Do you want to earn extra money by starting a small business at home? You are in the right place to learn how to start a small business at home with careful planning and strategy. This guide outlines essential steps to help you evaluate your business idea, create a solid business plan, set up an efficient workspace, and meet legal requirements.

From identifying a profitable niche to effective marketing and financial management, you’ll learn how to turn your home-based business idea into a successful reality. Whether it’s leveraging online marketplaces or forming strategic partnerships, these tips will guide you through building a sustainable and competitive home business.

FAQ

What is the easiest business to start from home?

How can I start a small business with no money?

How much money do you need to start a small business at home?

Can I start a small business from home?

Stage 1: Developing the idea and the business plan

Taking off a home-based business allows you to transform your passions and skills into a profitable enterprise from your comfort. Let’s cover the steps and practical tips necessary to launch, manage, and grow your small business at home.

Step 1: Identify a profitable niche

Start by assessing your talents and skills. Think about what you’re good at and what you enjoy doing. This could range from art or photography to therapy or meditation. Your home-based business should align with these strengths.

Research different home business ideas to see what matches your skills. Look into market demand. Use tools like Google Trends and Keyword Planner to see what people are searching for. Focus on areas with steady or growing interest.

Check how much people are willing to pay for the services or products in your niche. This will help you understand profitability. Your niche should be able to bring in enough income to sustain your business and cover any travel arrangements or other costs.

Step 2: Analyze the competition

Knowing who your competitors are is crucial. Search online for businesses offering similar services or products. Look at their websites, social media, and customer reviews. In this stage, you can do a SWOT analysis that will focus on the competition in the market you’re entering.

Take note of their strengths and weaknesses. Identify what makes them successful and where they lack. This information can help you find ways to differentiate your business.

List out what you can offer that they don’t. These might be unique products, better customer service, or more flexible delivery options. By finding gaps in the market, you can position your business more effectively.

Step 3: Understand your target market

Understand who your customers are and what they need. Conduct market research through surveys or interviews. Ask questions about their preferences, spending habits, and challenges. This will give you valuable insights into their needs and how you can meet them.

Look at demographic information like age, gender, location, and income level. This data helps you tailor your marketing and products to their interests. Use this information to create customer personas, which represent your ideal customers.

Stay flexible and adapt to market changes. The needs of your target market may evolve, and being able to respond to these changes can keep your business relevant and competitive.

Step 4: Define your business structure

A solid business plan is essential for launching a successful business, be it home-based or not. It outlines your goals, strategies, and financial forecasts. This section will guide you through defining your business structure, outlining your marketing strategies, and projecting your financial future.

