Starting a financial advisor business can be a rewarding venture with the right preparation. To get started, you need a solid business plan, appropriate business structure, and necessary licenses. Establishing a strong brand and staying updated with industry certifications and trends are crucial for long-term success. This guide provides detailed steps on how to start a financial advisor business, including strategic planning, marketing, and effective client acquisition strategies.

FAQ

How to start a financial advisor firm? Is it profitable to be a financial advisor? How do financial advisors make money? How do I start working as a financial advisor?

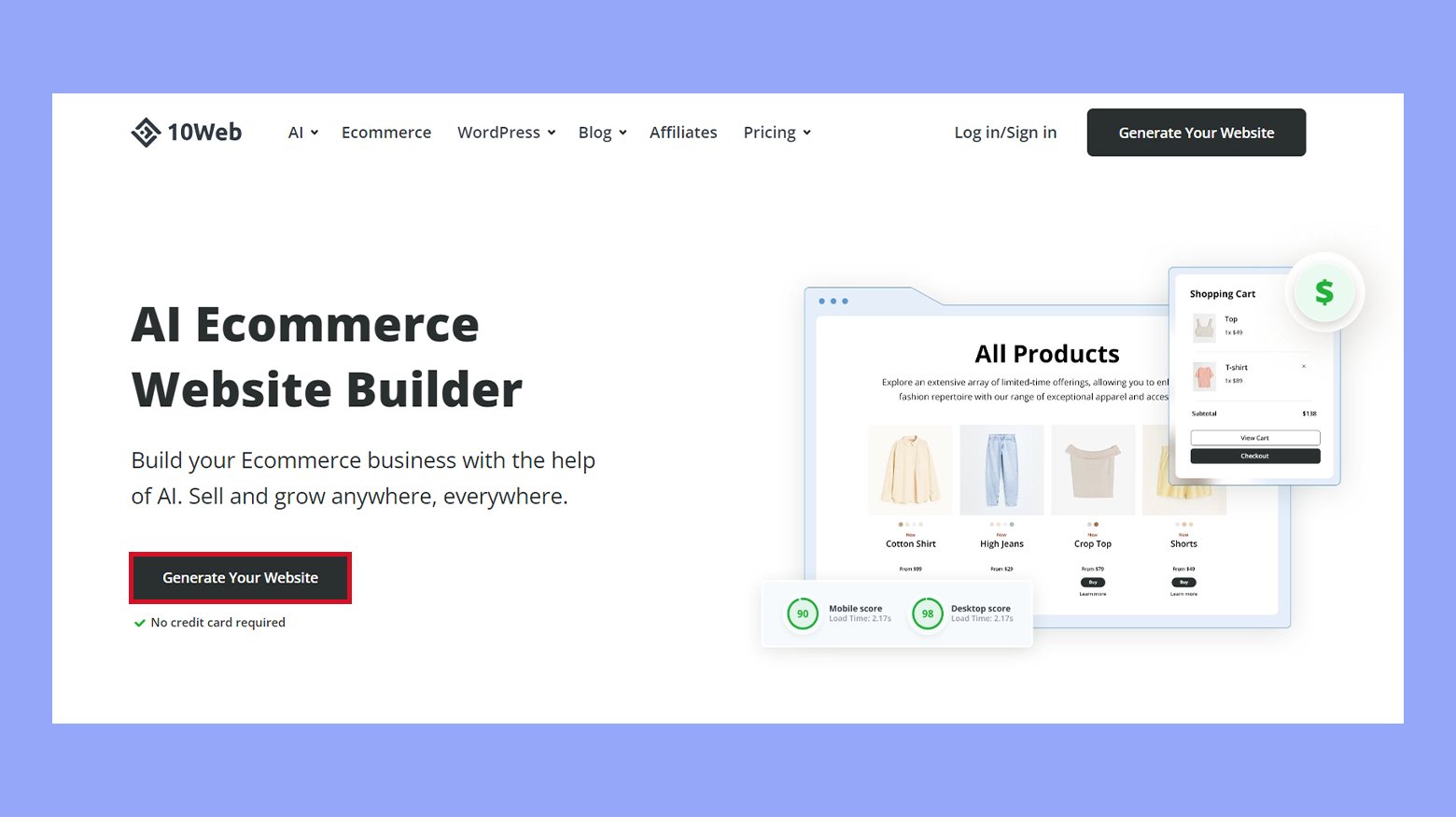

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Stage 1: Building the base for your financial advisor business

To start a financial advisor business, draft a solid business plan, choose the right structure, and get the necessary licenses. Build a strong brand with a unique value proposition and stay updated with certifications and industry connections.

