Starting a credit repair business can be profitable and rewarding, offering the chance to help individuals improve their financial health. As the need for credit repair services grows, so does the opportunity for dedicated entrepreneurs to establish a successful business in this field. This guide provides detailed steps to help you navigate the process of starting your credit repair business, from crafting a solid business plan to acquiring the necessary training and setting up your services. By following these steps and focusing on providing excellent customer service, you can build a reputable credit repair business.

Stage 1: Setting the foundation for a credit repair business

Step 1: Navigating the Credit Repair Organizations Act

When starting a credit repair business, understanding and adhering to legal and ethical standards is crucial. This includes complying with the Credit Repair Organizations Act, the Fair Credit Reporting Act, and other federal and state regulations.

The Credit Repair Organizations Act (CROA) is a federal law that controls what credit repair companies can and cannot do. You need to be aware of key restrictions and duties it places on your business.

Firstly, you’re not allowed to give misleading information about services or results. Be honest in all your advertising and promotions. Also, you must provide any potential clients with a detailed contract outlining services, costs, and contact information before they sign up.

Additionally, the CROA mandates a three-day cooling-off period, during which clients can cancel services without penalty. Be sure to inform your clients about this right clearly in your contracts. Knowing these rules helps you run an ethical and legal business.

Step 2: Complying with the Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) controls how credit information is gathered, shared, and used. For your business, this means you need to follow strict guidelines when disputing inaccuracies on clients’ credit reports.

To comply with the FCRA, you must ensure all disputes are legitimate and backed by proper evidence. Misleading the credit bureaus or filing false disputes can lead to significant legal trouble. Be transparent with your clients about what can realistically be achieved and ensure your methods are ethical.

It’s also important to respect client privacy and securely handle all their personal details. Unauthorized sharing of sensitive information can lead to hefty fines and loss of trust.

Step 3: Adhering to federal and state regulations

Besides the CROA and FCRA, various federal and state laws impact how you operate. For instance, you’ll need to register your business with relevant authorities and secure the necessary licenses or permits.

Federal laws, like those enforced by the Federal Trade Commission (FTC), aim to prevent fraud and protect consumers. At the state level, regulations can vary greatly, so it’s wise to consult with an attorney to ensure full compliance.

Make sure to regularly review the laws in your jurisdiction and stay updated on any changes. Implementing ongoing training for yourself and your staff can help maintain legal compliance and foster a reputable business environment.

Step 4: Setting up your business legally

Once you’ve chosen the right entity, the next step is setting up your business legally.

- Obtain an Employer Identification Number (EIN) from the IRS. An EIN is necessary for hiring employees, opening business bank accounts, and filing taxes.

- Register your business with your state. This process varies by state but generally involves filing articles of organization for an LLC or articles of incorporation for a corporation.

- Secure any required business licenses and permits. This might include a general business license or specific licenses related to credit repair services. Check with local and state authorities to ensure compliance.

By setting up your business legally, you ensure that your credit repair business operates smoothly and stays compliant with all regulations.

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Stage 2: Creating a solid business structure

A solid business structure is crucial for long-term success. Key elements include choosing the right business entity and setting up your business legally.