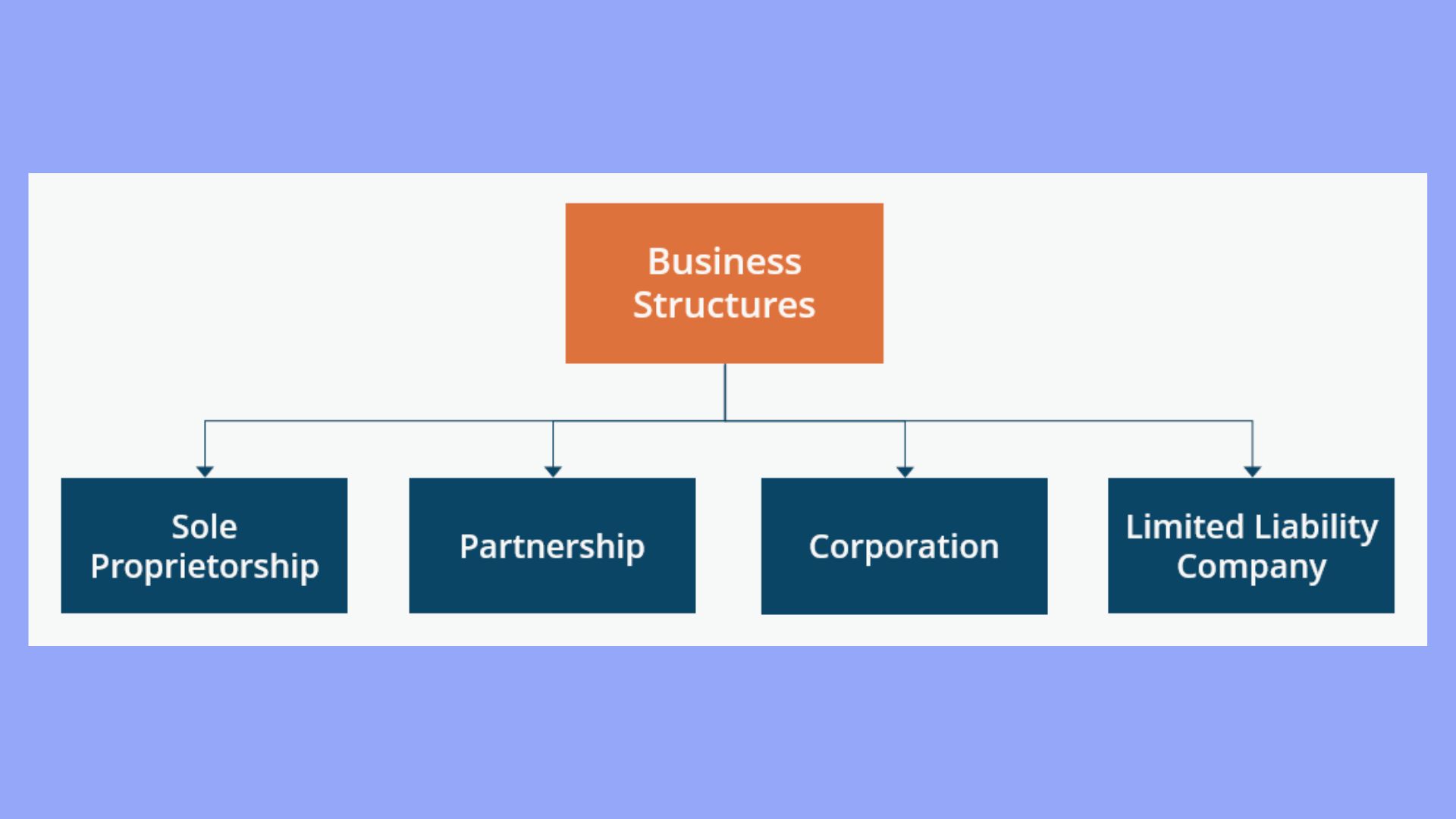

Your business structure determines your legal and tax obligations. Common options include sole proprietorship, partnership, limited liability company (LLC), and corporation.

Sole proprietorship: This structure is a one-person operation where the owner is personally responsible for all aspects of the business, including debts and liabilities, making it suitable for individual entrepreneurs starting small ventures. Sole proprietors have complete control but also bear all financial risks.

Partnership: This involves two or more individuals co-owning a business, where profits and liabilities are shared according to agreements made. It’s ideal for businesses that benefit from multiple owners’ combined skills and resources.

Limited Liability Company (LLC): An LLC protects its owners from personal liability for business debts, much like a corporation, but it allows for the flexibility of a partnership in terms of tax and management structures.

Corporation: A corporation is a legal entity separate from its owners, providing the highest level of liability protection to its shareholders while requiring strict compliance with regulatory and reporting requirements.

Of these business types, choose the one that best describes your needs, and conditions for starting a business at home.

Step 5: Outline your marketing strategies

Effective marketing strategies are crucial for attracting and retaining customers. Start by conducting market research to understand your target audience’s needs and preferences. Use this information to create a detailed marketing plan.

Identify the best channels to reach your audience, such as social media, email marketing, or local advertising. Clearly define your value proposition—what makes your business unique? This could be exceptional customer service, competitive pricing, or innovative products.

Consider strategies like discounts, promotions, and loyalty programs to attract new customers and keep existing ones engaged. Monitor your marketing efforts using tools like Google Analytics and adjust your strategies based on performance data. An effective marketing plan should be adaptable and customer-focused.

