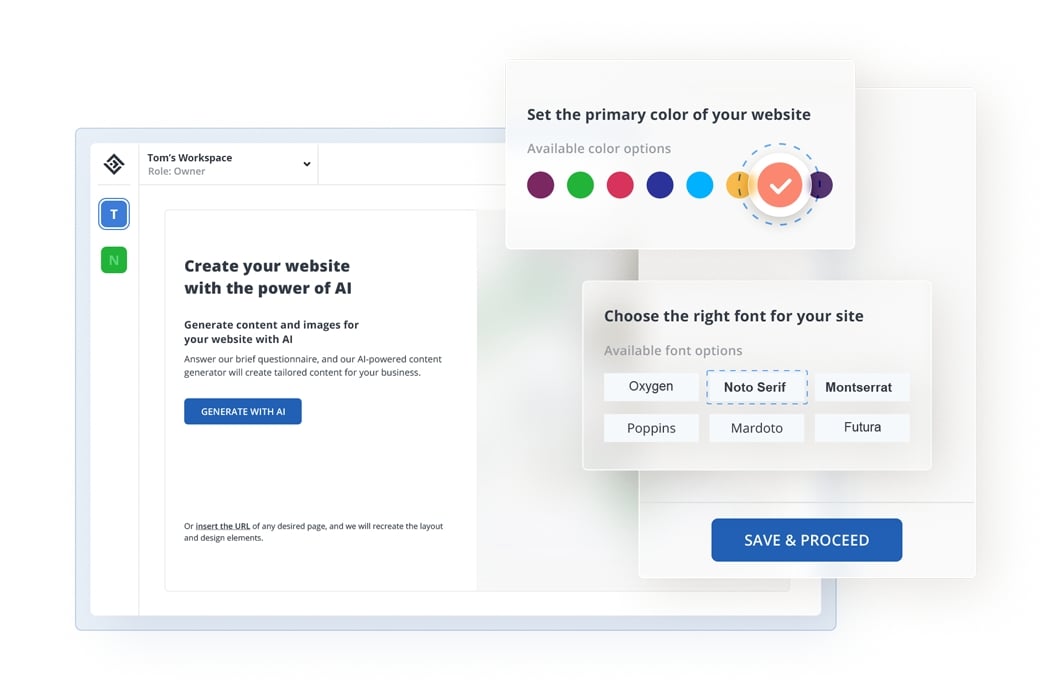

Create your website with

AI-generated content

and images effortlessly.

Start creating your website with AI

Create and customize your unique website

within minutes.

- Answer a few simple questions about your business

- AI will generate tailored content and images based

on your answers - Customize your content

and images - Add more pages and complete your website

Level up your

editing process

Create and customize

your unique website

within minutes.

Easily customize your website using our intuitive drag-and-drop editor and

premium widgets, all in one place.

Ensure full responsiveness across all screens, and experiment

with design elements, styles, colors, and typography.

