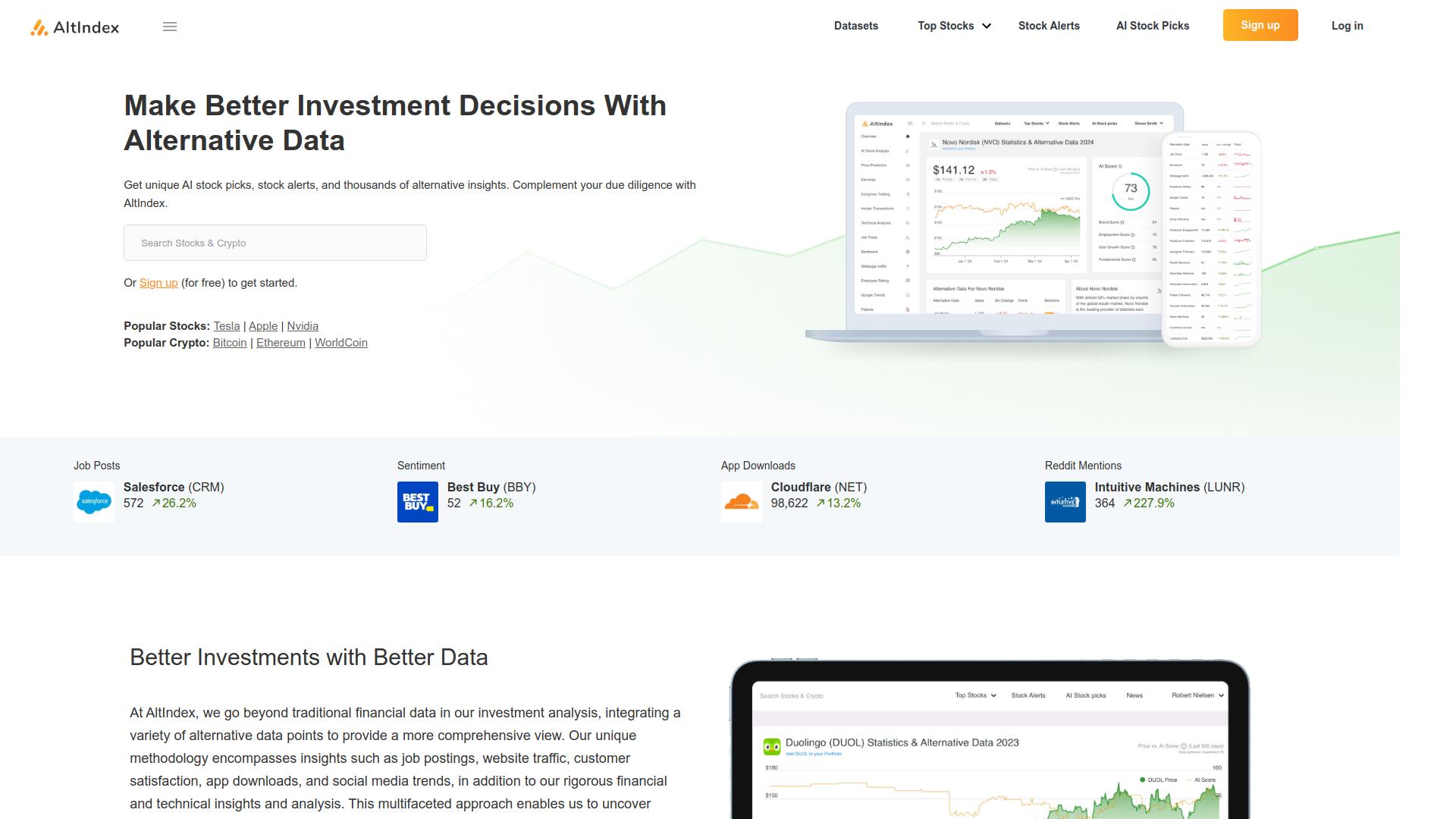

Overview

AltIndex is a cutting-edge investment platform that leverages artificial intelligence to provide unique stock picks and timely alerts based on a blend of traditional and alternative data sources. This innovative tool analyzes metrics such as job postings, website traffic, customer feedback, app downloads, and social media trends to offer a comprehensive view of potential investment opportunities. With over 20,000 members, AltIndex delivers more than 100 daily alerts and boasts an impressive 80% win rate on its AI-driven stock recommendations.

The platform is designed to keep investors ahead of market trends and informed about significant changes affecting companies in their portfolios. Whether it's a spike in social media engagement or a notable shift in website traffic, AltIndex's advanced algorithms detect and report these developments promptly, enabling users to react swiftly to market dynamics. The platform's user-friendly interface, combined with its robust analytics tools, makes it an invaluable resource for retail investors seeking to enhance their investment strategy.

AltIndex has garnered positive reviews for its effective stock picks, responsive customer service, and the actionable insights it provides. It is highly recommended for anyone looking to harness the power of AI in making smarter, data-driven investment decisions.

Key features

- AI-driven stock picks: AltIndex uses advanced algorithms to analyze both traditional and alternative data, achieving an 80% win rate on stock recommendations.

- Real-time stock alerts: Users receive immediate notifications based on dynamic changes in social media trends, website traffic, and other alternative data points.

- Comprehensive data integration: The platform integrates diverse data sources including job postings, customer reviews, and app downloads for a holistic investment perspective.

- User-friendly dashboard: AltIndex provides a streamlined, easy-to-navigate interface that allows users to efficiently manage their investments and access key insights.

- Portfolio performance alerts: The tool sends alerts about significant events affecting portfolio companies, helping users to react promptly to market changes.

- Community and support: With over 20,000 members, AltIndex fosters a community of investors, enhanced by responsive customer support and user testimonials.

Pros

Pros

- Customizable alerts: Users can set personalized criteria for stock alerts, ensuring they receive notifications tailored to their specific investment strategies and risk preferences.

- Historical data analysis: AltIndex offers extensive back-testing capabilities, allowing users to evaluate the performance of stock picks over historical data for more informed decision-making.

- Advanced risk management: The platform includes tools that help users assess and manage investment risks, providing strategies to mitigate potential losses in volatile markets.

- Seamless integration with brokers: AltIndex allows for direct integration with multiple brokerage accounts, enabling easy execution of trades and portfolio management from a single interface.

- Regular market insights: Subscribers receive weekly market analysis and insights, helping them stay informed about the latest trends and investment opportunities.

Cons

Cons

- Algorithm dependency: AltIndex heavily relies on algorithms which may not fully capture market nuances or rare economic events, potentially leading to unexpected results.

- Data overload risk: The vast integration of diverse data sources might overwhelm users, making it challenging to distinguish critical information from noise.

- Limited personalization: While comprehensive, the platform may not offer enough customization options for users with unique or complex investment strategies.

- Community bias influence: The large community could skew perceptions or investment decisions, especially if dominant opinions do not align with best investment practices.

- Alerts sensitivity: The real-time alerts system might generate frequent notifications, which could lead to decision fatigue or hasty trading actions by the users.