Step 6: Project your financial future

Financial projections are a key part of any business plan. They help you estimate startup costs, revenue, expenses, and profitability. Start with a break-even analysis to determine how much revenue you need to cover your costs.

Prepare detailed financial documents for at least the first year, including:

- Income statements: Track revenue and expenses to gauge profitability.

- Cash flow statements: Monitor cash inflows and outflows to understand liquidity.

- Balance sheets: Summarize your financial position at various points in time.

Anticipate variable costs, such as utilities and marketing expenses, and factor in your compensation. You may need financial forecasting software or consult a financial advisor to create accurate projections. Regularly review and update your financial forecasts to reflect changes in your business environment.

Stage 2: Choosing the workspace

Creating an effective home workspace involves choosing the right location, minimizing distractions, and understanding tax deductions.

Step 1: Choose the right location

Choose a location in your home that is quiet and away from high-traffic areas. A dedicated space helps you stay focused and productive. Your workspace should be well-lit, either by natural light or adequate indoor lighting. Good lighting reduces eye strain and improves your mood.

Think about your neighbors and outside noise. Setting up your workspace away from noisy areas can help you concentrate better. Consider using noise-canceling headphones to block out sounds when you need to.

If possible, set up in a space with a door. This allows you to create boundaries, signaling to others that you are in work mode. A clear separation between your personal and professional life can boost productivity.

Step 2: Minimize distractions

Distractions can significantly impact your productivity. Identify and remove common distractions from your workspace. Keep your area organized and free of mess. A tidy desk can help you focus better.

Set rules with family or roommates to respect your work hours. Communicate when you need quiet time or privacy. This can make a big difference in maintaining your workflow.

Use tools and apps that help you manage time and stay on track. For example, a virtual assistant can help remind you of tasks and deadlines. Limiting social media and other non-work-related activities during work hours can also be beneficial.

Step 3: Claim home office deductions

You may be eligible for home office tax deductions if you use a part of your home exclusively for business. This can include a portion of rent, utilities, and other home expenses. To qualify, your workspace must be your principal place of business or be used regularly to meet clients.

Keep accurate records of your workspace expenses. This can help you when filing taxes. Detailed records can include receipts, utility bills, and mortgage interest statements.

Understand the rules and requirements for home office deductions. The IRS has specific guidelines, so review them carefully. Making sure you meet these criteria can result in significant tax savings. For more information, you can refer to the IRS or consult a tax professional.

Stage 3: Legal requirements and finances

Starting a small business at home involves understanding various legal requirements and ensuring you have the necessary documentation. Key areas include obtaining licenses, registering your business name, and meeting tax obligations.

Step 1: Obtain necessary licenses

To run your home business legally, you must secure the right licenses. The type of license depends on your business type and location. For example, a home catering service may need health department permits.

Check with your local city or county office for specific licensing requirements. Some businesses also require state or federal licenses, especially if they sell products like alcohol or firearms.

It’s essential to ensure your licenses are up to date to avoid fines or closures. Make a checklist of all necessary licenses and permits before you begin operations.

Step 2: Register your business name

Your business name is critical as it’s your brand’s identity. First, ensure the name is unique by checking with your state’s business registry. Some states require a “Doing Business As” (DBA) registration if you plan to operate under a different name.

Registering a DBA is simple. You fill out a form and pay a small fee. This registration makes your business name official and helps avoid legal issues with other businesses.

Registering your business name also involves trademark checks. If you plan to use your business name nationwide, consider trademarking it.

Step 3: Understand tax obligations

Tax obligations are a crucial part of your business. One major requirement is obtaining an Employer Identification Number (EIN) from the IRS. This number is necessary for filing taxes, even if you don’t have employees.

You need to understand federal and state tax requirements for your business structure. For instance, sole proprietorships report income on personal tax returns, while an LLC might have different rules.

Keep accurate records of all income and expenses. Consider hiring an accountant or using accounting software to stay compliant with tax laws and avoid potential penalties. Ensure you know all filing deadlines and requirements to maintain good standing.

Step 4: Funding options

Securing funding and managing your finances are critical steps when starting a home-based business. You need to explore different funding options and maintain a clear separation between personal and business finances.

