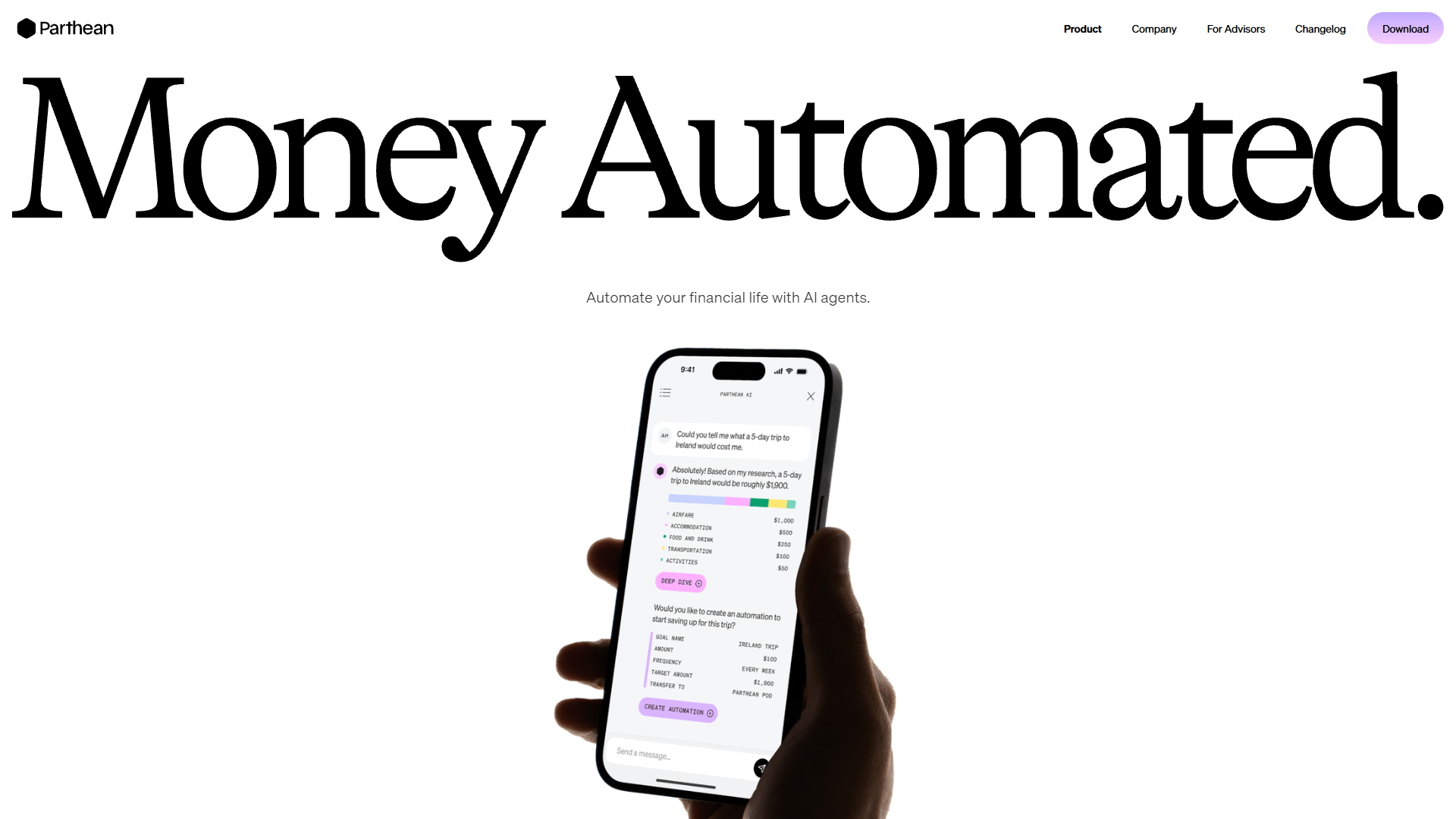

Overview

Parthean is a revolutionary tool that transforms how individuals manage their finances. Harnessing the power of AI, it provides an intuitive platform where users can automate their financial transactions and gain insights into every monetary aspect. Its features include daily, weekly, or monthly automated saving and debt management, ensuring users never miss a payment or incur an overdraft.

Moreover, Parthean offers real-time insights into spending, investments, and credit, empowering users with knowledge to make informed financial decisions. The app works as an AI-powered financial assistant, offering personalized financial plans based on the user's particular goals and needs, be it planning for a major life event or just optimizing monthly savings.

Security is another key feature. Parthean is conscientious about providing a safe environment for financial activities by employing top-tier encryption and data protection measures. By ensuring bank-level security, it builds trust and allows users to engage freely with their financial data. With its blend of automation, insights, and security, Parthean represents a significant advancement in AI-driven financial tools, offering unmatched convenience and peace of mind.

Key features

- Automated financial management: Parthean enables users to set up automated savings and debt repayments, ensuring financial activities are carried out smoothly without the risk of overdrafts or missed deadlines.

- Real-time financial insights: The tool provides up-to-the-minute information on spending, investments, and credits, allowing users to monitor their financial health and make data-driven decisions.

- AI-driven personalization: Parthean customizes financial advice and planning according to individual user goals, offering personalized strategies for financial events like paying off debt or planning trips.

- Bank-level security: The app prioritizes the user's data protection by using advanced encryption and anonymization techniques, making financial transactions safe and secure.

- Seamless account linkage: Users can easily connect all their financial accounts through Parthean, fostering a streamlined management experience from one unified interface.

- Intuitive user interface: Simplicity and ease of use are central to Parthean’s design, ensuring users can navigate and utilize its features effectively without prior technical expertise.

Pros

Pros

- User-friendly interface: Parthean is designed with the end-user in mind, ensuring that financial management is as simple and intuitive as possible, which helps users of all skill levels engage with the app seamlessly.

- Comprehensive financial planning: The tool offers users the ability to outline and reach financial goals, providing insights and strategies tailored to individual needs, from debt reduction to savings optimization.

- Advanced data protection: By implementing cutting-edge encryption technologies, Parthean ensures that user data is securely managed and protected against unauthorized access.

- Seamless automation: Parthean takes care of routine financial tasks through automation, freeing users to focus on their financial goals without being bogged down by manual processes.

- Integrated financial insights: Parthean consolidates data from multiple sources to provide a thorough overview of a user's financial situation, empowering informed decision-making.

Cons

Cons

- Limited international availability: As of now, Parthean's financial services are primarily available to users within specific regions, restricting its accessibility for international users wanting the same benefits.

- Requires bank account linking: To take full advantage of all features, users need to link their bank accounts, which may present privacy concerns for some individuals.

- Mobile app only: Parthean is optimized for mobile platforms, which might limit usability for those preferring desktop solutions or larger interfaces for managing finances.

- Initial learning curve: New users might experience a learning curve as they familiarize themselves with the app's various features and automated functionalities.

- Dependency on AI algorithms: Users need to trust AI-driven insights and decisions, which may not always align perfectly with individual financial philosophies or practices.