Step 1: Drafting your financial advisor business plan

A solid business plan is essential. Begin with a clear mission and vision that outlines what you aim to achieve and your long-term goals. Detail the services you will offer and identify your target market. Include a value proposition—what makes your services unique compared to competitors.

List financial projections and outline marketing strategies. Be specific about how you will attract clients and generate revenue. Also, delve into operational plans that cover licensing, office setup, and technology needs. Your plan should be a roadmap guiding you where you want to go.

Step 2: Choosing your business structure

Selecting the right business structure is crucial. Common options include sole proprietorship, corporation, and LLC. Each has its pros and cons.

- Sole proprietorship is simple but offers no personal liability protection.

- Corporation provides liability protection but involves more regulatory requirements and paperwork.

- LLC combines the benefits of a corporation with the simplicity of a sole proprietorship.

Evaluate each structure based on liability, taxation, and management flexibility. Consider your future growth plans and choose a structure that aligns with your business goals. This decision will affect your taxes, paperwork, and personal liabilities.

Step 3: Understanding necessary licenses

To operate legally, you need to secure certain licenses.

In the U.S., this often includes passing exams like Series 6 or Series 65. The Series 6 license allows you to sell mutual funds, variable annuities, and insurance products. The Series 65 license is essential for giving financial advice on non-securities products and does not require sponsorship from a firm.

Additionally, if you plan to offer securities-related advice, registering with the Securities and Exchange Commission (SEC) may be necessary. This ensures you follow regulations related to the securities industry. Consulting a legal professional can help clarify which specific licenses you need based on your service offerings and location.

Step 4: Registering your business and taxation

Once you have the necessary licenses, you need to formally register your business.

This typically involves choosing a business structure, such as an LLC, corporation, or sole proprietorship. After deciding on the structure, you must register the business with your state, which often involves naming your business and filing the appropriate paperwork.

Next, you will need an Employer Identification Number (EIN) from the IRS. An EIN is like a Social Security number for your business and is required for tax filings and hiring employees.

Understanding your tax obligations is also critical. This involves paying federal, state, and sometimes local taxes. Be sure to keep detailed financial records and consider hiring a tax professional to prevent any errors. Also, consider obtaining business insurance to protect your assets and ensure compliance with any state or local mandates.

Step 5: Crafting your unique value proposition

A unique value proposition (UVP) highlights what sets you apart from other financial advisors. Think about your skills and experiences that are most valuable to clients.

- Identify your strengths: Consider your expertise, whether it is retirement planning, investment strategies, or tax advice. List your strengths.

- Understand your clients: Know who your ideal clients are. Are they young professionals, retirees, or business owners? Tailor your UVP to meet their needs.

- Clear messaging: Craft a message that is concise and easy to understand. Use simple language to convey how you can solve their financial problems better than others.

Here’s an example of a strong UVP:

“I help small business owners manage their finances and plan for the future with customized investment strategies.”

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Step 6: Creating an engaging elevator pitch

An elevator pitch is a short and compelling way to introduce yourself and your services. It should be brief, informative, and memorable.

- Start with a hook: Begin with an intriguing statement or question that grabs attention. For example, “Ever wondered how you can retire comfortably without financial stress?”

- Explain your services: Briefly describe what you do. Mention your services, such as personalized financial planning or retirement strategies.

- Show value: Clearly state the benefit of your services. For instance, “I provide tailored financial plans that help you achieve your long-term financial goals.”

- Call to action: End with a call to action. Encourage the listener to follow up. “Let’s schedule a consultation to discuss your financial future.”

An example elevator pitch:

“Ever wondered how you can retire comfortably without financial stress? I offer tailored financial plans that help achieve your long-term goals. Let’s schedule a consultation to secure your financial future.”

By focusing on your unique value proposition and creating a strong elevator pitch, you can effectively develop your brand identity and succeed in starting a financial advisor business.

Step 7: Acquiring certifications and continuing education

To excel as a financial advisor, obtaining the right certifications is crucial. Certified Financial Planner (CFP) and Chartered Life Underwriter (CLU) are key credentials. These certifications demonstrate your expertise in financial planning and insurance.

You’ll need to pass exams and meet work experience requirements for these certifications. The CFP exam has 170 multiple-choice questions and is divided into two three-hour sections. The pass rate is around 65%.

Continuing education is also important. Stay updated on industry trends and regulations. Attend workshops, webinars, and read relevant materials regularly to keep your knowledge fresh.

Step 8: Building relationships with mentors and peers

Connecting with mentors and peers can significantly boost your career. Mentors provide guidance, share their experiences, and help you navigate challenges. Seek out experienced financial advisors who can offer valuable insights.

Build relationships with peers by joining professional organizations and attending industry events. Networking with other financial advisors can open doors to new opportunities and enhance your skills.