Step 1: Deciding on a business entity

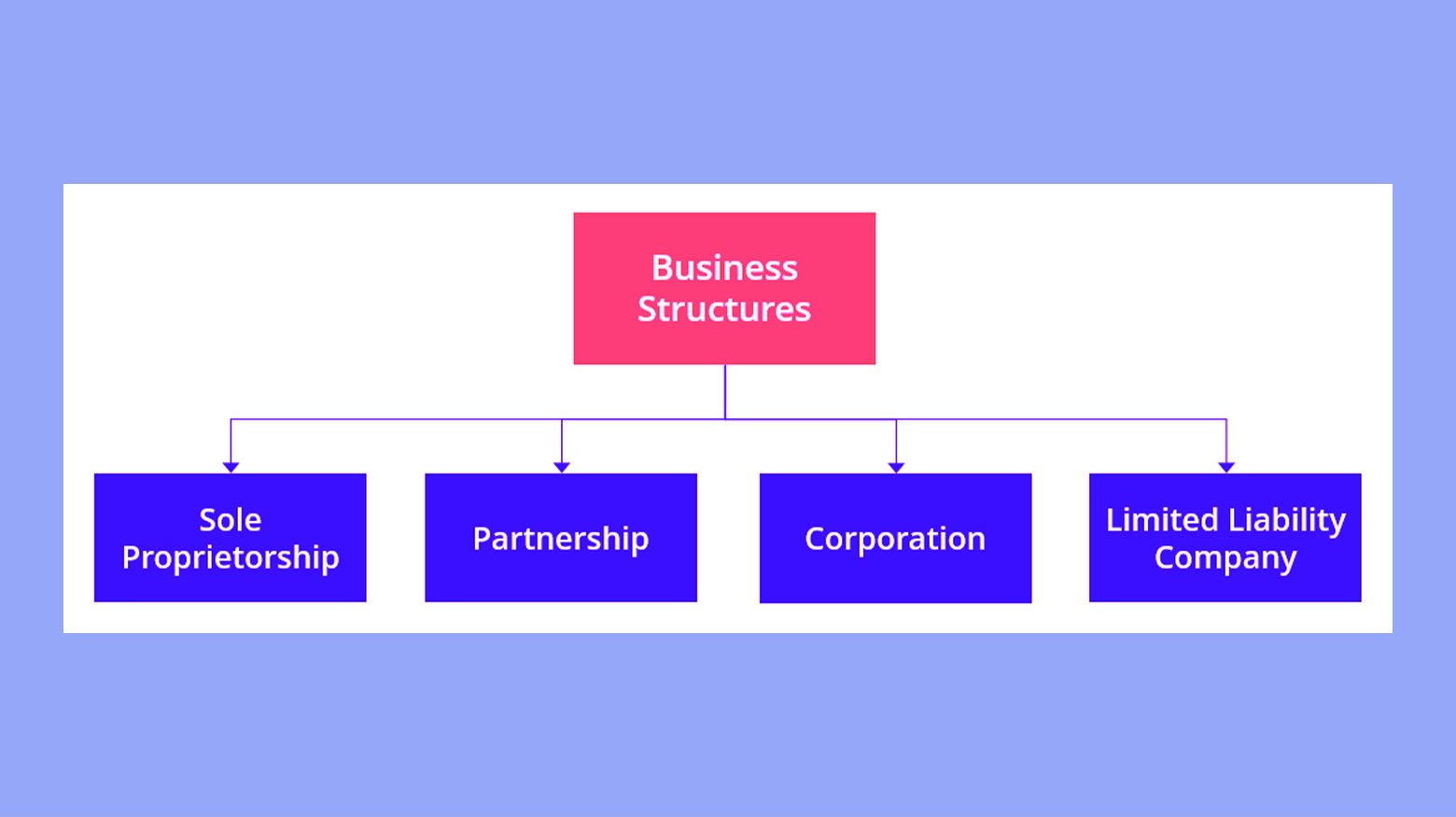

The first step is deciding on a business entity. Several options are available: sole proprietorship, LLC, and corporation.

A sole proprietorship is the simplest option, but it doesn’t provide personal liability protection.

An LLC offers limited liability protection, shielding your personal assets from business debts. It also provides flexibility in management and fewer formalities than a corporation.

A corporation, while more complex, can offer additional benefits like the ability to issue stock and attract investors. It’s important to consider factors like setup costs, future growth plans, and personal liability when making your choice.

Step 2: Managing startup costs and overhead

To manage your startup costs, create a detailed budget outlining all necessary expenses. These might include registration fees, office space, marketing, and software. It’s important to also account for ongoing costs like utilities, internet, and employee salaries.

Consider obtaining a surety bond to comply with legal requirements. You might need to set up a dedicated business bank account to keep finances separate and organized. Funding options could include personal savings, small business loans, or investors.