Start with calculating your startup costs. Low startup costs are often a benefit of home businesses. For example, you can save on overhead costs like rent. Depending on your needs, consider these funding sources:

- Personal savings: Using your own money helps you avoid debt.

- Family and friends: They might support your idea without high interest rates.

- Small business loans: Check out banks or online lenders.

- Grants and scholarships: These are available for specific industries and demographics.

- Investors: Angel investors or venture capitalists could be interested in your business.

Having a clear idea of costs and funding needs makes it easier to present your case to potential funders.

Step 5: Personal and business finances

It’s essential to open a business bank account to keep your business finances separate from your personal ones. This clarity helps in tracking expenses and income and avoids any mix-ups during tax season.

- Business bank account: Open an account dedicated to your business transactions.

- Expense tracking: Use accounting software or hire a professional to manage your finances.

- Separate credit cards: Consider having a business credit card to keep all expenses distinct.

- Monthly reconciliation: Regularly review and reconcile your accounts to identify any discrepancies.

Keeping finances separate will simplify accounting, reduce auditing issues, and provide clearer financial health indicators for your business.

Stage 4: Marketing and selling online

To successfully market and sell your products online, it’s important to have a strong online presence, leverage online marketplaces, and make the most of social media. Each of these strategies can help you reach a broader audience and boost your sales.