Engage in online forums and social media groups dedicated to financial advisory. These platforms allow you to share ideas and advice with like-minded professionals. Your business will benefit from the collective knowledge and support of your network.

Stage 2: Strategizing your service offerings

When starting a financial advisor business, the next stage is defining your target audience, setting clear service offerings, and aligning them with client needs. You should analyze competition, stay current with market trends, and use technology to grow your business and build strong client relationships.

Step 1: Defining your target audience

The first step is to identify who you will serve. Consider factors like age, income level, and life stage. Are you focusing on young professionals, retirees, or business owners? Each group will have distinct financial needs.

For example, young professionals might need help with saving and investment management, while retirees could be looking for estate planning and retirement planning. By specifying your niche, you’ll tailor your services effectively.

Step 2: Setting your financial planning services

After defining your audience, decide which services to offer. These might include investment management, wealth management, estate planning, and retirement planning. Ensure each service meets a crucial need of your audience.

For instance, if your target audience is retirees, focus on retirement planning and estate planning services. If you are targeting high-net-worth individuals, wealth management and investment management would be vital.

Organize your services in a clear and structured way, so it’s easy for clients to understand what you provide. A well-defined service list will attract clients and build trust.

Step 3: Conducting competitive analysis

When starting out, it’s crucial to understand who your competitors are and what they offer. Look at other financial planning businesses in your area and analyze their services, pricing, and marketing strategies.

Steps to conduct a competitive analysis:

- Identify your competitors: List both local and major financial advisory firms.

- Evaluate their offerings: Note the types of services and alternative investments they provide.

- Check pricing: Compare how they price their services.

- Analyze their marketing: Look at their advertising methods, social media presence, and customer engagement.

Use online reviews and feedback to gauge client satisfaction with your competitors. This insight can help you improve your own business strategies.

Step 4: Staying ahead of market trends

Staying updated with market trends is essential for sustaining and growing your financial planning business. Keeping an eye on trends helps you adapt to changes and offer relevant services that meet your clients’ needs.

Tips for staying ahead of market trends:

- Read industry reports: Regularly review financial industry publications.

- Attend webinars and conferences: These events can provide insights into new tools and methods.

- Network with professionals: Join financial planning groups or forums.

- Leverage technology: Use advanced software for financial analysis and planning.

By keeping up with trends, you can anticipate changes in the market and adjust your services accordingly, ensuring your business stays competitive.

Step 5: Developing realistic financial projections

When you create financial projections, you estimate future revenue, expenses, and profits. This helps you understand what to expect financially and plan accordingly. Start by analyzing your business plan and identifying your income sources, such as advisory fees, commissions, or subscription payments.

Next, estimate your expenses. Include costs like office rent, salaries, marketing, software, and insurance. Don’t forget to account for variable expenses and unexpected costs. Create monthly and yearly projections to track progress over time.

Use financial tools like spreadsheets or software to make these projections clear and accurate. This practice not only guides your strategy but helps when presenting your business to investors or lenders.

Step 6: Securing funding and managing assets

Securing funding is crucial for getting your business off the ground. You might need to apply for small business loans, seek investors, or use personal savings. Outline how much funding you need and for what purposes. Clear, detailed plans inspire confidence in potential investors or lenders.

While managing your assets, keep track of assets under management or AUM. These are client assets you will manage and in turn earn fees from. Maintaining proper records of these assets and their growth can aid in better financial planning and projections.

Investing in financial management tools can help you monitor these assets efficiently. Regularly review and adjust your strategy based on performance and changes in the market. By focusing on strong financial management and well-founded projections, you’ll set your business on a path to growth and success.

Step 7: Leveraging networking for client acquisition

Networking is crucial for reaching potential clients. Join local business groups, attend financial seminars, and participate in industry events. Create a LinkedIn profile to showcase your expertise and connect with professionals in your community.

Engage regularly with your existing network. Share valuable insights and updates in your field. Collaborate with colleagues who serve similar client bases but offer different services, enhancing your visibility. For instance, partner with accountants or lawyers to offer comprehensive financial solutions.

Use social media platforms to reach a wider audience. Post informative content that addresses common financial concerns. Hosting webinars or live Q&A sessions can also attract potential clients looking for guidance.

Step 8: Increasing referrals and retention

Referrals are an excellent way to expand your client base. Satisfied clients are more likely to recommend your services. Provide exceptional service to make them feel valued. Keep in touch through regular check-ins and share updates on market trends relevant to their interests.

Request referrals directly. When a client expresses satisfaction, politely ask if they know anyone who might benefit from your services. Cultivate relationships with centers of influence, like community leaders or other professionals who can refer clients to you.

Retention is also vital. Create a personalized experience for each client. Understand their goals and provide tailored advice. Offer exclusive content or special consultation hours to retain their loyalty. Effective relationship management will ensure long-term client satisfaction and business growth.