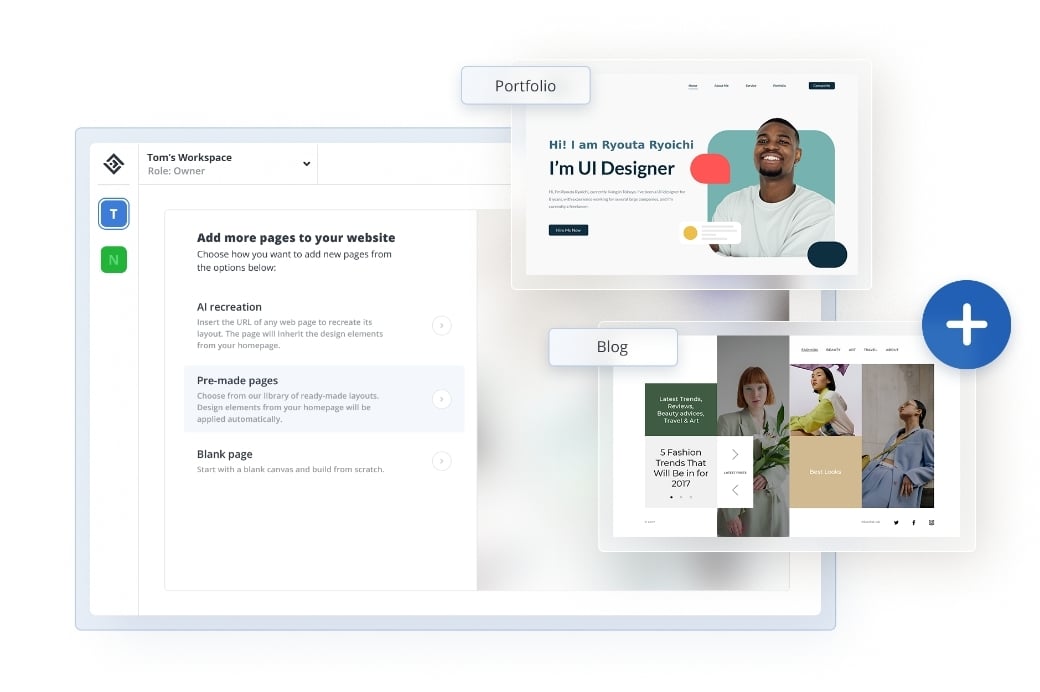

Add pages with AI

Choose the way you want to add pages and complete your website.

