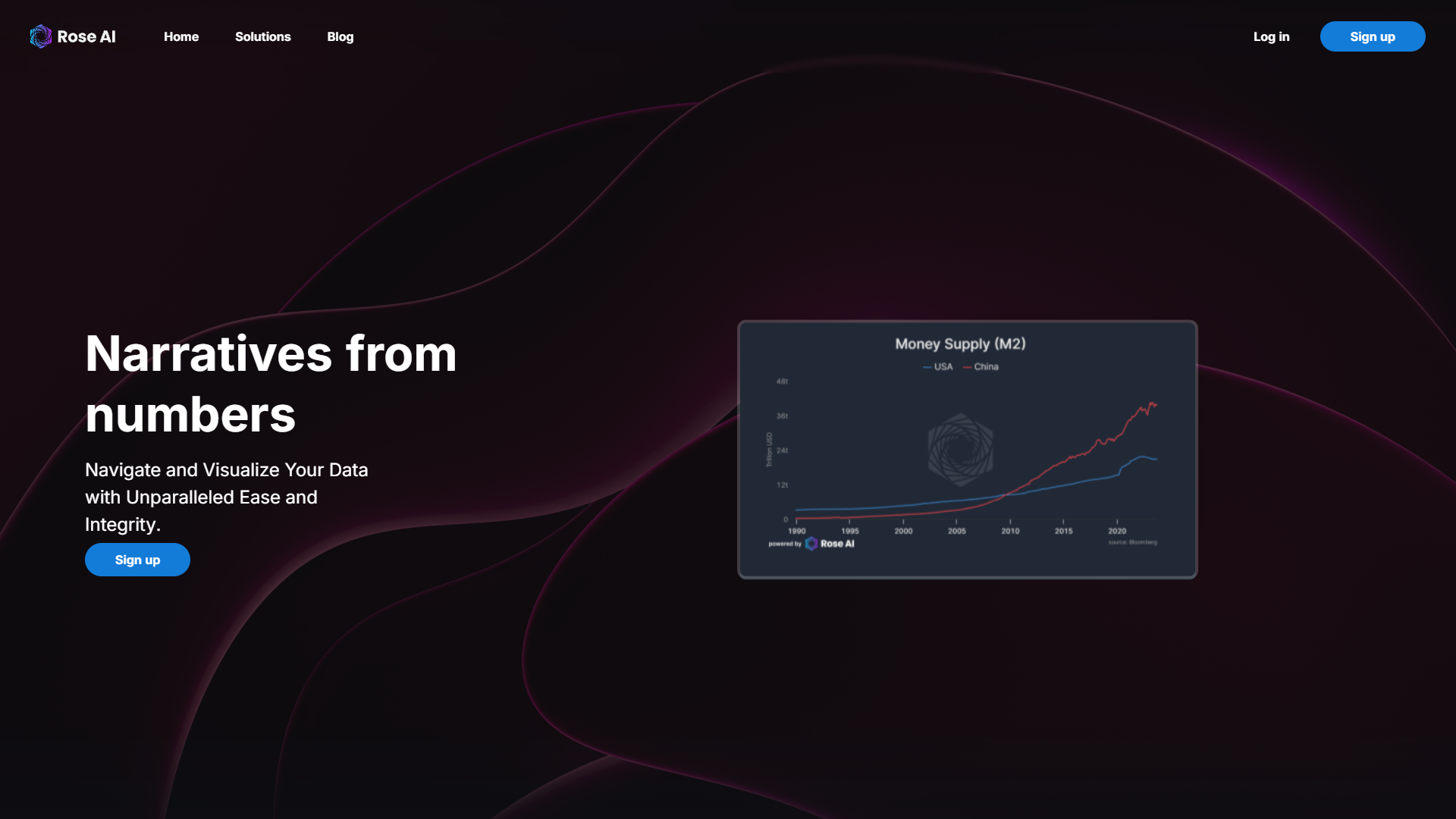

Overview

Rose AI is an innovative platform tailored for financial analysts and decision-makers, designed to streamline the complexities of data integration, warehousing, and visualization. This robust tool leverages advanced language models to enhance data discovery and provides dynamic, insightful visualizations that make interpreting vast amounts of financial data straightforward and efficient. With Rose AI, users benefit from logic trees that ensure each data point is traceable, promoting transparency and reliability in data analysis.

The platform is equipped with over 100 built-in data transformations and supports a wide array of data sources, enhancing its versatility and user-friendliness. Rose AI's intuitive use of natural language processing (NLP) allows users to interact with their data conversationally, making it easier to convert complex datasets into clear, actionable narratives. This feature, combined with powerful data visualization tools, enables users to not only understand their data at a glance but also to share insights seamlessly, fostering better collaboration within teams.

Endorsed by leading venture capital firms and celebrated in user testimonials, Rose AI stands out as a cost-effective, time-saving solution for financial professionals. It empowers them to navigate through the intricacies of financial data with confidence and ease, thereby enhancing decision-making processes and business outcomes.

Key features

- Advanced language models: Utilizes cutting-edge language processing to enable intuitive data queries and simplify data discovery for financial analysts.

- Logic tree visualization: Provides a traceable visualization of data points, allowing users to see the decision paths and origins of data insights.

- Dynamic data visualization: Offers a range of visualization tools that adapt to the complexity and nature of financial data, enhancing interpretability.

- Seamless collaboration features: Facilitates effective teamwork with tools that support simultaneous data access and manipulation by multiple users.

- Extensive data transformations: Includes over 100 pre-built transformations to streamline the process of converting raw data into actionable insights.

- Comprehensive data integration: Supports a wide array of data sources, ensuring flexible and robust data warehousing solutions for diverse financial environments.

Pros

Pros

- Real-time data updates: Automatically refreshes data, ensuring financial analysts always have access to the most current information for accurate decision-making.

- Customizable dashboards: Allows users to create personalized interfaces that highlight key metrics and data points critical to their specific financial analysis needs.

- Enhanced security protocols: Employs robust security measures to protect sensitive financial data from unauthorized access and breaches, ensuring compliance and trust.

- Scalable architecture: Designed to handle increasing amounts of data and user growth, making it ideal for expanding financial organizations.

- AI-driven insights: Leverages artificial intelligence to provide predictive analytics and trend forecasting, enhancing strategic financial planning.

Cons

Cons

- Complex setup process: The initial configuration and integration of diverse data sources can be time-consuming and require specialized IT skills.

- Overwhelming feature set: The extensive range of transformations and visualizations might be complex for new users to navigate effectively.

- High resource consumption: Advanced processing capabilities and extensive data handling can lead to significant demands on system resources.

- Potential data overload: The capability to integrate and visualize vast amounts of data might lead to information overload, complicating decision-making.

- Steep learning curve: The sophisticated features like logic tree visualization and dynamic data visualization require a considerable learning investment.