Step 9: Choosing the right financial advisory software

Selecting the right software is critical for efficiency. Look for software that offers client management, financial planning, and portfolio management in one place. Integrated platforms save time by keeping all your tools together.

Popular options include SmartAsset, which connects clients with advisors, and eMoney Advisor, known for robust planning features.

Take the time to assess your specific needs. Whether you need strong analytical tools or user-friendly interfaces, the right software will make it easier to run your business and give better service to your clients.

Step 10: Automating your marketing and lead generation

Automated marketing helps attract and keep clients without manual effort. Tools like HubSpot and Mailchimp can handle email marketing, social media posts, and client lead generation.

Set up automatic email campaigns for new leads and regular newsletters to keep current clients informed. Use social media automation tools to maintain an active online presence.

SmartAsset AMP can also enhance your lead generation by connecting you with potential clients actively seeking advice. Automating these tasks frees up your time to focus on personal interactions and growing your business.

By leveraging these tools, you can streamline your processes and reach more clients efficiently, making launching and expanding your financial advisor business much more manageable.

Stage 3: Developing your presence through your marketing strategy

Creating a strong marketing strategy is crucial for starting a successful financial advisor business. You need to build an online presence, create an effective website, and identify the best marketing channels.

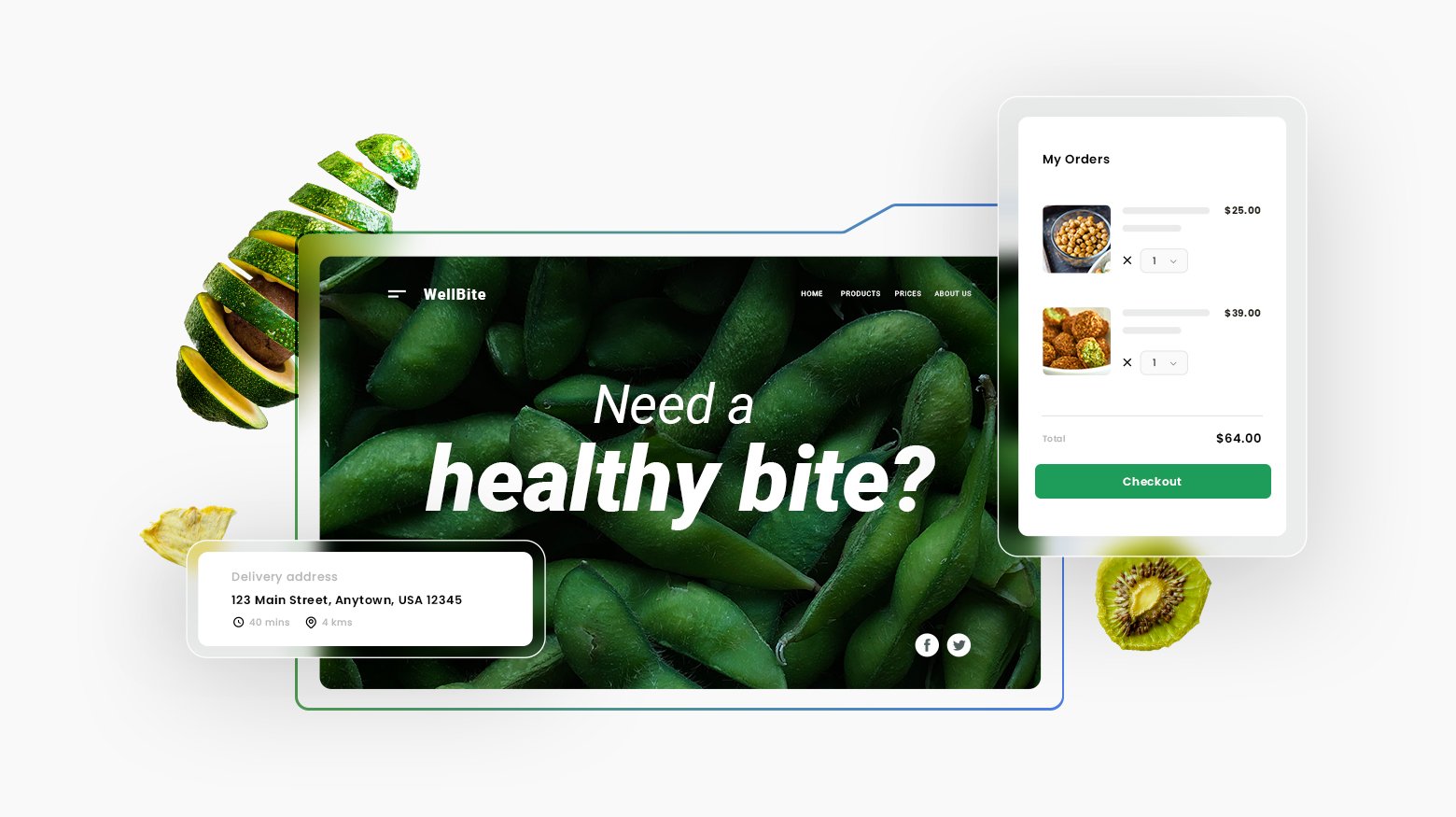

Step 1: Building an online presence

Establishing an online presence is essential. Your clients will likely search for financial advisors online before making any decisions. Start by being active on social media platforms like LinkedIn, Facebook, and Twitter. These channels help you connect with potential clients and showcase your expertise.