Minimizing overhead is crucial. Opt for remote workspaces to cut down on office rent or consider part-time employees instead of full-time staff to save on labor costs. Keep an eye on your cash flow to ensure you stay within budget.

Step 3: Determining service fees and revenue models

Setting your service fees correctly is key to maximizing profits. Study the market to understand what competitors charge. You can opt for a flat fee model where clients pay a set amount for services, or a recurring revenue model where clients pay monthly for ongoing support.

A flat fee might be attractive for clients looking for a one-time service, while recurring revenue provides a steady income stream. Offering different packages can cater to varying client needs and budgets. Make sure your pricing covers your overhead and allows for a profit margin.

Consider creating discounts or bundled services to appeal to a broader audience. Transparent and fair pricing helps build trust and can lead to steady growth in revenue.

Step 4: Selecting credit repair software

Choosing the right credit repair software is essential for managing your business efficiently. Look for software that automates tasks like tracking disputes and generating reports. Credit Repair Cloud is a popular choice due to its comprehensive features and ease of use.

Factors to consider:

- User-friendly interface: Ensure the software is easy to navigate.

- Automated processes: Automation saves time and reduces errors.

- Customer support: Reliable support can help resolve issues quickly.

- Cost: Compare subscription plans to find one that fits your budget.

Taking the time to select the right software will streamline your workflow and improve client satisfaction.

Step 5: Becoming a credit repair specialist

Becoming a certified credit repair specialist adds credibility to your business. Consider enrolling in training programs that cover credit laws, dispute strategies, and credit scoring models. Certifications from reputable organizations can set you apart from competitors.

Steps to become a specialist:

- Research available certifications: Look for programs recognized in the industry.

- Complete necessary training: These programs often include online courses and exams.

- Obtain certification: After passing exams, you’ll receive your certification.

Gaining expertise not only increases your confidence but also builds trust with clients, knowing they are working with a knowledgeable professional.

Step 6: Accounting and bookkeeping essentials

Accurate accounting and bookkeeping are crucial for your credit repair business. Start by opening a business bank account to separate personal and business finances. Use accounting software like QuickBooks or FreshBooks to track income, expenses, and profits.

Hire a professional accountant if needed, especially during tax season. Regularly review your financial statements to spot trends and make informed decisions. Keeping up-to-date and accurate records prevents financial mishaps and aids in strategic planning.

Step 7: Hiring and training employees

Hiring the right employees and providing effective training are essential for success. First, define clear roles and responsibilities for each position. Look for candidates who have experience in credit repair or customer service.

Conduct thorough training sessions that cover industry regulations, such as the Fair Credit Reporting Act (FCRA), and the company’s operating procedures. Regular training sessions can help employees stay up-to-date with the latest laws and practices. This ensures your team is competent and can provide excellent service to clients.

Set up performance reviews to monitor and enhance employee performance. Providing feedback and additional training as needed helps in maintaining high standards and keeping your team motivated.

Stage 3: Crafting a strategic marketing plan

To start a successful credit repair business, it’s critical to establish a strong marketing plan that includes both online and offline strategies. Building solid relationships with affiliates and establishing a robust online presence are also key components.

Step 1: Utilizing online and offline advertising

Online advertising can be a powerful tool for reaching a wide audience. Begin by creating targeted ads on social media platforms like Facebook and Instagram. These platforms allow you to target specific demographics based on interests and online behavior.

Search engine advertising, such as Google Ads, can also help you reach potential customers who are actively searching for credit repair services. Use keywords that your target audience is likely to search for.

Offline advertising should not be overlooked. Traditional methods like direct mail, flyers, and local newspaper ads can be very effective, especially in reaching local customers. Attend community events and fairs to distribute your business cards and flyers. Sponsor local events to increase your visibility.

Step 2: Choosing a business name and brand identity

Your business name should be easy to remember and align with your services. Spend some time brainstorming names that reflect trust, reliability, and financial acumen. Check if the domain name is available so you can create a professional website.