Step 1: Developing an online presence

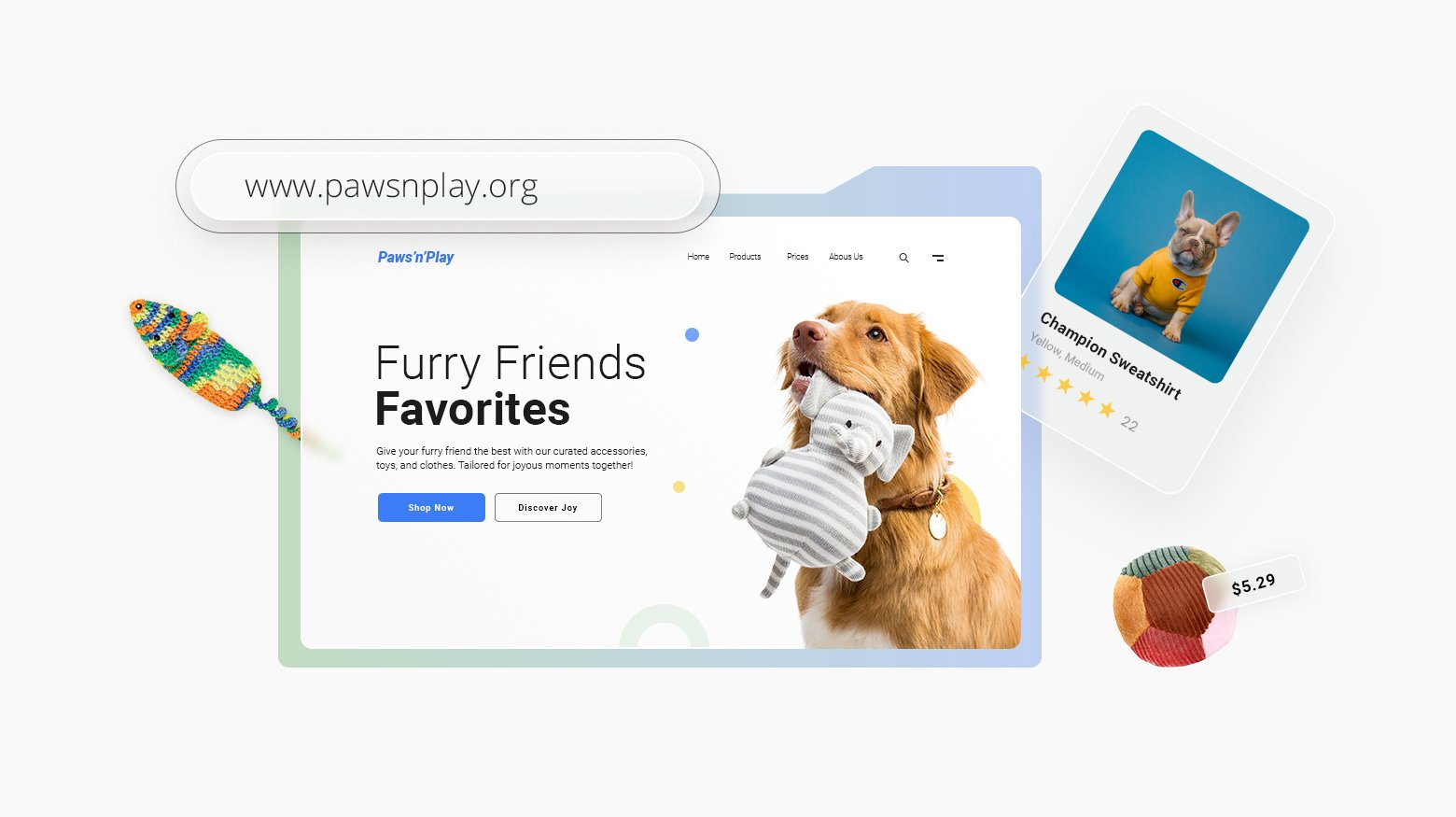

Creating a user-friendly website is crucial. Your online store should be easy to navigate and include high-quality images and detailed product descriptions. It’s important to optimize your website for search engines by using relevant keywords. This improves your site’s visibility when potential customers search for your products.