Consistent branding is key. Use the same photo, logo, and colors across all your profiles to build a recognizable brand. Regularly post valuable content such as financial tips, success stories, or industry news to engage your audience.

Next, focus on online reviews and testimonials. Encourage satisfied clients to leave positive reviews on platforms like Google My Business and Yelp. Positive reviews help build trust and credibility with new prospects.

Step 2: Build an effective website with 10Web

Your financial advisor website is often the first impression clients have of your business. Using 10Web, you can create a professional, effective website without needing extensive technical skills.

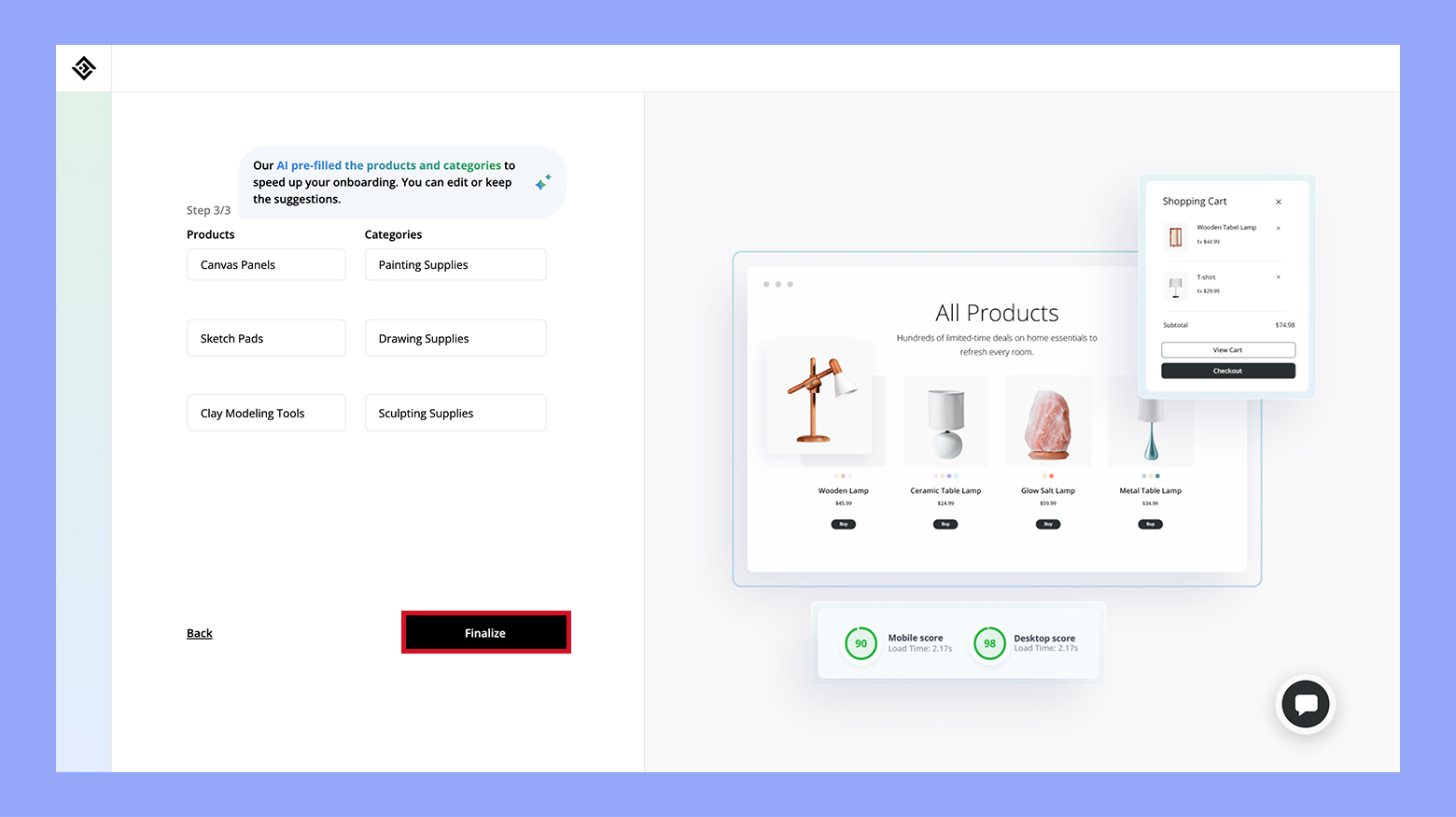

- Go to the 10Web Website Builder page and click Generate your website.

