Overview

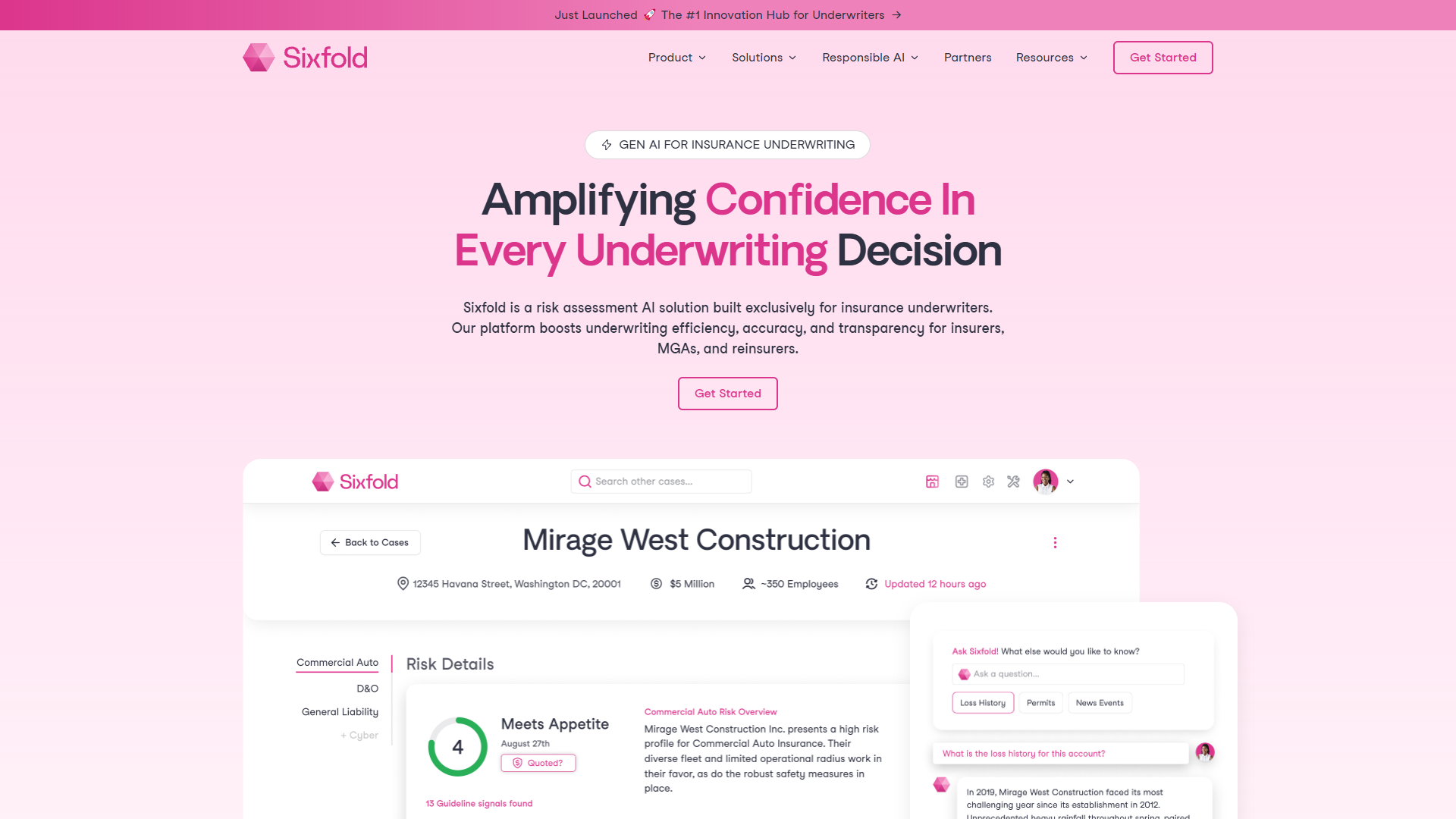

Sixfold is a specialized AI tool crafted to support the complex needs of insurance underwriters. It leverages advanced AI capabilities to streamline and enhance the underwriting process by ensuring more accurate and efficient decision-making. This tool is particularly beneficial for insurers, MGAs, and reinsurers who rely on precise risk assessments to make informed decisions. With Sixfold, users can enjoy a significantly faster triaging process, gain access to fully contextualized risk signals, and experience a drastic reduction in the time needed to gather necessary data.

Using Sixfold, underwriters can benefit from a more transparent and comprehensive workflow. The tool ingests underwriting guidelines to clearly identify various risk factors, extracts risk-related data from submissions and supporting documents, and provides tailored recommendations that align with a company's unique risk appetite. By synthesizing data from diverse sources, the platform offers semantic matches, summaries, and suggestions that can lead to improved efficiency and accuracy in underwriting decisions. The implementation of Sixfold promises to transform traditional underwriting processes into a seamless and more intelligent operation.

Key features

- Faster triaging process: Sixfold speeds up the triaging process for underwriters, helping them to sort and assess submission priorities more rapidly and efficiently than traditional methods.

- Contextualized risk signals: The platform offers comprehensive risk signals that are fully contextualized, providing a deeper understanding of both positive and negative factors involved in underwriting decisions.

- Efficient data gathering: It reduces the time needed for data collection from days to minutes by efficiently gathering information from submissions, supporting documents, and third-party sources.

- Tailored recommendations: Offers customized recommendations and insights based on the unique risk appetite of the user, making underwriting decisions more precise and informed.

- Data synthesis capabilities: Sixfold synthesizes data from various sources into summaries and semantic matches, simplifying complex information into easily understandable formats.

Pros

Pros

- Streamlines complex workflows: Sixfold significantly simplifies the intricate processes involved in insurance underwriting, making it easier for underwriters to manage and analyze data.

- Improves decision transparency: The platform ensures transparency in all underwriting decisions, providing underwriters with clear insights and a comprehensive view of each decision.

- Enhances data-driven insights: With robust data analysis features, Sixfold empowers users with valuable insights derived from a wide array of data sources, boosting informed decision-making.

- Customizable to user needs: Users can tailor Sixfold's features and recommendations to align perfectly with their specific risk appetite, allowing for more personalized and effective underwriting.

- Reduces operational time: By automating data collection and synthesis, Sixfold helps in reducing the time spent on repetitive tasks, allowing underwriters to focus on strategic activities.

Cons

Cons

- Steep learning curve: New users might experience challenges while understanding and integrating Sixfold into their existing workflows, requiring time and training for maximum efficiency.

- Limited industry applications: While Sixfold excels in insurance underwriting, its application in other industries may be limited, focusing primarily on insurers, MGAs, and reinsurers.

- Requires guideline integration: Users need to properly integrate their underwriting guidelines for Sixfold to deliver tailored results, which can be time-consuming without proper setup.

- Dependency on data quality: The effectiveness of Sixfold heavily relies on the quality and comprehensiveness of the data provided, necessitating accurate and up-to-date information for optimal performance.