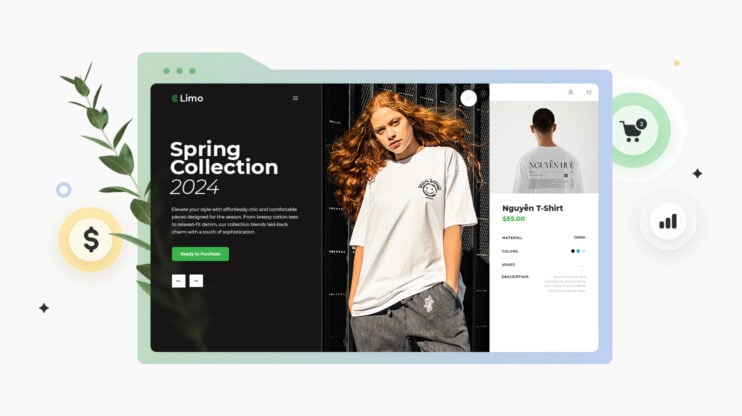

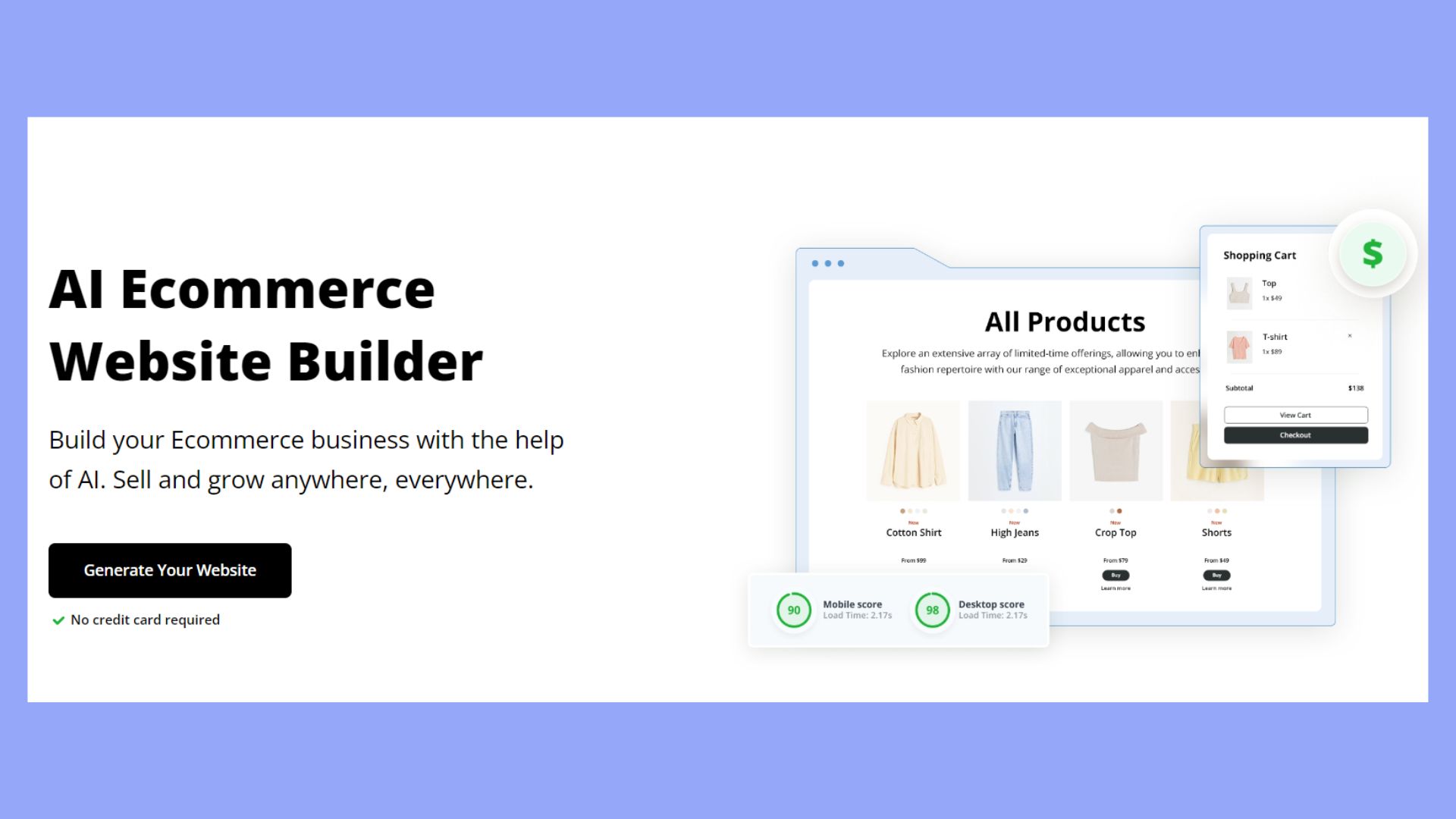

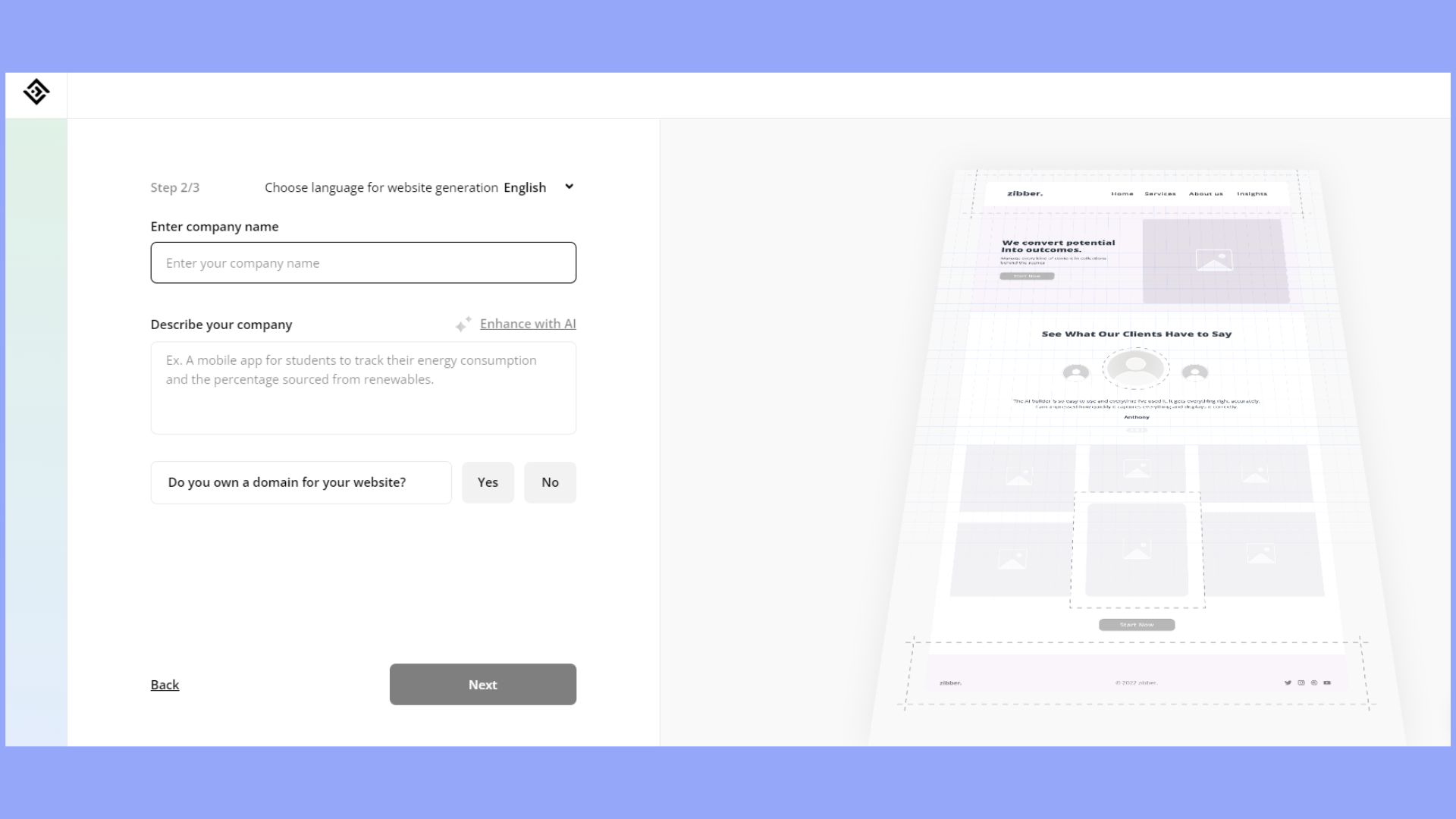

To ensure your online store is effective and professional, consider using 10Web as your platform to launch your online presence. 10Web offers an all-in-one solution that simplifies website creation and management. With its AI-powered website builder, you can create a stunning, responsive website without needing advanced technical skills. The platform includes features like automated WordPress hosting, speed optimization, and enhanced security, ensuring your site runs smoothly and safely.

If you’re starting an online business, you can build your ecommerce business website with AI and save yourself from the hassle of coding and configuring your online presence.

Consider starting a blog or sharing expert tips related to your products. This content can help attract more visitors to your site. Make sure your site is mobile-friendly since many shoppers use their phones to browse and buy products.

Step 2: Using online marketplaces

Selling on platforms like Etsy, Amazon, and eBay can significantly expand your reach. These marketplaces have millions of users who actively search for products to buy. Setting up a store on these platforms is relatively straightforward.

Detailed and clear product listings are essential. Include keywords that shoppers might use to find items like yours. High-quality photos and accurate descriptions can help boost sales and reduce returns. Offering excellent customer service and quickly addressing any issues can also lead to positive reviews, which can improve your store’s reputation.

Step 3: Integrating social media

Social media platforms like Facebook, Instagram, and TikTok offer powerful tools for marketing your products. Regularly post engaging content that showcases your products in creative ways. Use features like tags and hashtags to increase your posts’ visibility.

Social media management tools can help schedule your posts and track engagement. Running targeted ads on these platforms can also be effective. Ads can be customized to reach specific audiences based on factors like age, location, and interests.

Live streaming your products on social media can create excitement and allow real-time interaction with potential buyers. This can build a loyal following and increase sales.

Step 4: Create unique offerings

To stand out, your offerings need to be unique. Whether you are into pet sitting, freelance writing, or creating art products, identifying what makes your product or service different can help attract clients. Consider trying a niche that is not saturated.

For instance,

- For pet sitting, offer personalized pet care updates.