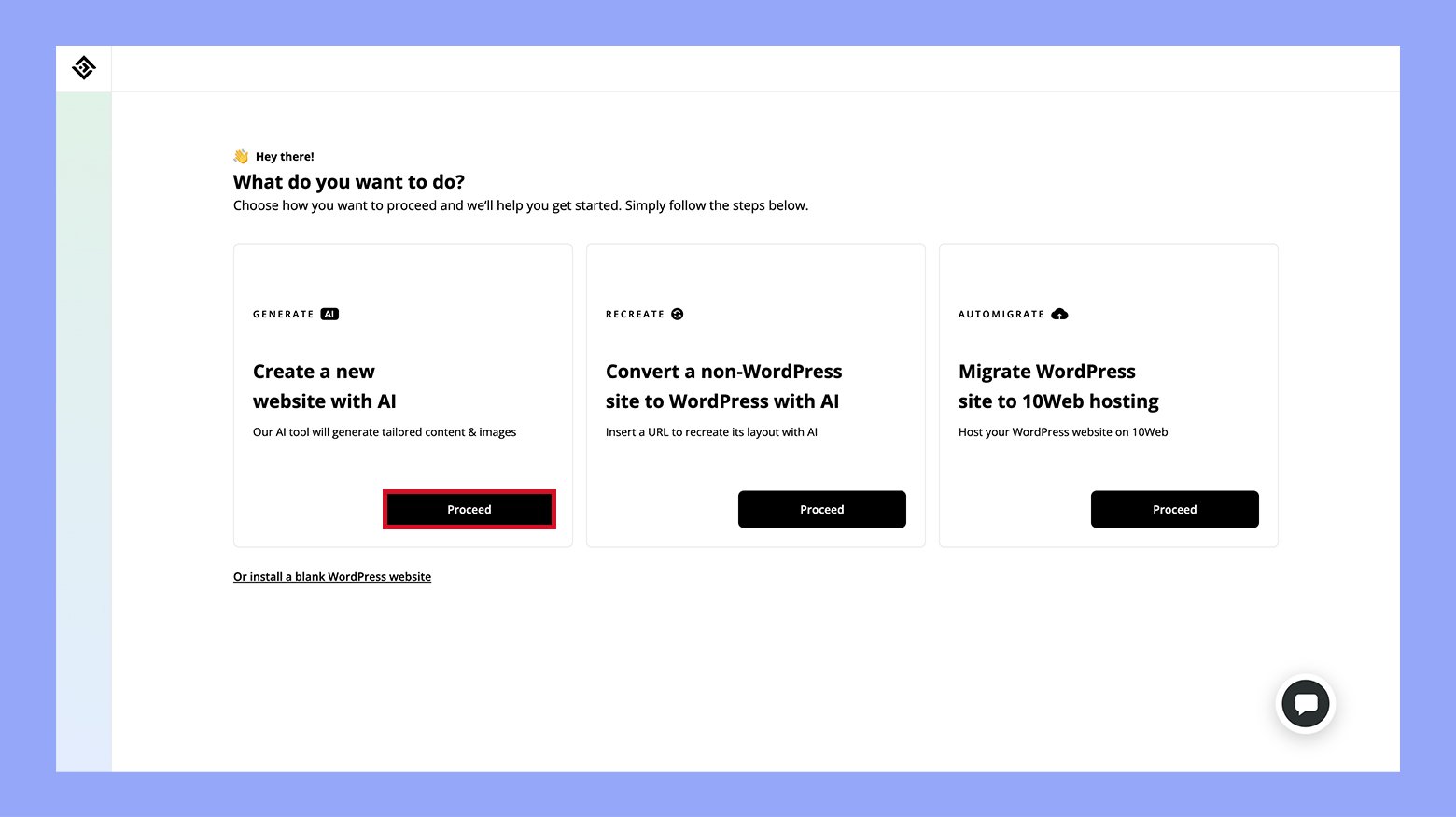

- Choose Proceed to create a new website with AI.