A strong brand identity includes a logo, color scheme, and tagline. These should be consistent across all materials, including business cards and social media profiles. Your business cards should feature your logo, contact information, and a tagline that succinctly describes what you do.

Use free tools or hire a designer to ensure your brand looks professional. A well-crafted brand identity will convey credibility and attract clients.

Step 3: Establishing an online presence

Creating a robust online presence is crucial for your credit repair business. Here’s how to get started:

Select a Domain Name

- Choose a domain name that is short, memorable, and relevant to your business.

- Ensure it’s easy to spell and pronounce.

- If your desired domain is unavailable, consider variations and different top-level domains (e.g., .com, .co, .store, .shop, etc.).

Choose Reliable Hosting

Your hosting provider plays a vital role in your site’s performance. Look for a service that offers excellent uptime, fast loading speeds, and strong security features. Additionally, ensure it can handle seasonal traffic spikes and support your business’s growth.

For example, 10Web’s automated WordPress hosting, powered by Google Cloud, guarantees 99.9% uptime, high-speed infrastructure, and advanced caching for fast-loading web pages. Its elastic scaling technology can seamlessly adapt to visitor fluctuations on the fly. It also includes features like 24/7 technical support, backup and restore, and built-in security to help you manage your site efficiently.

Set Up Your Website

Creating an online platform for your credit repair business with 10Web is simple and efficient. You have two options to get started:

- Custom replica: Provide 10Web AI Website Builder with a link to a design you like, and it will create a similar one for you.

- Generate from scratch: Answer a few questions about your business to generate a website from scratch.