- In freelance writing, specialize in a specific industry or style.

- For homemade products, create items that reflect unique cultural traditions.

You can easily make your unique offer visible to potential customers by creating a dedicated website or a web page with the help of AI.

You must also analyze the market to ensure there is a demand for your product or service. Conduct surveys and engage with potential customers online to understand their needs and expectations.

Step 5: Create quality content

Creating quality content is vital for marketing your product or service. Use social media, blogs, and videos to showcase what you offer and how it can benefit potential clients. This is crucial for businesses like print-on-demand or data entry services.

Key points:

- Post regularly to keep your audience engaged.

- Use high-quality images and videos for homemade products.

- Write informative blog posts to demonstrate expertise in services like bookkeeping.

You should also consider SEO practices to make your content discoverable. Using keywords relevant to your business can help improve your search engine ranking and attract more visitors to your site.

Step 6: Offer exceptional customer service

Excellent customer service can set your business apart. Make it easy for customers to contact you and ensure quick response times. For service-based businesses such as home staging or bookkeeping, reliability and professionalism are critical.

Here are some tips for integrating customer service:

- Implement a live chat feature on your website.

- Follow up on client inquiries promptly.

- Resolve issues quickly and politely.

Providing exceptional service involves listening to customer feedback and continuously improving your offerings. Satisfied customers can become repeat clients and can offer valuable word-of-mouth referrals, enhancing your home-based business’s reputation.

Step 7: Manage time and tasks

Effective time management is crucial for your success. Create a daily schedule and prioritize tasks to keep productivity high. Use tools like calendars, to-do lists, and project management software such as Trello or Asana.

Break tasks into smaller steps to make them more manageable. Set specific goals and deadlines for each task. Allocate time for breaks to avoid burnout, especially when working remotely.

Stay self-motivated by setting rewards for completing tasks and staying on track. Avoid distractions by creating a dedicated workspace, and inform family members of your work hours to minimize interruptions.

Step 8: Ensure proper insurance

Getting the right business insurance is essential for protecting your home business. Even if you run a small operation, unforeseen events can be costly without coverage. Homeowner’s insurance often doesn’t cover business activities, so look into specific policies like general liability or home-based business insurance.

General liability insurance covers incidents like property damage or injuries that occur during business operations. Professional liability insurance protects against claims of negligence or mistakes in your work.

Consult with an insurance expert to understand your needs and find the best policies. Regularly review your coverage, especially as your business grows or changes. Taking these steps ensures your home business has the protection it needs.

Adapting to changes and challenges

Starting a small business at home comes with unique challenges. Embracing technology and maintaining professionalism during disruptions are key to success.

Staying ahead with technology

Incorporate technology into your business to stay competitive. Use online tools like project management software and virtual meeting platforms to streamline operations. Cloud storage solutions can help you access files from anywhere, making remote work easier. With the rise of ecommerce, create a professional website and utilize social media for marketing.

Stay updated with tech trends by reading industry blogs and attending webinars. Automation tools can save time on repetitive tasks like accounting and inventory management. Investing in quality cybersecurity measures is also essential to protect your business data from potential threats.

Handling disruptions professionally

Disruptions, such as the COVID-19 pandemic, can test your resilience. Develop a crisis management plan to handle unexpected situations. Flexibility is crucial; be ready to adapt your services and products to meet changing customer needs. For example, consider offering new services like home delivery or virtual consultations.

Stay transparent with customers and employees during disruptions. Clear communication builds trust and keeps everyone informed. Maintain focus on your core values and find innovative ways to continue operations. During tough times, focusing on excellent customer service can set your business apart from competitors.

In conclusion

In conclusion, starting a small business at home requires careful planning, dedication, and a strategic approach. With the steps outlined in this guide, you can turn your business idea into a success. From evaluating your business idea and creating a comprehensive business plan to setting up an efficient workspace and meeting legal requirements, every step is crucial for building a solid foundation. What’s more, utilizing platforms like 10Web can further streamline the process, offering an all-in-one solution for creating and managing a professional online presence with ease.

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Looking to sell online?