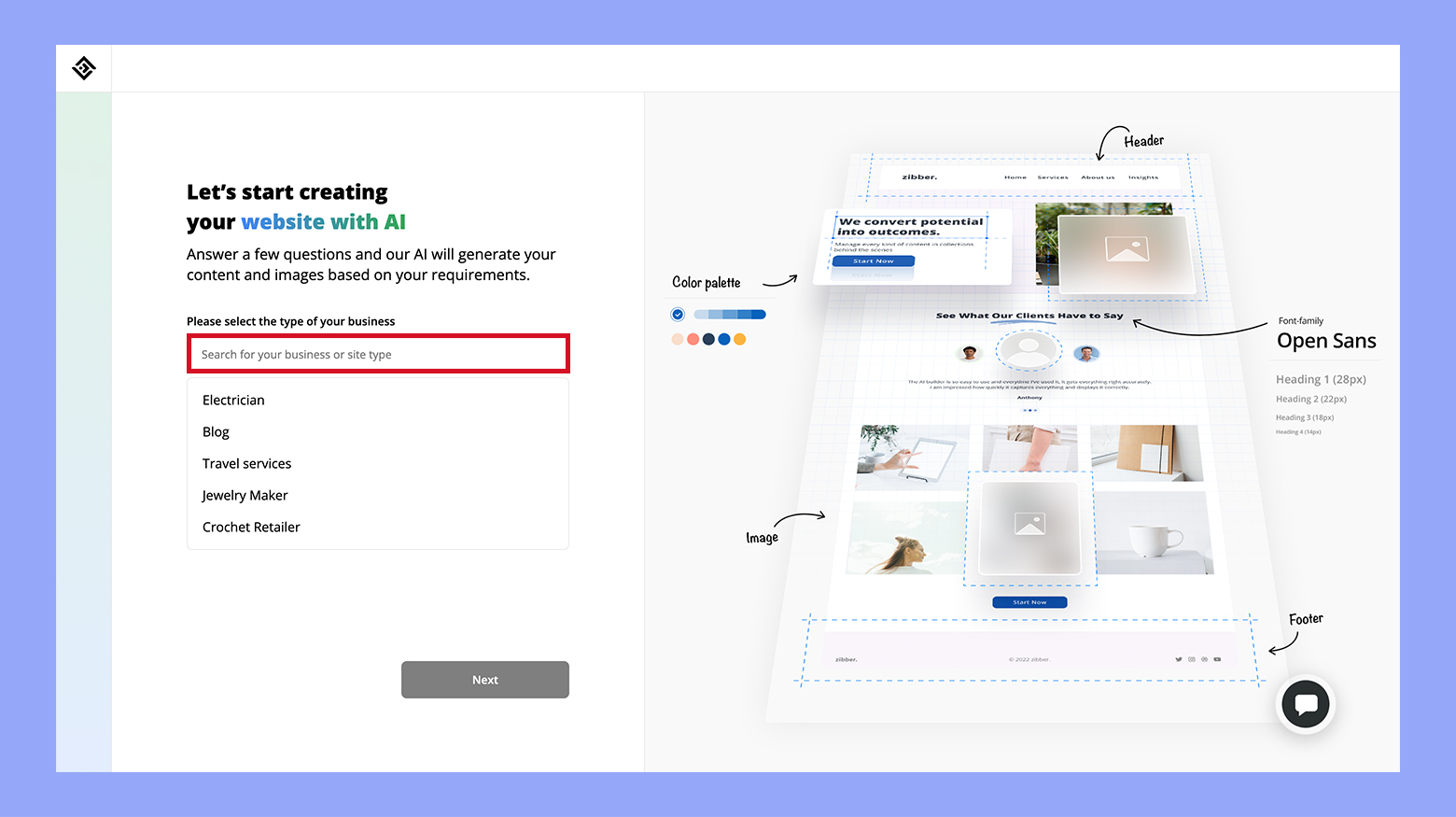

- Specify your business type.