- Insert the URL of any web page to recreate the layout

- Choose from our library

of ready-made layouts - Start with a blank canvas and build from scratch

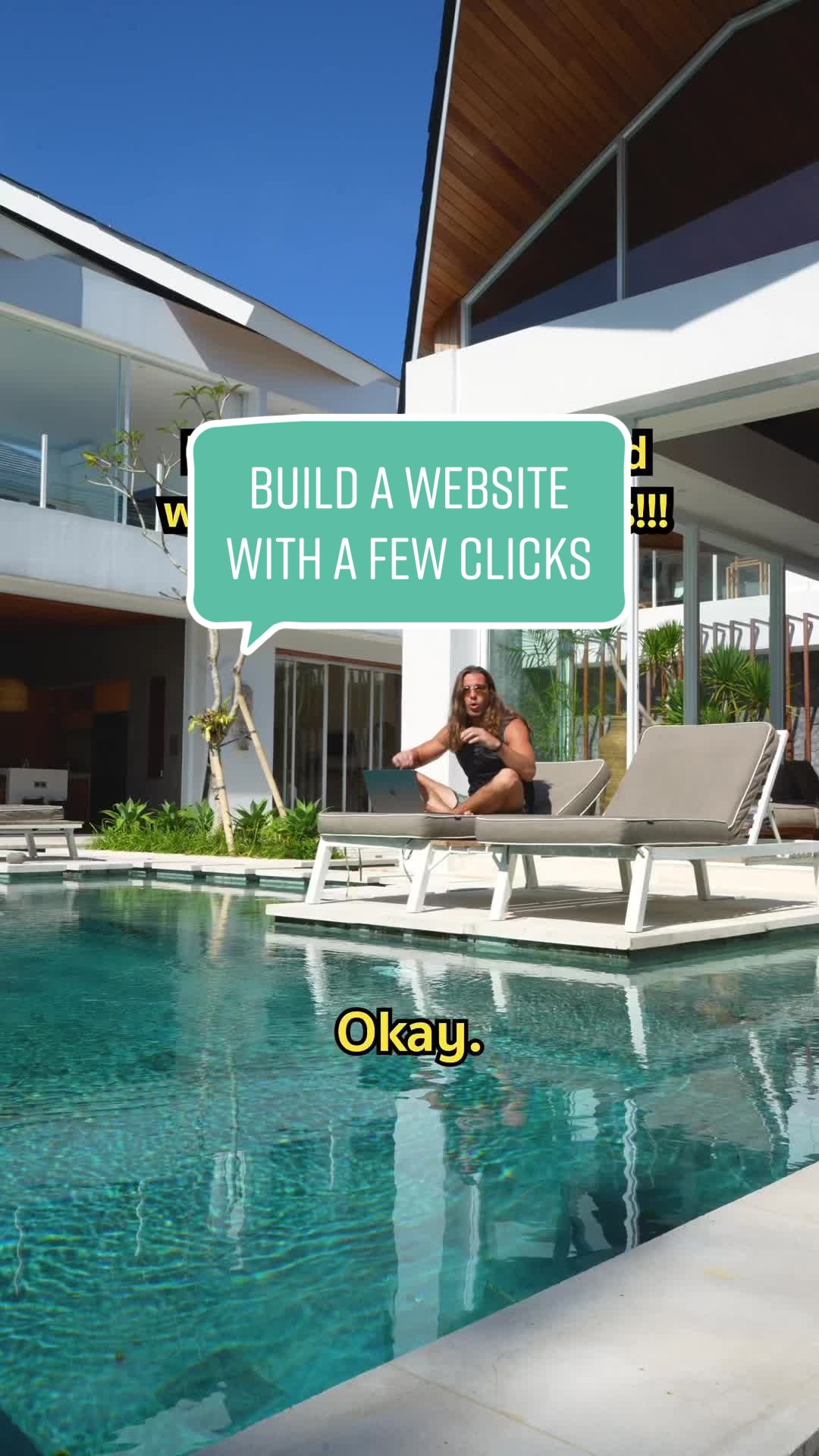

Recreate any website

Like a website and want

to make one similar?

Let AI

save you hours of work in

just minutes.

- Simply insert

the homepage URL - AI will copy the layout, design elements, and content

- Customize with drag

and drop editor - Add more pages and complete your website

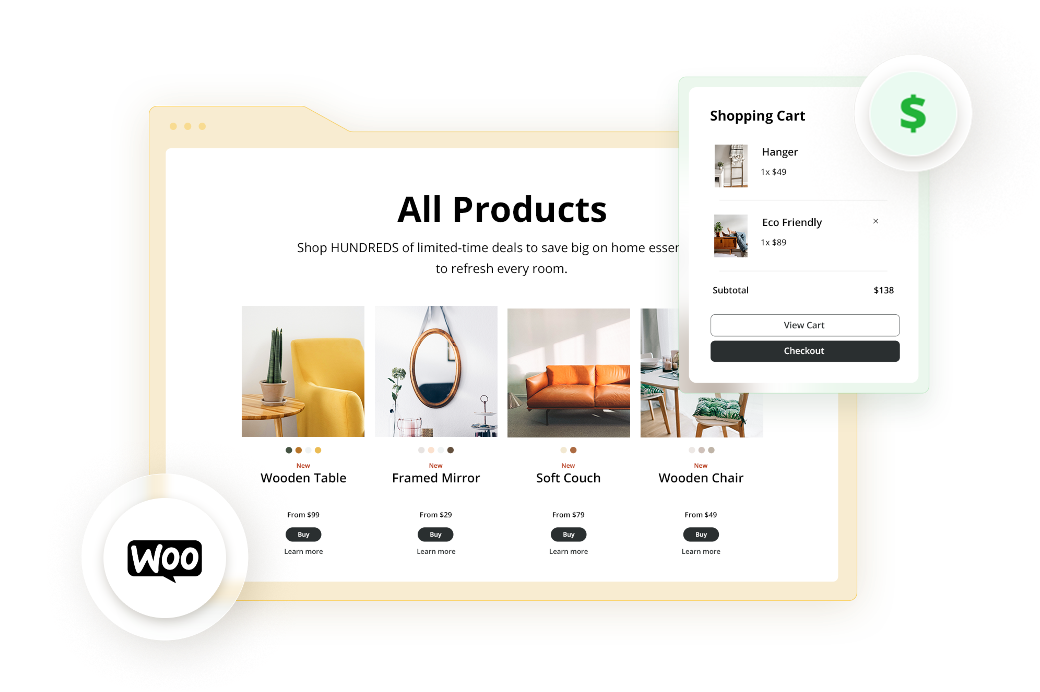

Scale your Ecommerce business

Experience unlimited growth opportunities for

your Ecommerce business with 10Web.

Get unparalleled performance, reliability,

and ease-

of-use with 10Web

AI Ecommerce Website Builder.