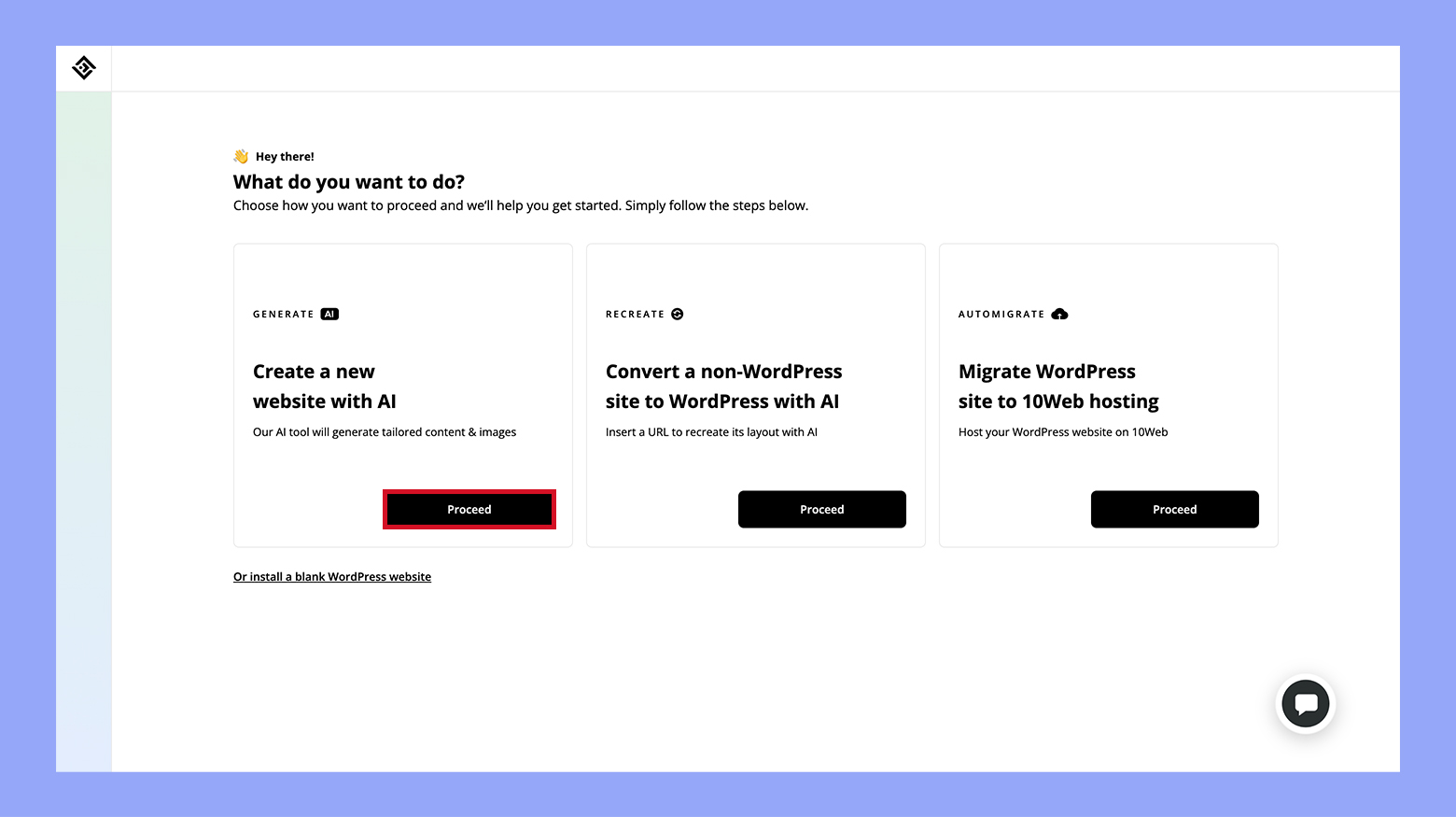

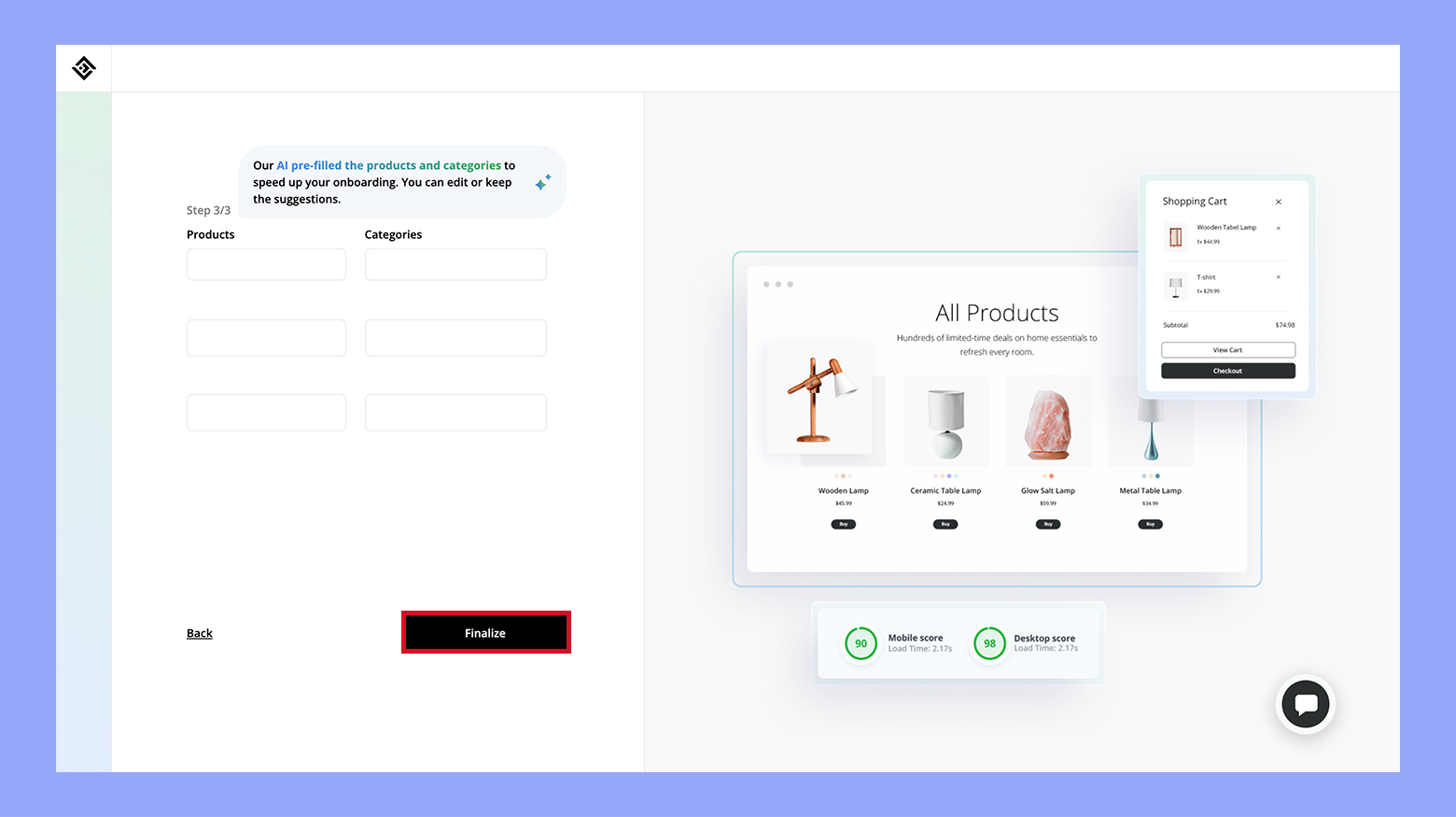

For this example, let’s go with the second option:

- Go to the 10Web Website Builder page and click Generate your website.

- Select Proceed to create a new website with AI.