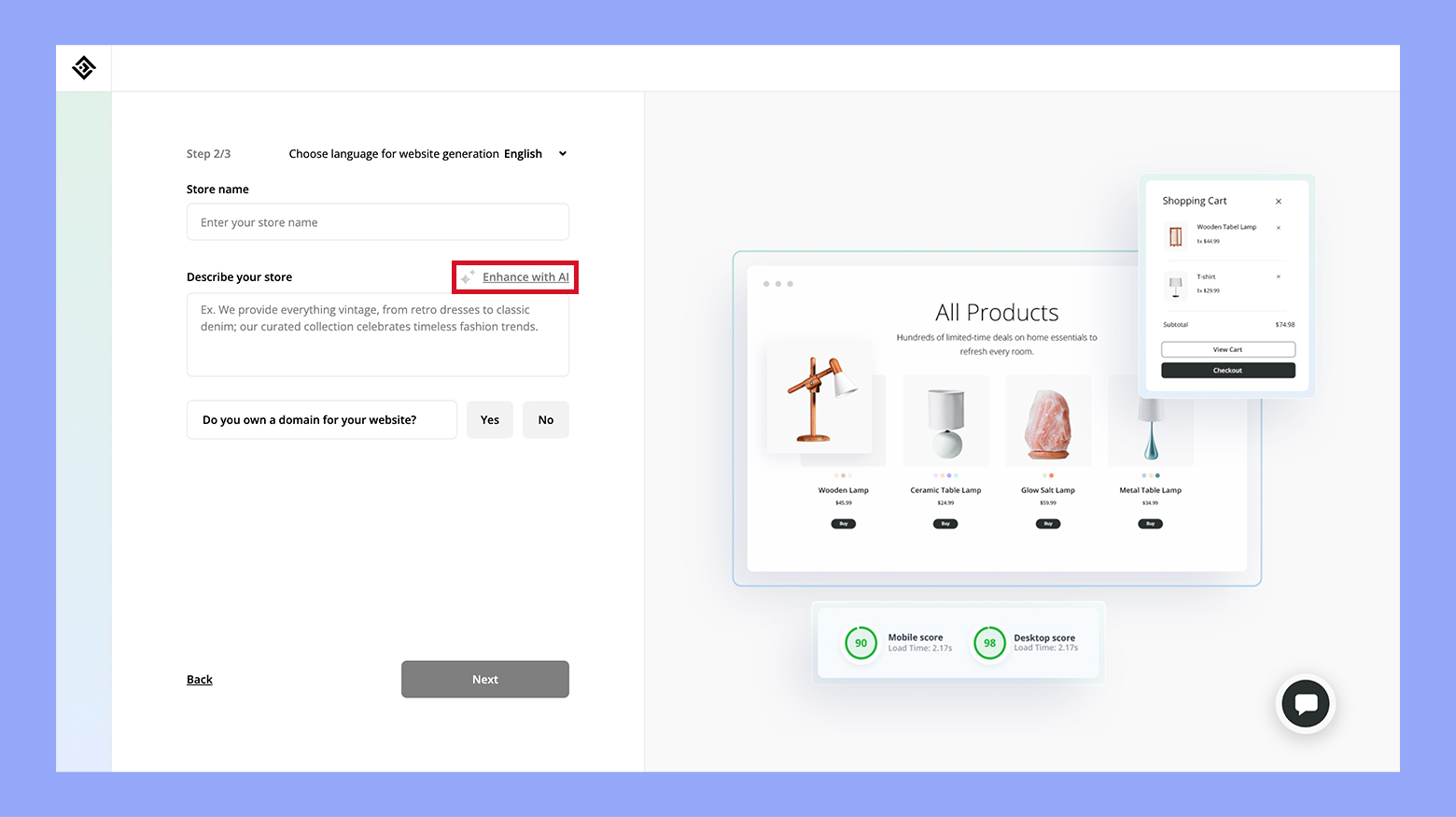

- Provide your business name and description. Utilize the Enhance with AI tool if necessary.

- Opt for Yes to get a domain or click No if you already have one.

- Enter information for your first three services and categories. AI will pre-fill them, allowing you to edit or accept the suggestions. Click Finalize when done, and wait for 10Web to create your site.

- Once your site is ready, preview it and make any required adjustments using the tools provided by 10Web.

Include clear calls-to-action (CTAs). Buttons like Get a Free Consultation or Contact Us should be prominent and easy to find. Additionally, integrate booking tools allowing clients to schedule consultations directly through your site.

Search engine optimization (SEO) is crucial. Ensure your website uses relevant keywords, has clear headings, and contains quality content that answers common client questions. This helps increase your visibility on search engines.

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Step 3: Identifying effective marketing channels

Choosing the right marketing channels is critical for reaching your target audience effectively. Begin by identifying where your potential clients spend their time.

Email marketing is a powerful tool. Build an email list and send out regular newsletters or financial advice updates. This keeps you top-of-mind for clients and helps establish you as an authority in your field.

Consider content marketing through blogs or articles on your website. Writing about topics like retirement planning, investment tips, or tax strategies can attract clients searching for that information online.

Paid options like Google Ads or social media advertising can also be effective. You can target specific demographics, ensuring that your ads reach the right audience. Always monitor the performance of your marketing efforts and adjust your strategies as needed.

By building an online presence, creating a professional website, and identifying the best marketing channels, you can effectively market your financial advisor business and attract new clients.

Conclusion

Starting a financial advisor business involves strategic planning, securing licenses, and building a strong brand. Develop a detailed business plan, choose the right structure, and establish a unique value proposition. Stay updated with industry trends and leverage technology for efficiency. Effective networking and client acquisition are key to growth. For a professional website, use 10Web to create and optimize your online presence. Follow these guidelines on how to start a financial advisor business to ensure a successful launch and sustainable growth.