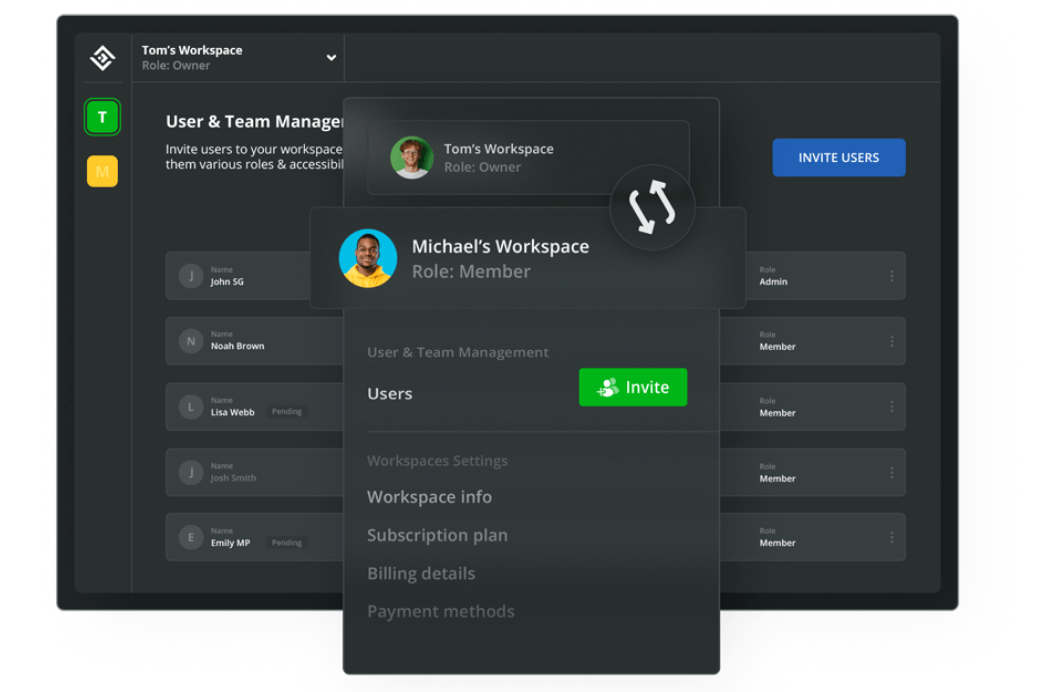

AI Website Builder integration

Product page customization with AI

Product description generation with AI

Easy-to-use dashboard

for product managementInventory and order tracking

WooCommerce powered backend

AI tools for your business success

AI Business

Name Generator

Effortlessly generate captivating

and memorable business names

using AI,

at no cost.

AI Marketing

Strategy Generator

Leverage the power of AI

to create your winning marketing

strategy

and achieve exponential

revenue growth.

WordPress

AI Assistant

Write and perfect SEO-optimized content with

AI 10X faster

in Gutenberg and

Classic Editor.

AI Assistant

SEO Pack

Improve your website SEO,

increase

your website rankings

and fix SEO

and readability errors

in Yoast SEO.