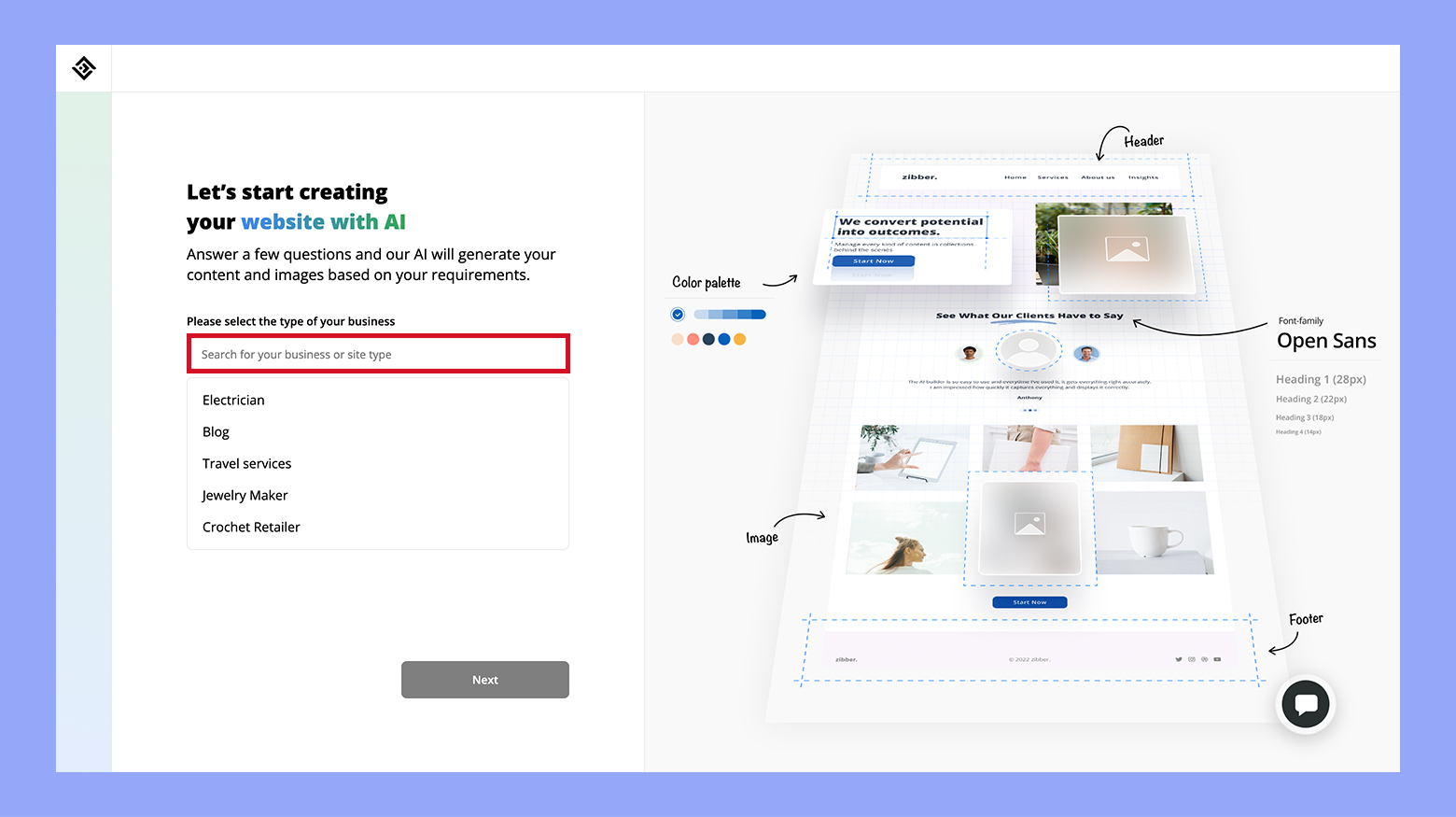

- Enter your business type.

