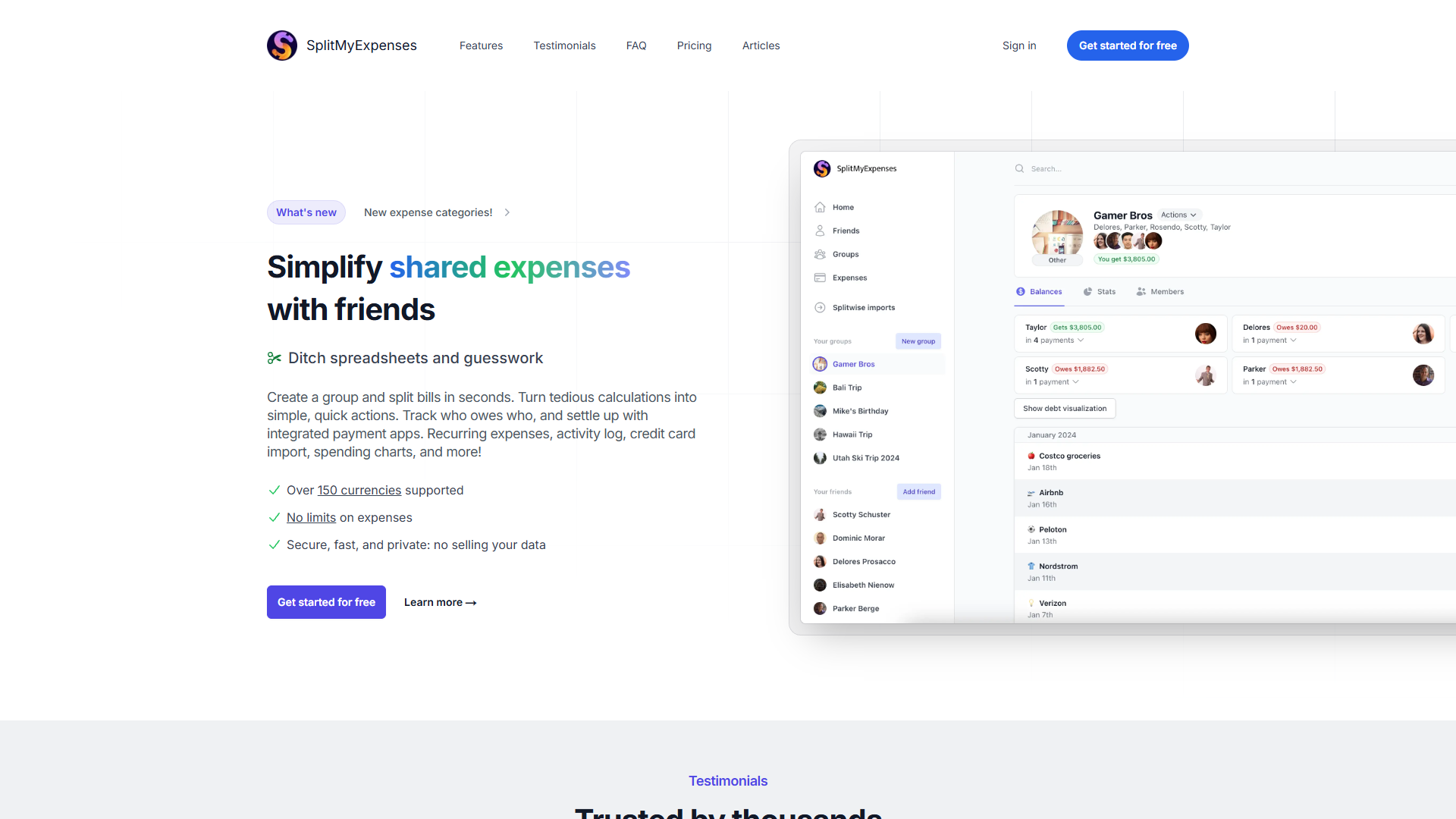

Overview

SplitMyExpenses aims to revolutionize how individuals manage shared expenses, offering tools that simplify bill splitting and settlement. The platform enables users to create groups and split bills seamlessly, saving time and reducing errors associated with manual calculations. By supporting over 150 currencies and providing integrated payment options, settling up becomes more straightforward, no matter where the users are located.

Through advanced features like AI-powered receipt itemization, SplitMyExpenses makes it possible to easily categorize expenses by item, ensuring accuracy and transparency among group members. The app's design emphasizes a user-friendly experience with its modern layout, keyboard shortcuts, and customization options. Users can track recurring expenses, check spending trends through visual charts, and manage debts with ease. Overall, SplitMyExpenses is a comprehensive tool designed for those who want to avoid the complexities associated with shared expenses.

Key features

- Split bills seamlessly: Users can create groups to divide expenses among friends instantly, ensuring everyone pays their share without complex calculations.

- AI-powered receipt itemization: The tool scans receipt images, automatically breaking down item costs so expenses can be split accurately among members.

- Beautiful spending charts: Visualize spending patterns by category and see debts using colorful, easy-to-read charts, aiding financial understanding and planning.

- Integrated with payment apps: Directly connects with popular payment platforms like Venmo and PayPal to streamline the settlement of shared bills.

- No limit on expenses: Supports limitless entries for users to manage all their shared expenses without restrictions, enhancing flexibility and accessibility.

Pros

Pros

- User-friendly interface: The platform's intuitive design and easy navigation make it accessible even for users who are not tech-savvy.

- Efficient debt management: Automatically rearranges debts in group settings to minimize the number of transactions needed, saving users time and effort.

- Secure and private platform: Promises strong privacy measures, ensuring no user data is shared or sold, offering peace of mind.

- Comprehensive currency support: Handles over 150 currencies, making it ideal for international users managing expenses across borders.

Cons

Cons

- Learning curve for new users: New users might require some time to get accustomed to all features and functionalities offered by the tool.

- Limited free receipt scans: The free plan might restrict the number of receipt scans available to users, potentially complicating expense tracking for larger groups.

- Customization might overwhelm simple needs: Users with basic needs might find the extensive customization options excessive or unnecessarily complex.

- Occasional feature over-exploration: Users might occasionally struggle to locate specific features among the many offered ones without some initial guidance.