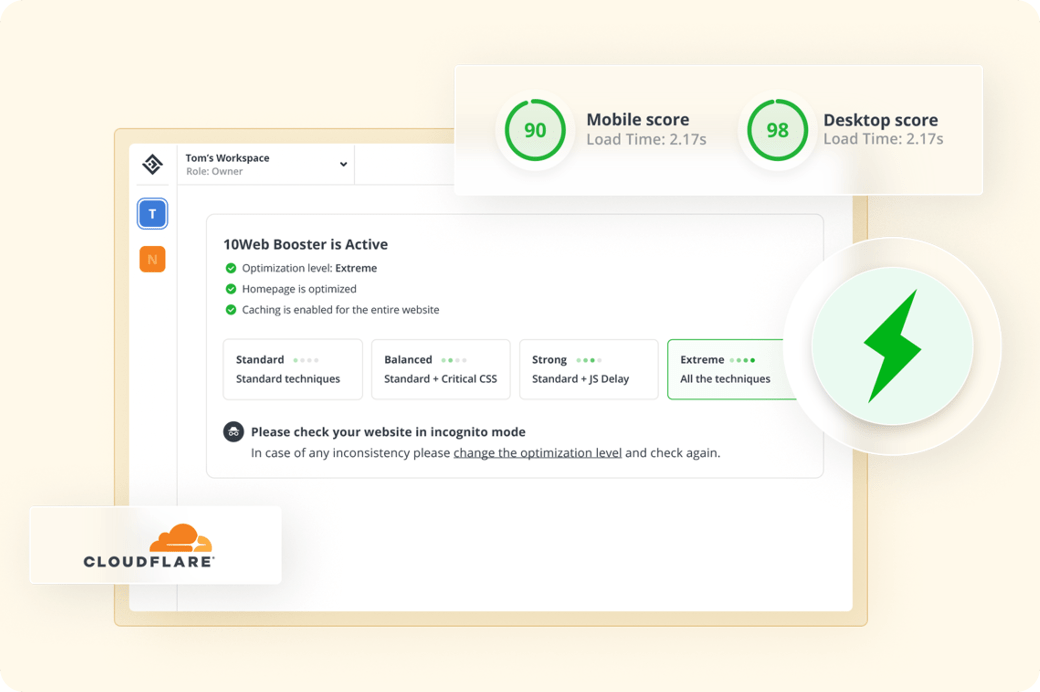

Automated PageSpeed

Booster

with Cloudflare CDN

Supercharge your website’s performance and speed with ease.

Website optimization

Complete frontend

optimization on any hosting that gives

WordPress websites:

90+ PageSpeed score

Improved Core Web Vitals

50% faster load times

Higher rankings on Google

Better UX and website performance

Image optimization

Optimize all images on your website for faster loading:

WebP conversion

Container-specific image resizing

Image lazyload

Auto-optimization of new uploads

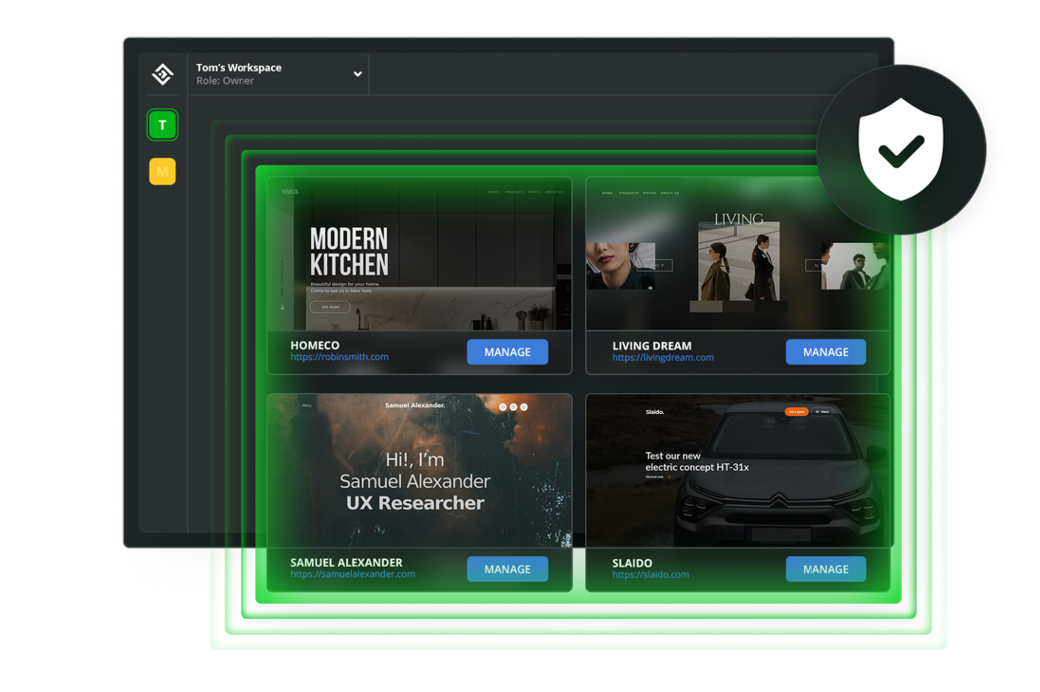

Cloudflare CDN

Reduce latency and load times and improve performance by enabling Cloudflare Enterprise CDN:

Enterprise CDN

Full page cache

DDoS and bot protection

Free SSL certificate

Web application firewall

Mobile optimization with Mirage

100s of influencers love 10Web

Experience the revolutionary impact of 10Web in the digital landscape.

Unlock the potential of AI firsthand.

FAQ

Image optimization does several things. First it converts images to WebP format, which drastically reduces the size of your website images, allowing them to quickly load.

Second, it implements container-specific image resizing, which creates small size images and displays them instead of full-size images for visitors using small-screen devices.

Third, image optimization implements lazy-loading and preloading of images, two techniques ensuring fast webpage loading with instant on-demand image display.

On top of that, with Cloudflare’s Mirage optimization, we optimize all images based on device and network connection types for each mobile visitor