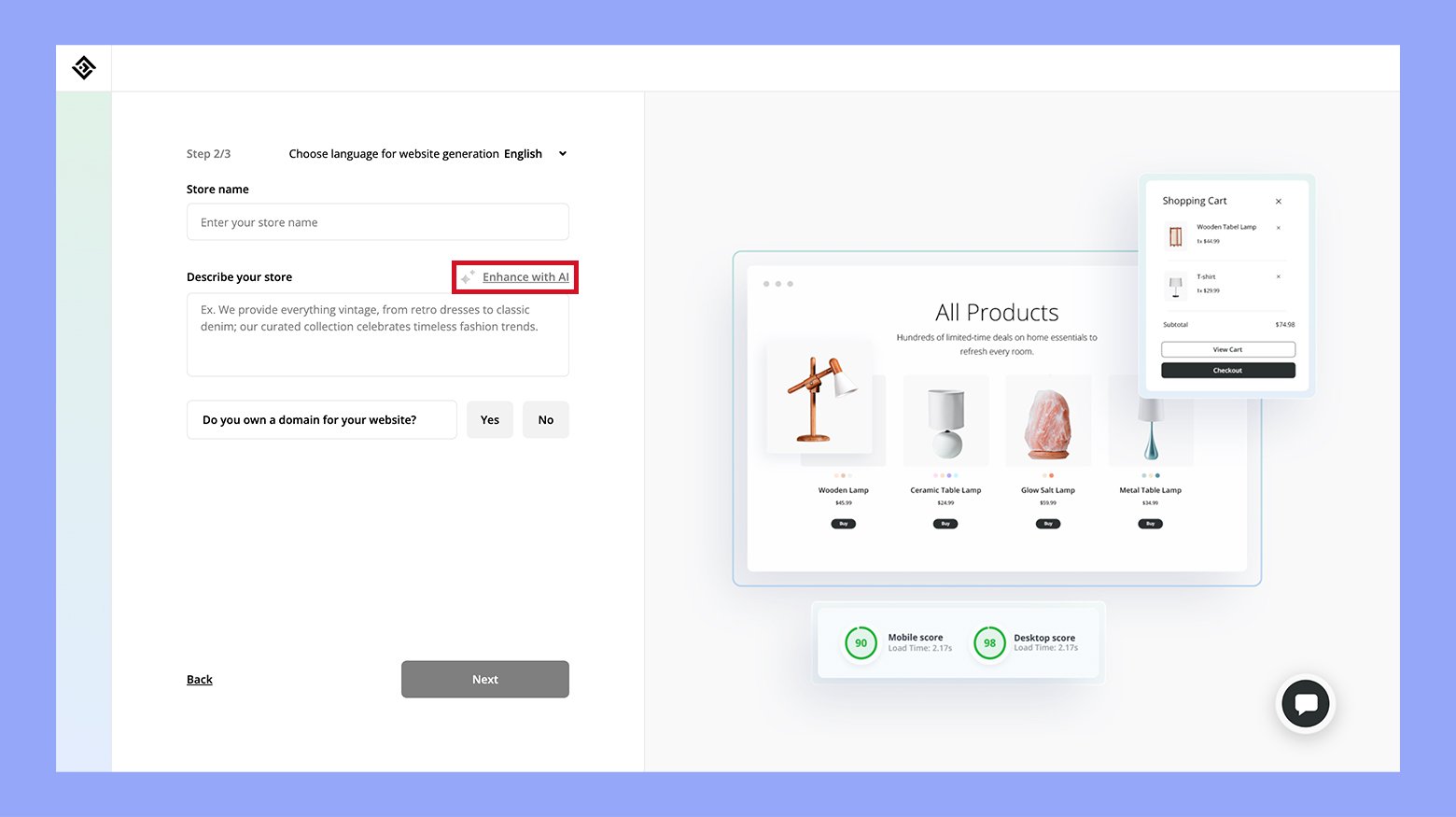

- Provide a business name and description. Use the Enhance with AI tool if needed.

- Enter details for your first three services and categories. AI will pre-fill them for you, you can edit or keep the suggestions. When done, click Finalize, and wait for 10Web to generate your site.

Creating a professional website is crucial. Your website should be user-friendly, visually appealing, and contain clear information about your services. Ensure it has an easy-to-find contact form and live chat options to engage potential clients.

Search engine optimization (SEO) will help your website rank higher in search results. Use relevant keywords, create valuable content, and ensure your site is mobile-friendly. Starting a blog with credit repair tips can attract visitors and establish you as an expert in your field.

Social media marketing is equally important. Regularly post updates related to credit repair, share client success stories, and engage with your audience on platforms like Facebook, Instagram, and LinkedIn. Respond promptly to messages and comments to build a loyal following.

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Expanding outreach and associations

To make your credit repair business grow, you need to expand your influence and build strong connections. This includes forming partnerships with financial entities and using customer feedback to build trust.

Partnering with related financial entities

Forming partnerships can greatly benefit your credit repair business. Start with these steps:

- Identify potential partners: Look for banks, mortgage brokers, and real estate agents. These entities often deal with clients needing credit repair.

- Reach out: Send a professional email or make a call. Explain the mutual benefits.

- Propose collaboration: Offer to refer your clients to them and request them to do the same for you.

- Formalize the partnership: Create agreements outlining referral percentages or other terms.

Aligning yourself with these financial entities can boost your credibility and client base quickly.

Leveraging customer testimonials and reviews

Customer feedback plays a huge role in building trust. Follow these steps to leverage it:

- Collect testimonials: After servicing a client, ask for their feedback. Make it simple, like a quick online form.

- Showcase reviews: Post these reviews on your website and social media. Positive testimonials act as trust signals.

- Encourage sharing: Ask satisfied clients to leave reviews on public sites like Google and Yelp.

- Highlight success stories: Share detailed accounts of how you helped improve clients’ credit scores.

Using customer testimonials can enhance your business’s reputation and attract new clients.

Conclusion

Starting a credit repair business is exciting and rewarding but requires thorough preparation and commitment. By following the guidelines outlined in this article, you can establish a strong foundation for your business. Remember to create a detailed business plan, understand and comply with legal requirements, obtain necessary training, and correctly set up your business structure. With the right approach, you can create a thriving business that makes a significant difference in the lives of many.