A white-label payment gateway is a powerful tool for businesses looking to simplify payment processing and improve customer trust with branded experiences. By allowing companies to offer payment solutions under their own brand, white-label payment gateways have a range of benefits, from faster time-to-market to strong security, and user-friendly design options.

This article will discuss the functionality, types, and advantages of white-label payment gateways, covering everything from setup to scalability, as well as strategies for customization and user experience. With white-label payment solutions, businesses can capitalize on the rising demand for secure, customized payment options.

FAQ

What is a white-label payment gateway?

Is Stripe a white-label payment gateway?

What is a white-label billing system?

What is the cost of a white-label payment solution?

How to become a white-label payment reseller?

Which is the best white-label payment option?

What are the features of a white-label payment gateway?

How does white-label checkout work?

What types of payment gateways are available?

What is a payment gateway?

A payment gateway is a tool that helps businesses accept online payments. It is like a link between a company’s website and the banks involved in the transaction.

When you buy something online, the payment gateway plays a crucial role by securely handling your payment information and coordinating with banks to complete the transaction. Here’s how it goes. First, you enter your card details on the website, and the payment gateway encrypts this information to ensure it’s safe. Then, it sends this encrypted data to the merchant’s bank, which contacts your card issuer to approve the payment. The card issuer either approves or declines, and the merchant’s bank relays this decision back to the website, confirming if the payment was successful.

All this happens in seconds. The payment gateway makes sure your money moves safely from your account to the seller’s.

Types of payment gateways

There are three main types of payment gateways:

- Hosted gateways: These take you to another site to pay. PayPal is an example.

- Self-hosted gateways: These let you pay right on the seller’s website.

- API-hosted gateways: These work behind the scenes. You don’t see them, but they handle the payment process.

Each type has its pros and cons. Hosted gateways are easy to set up but less simple for customers. Self-hosted ones give a better user experience but need more work to set up. API-hosted gateways offer the most control but require tech skills to use.

What are white-label payment gateways?

White-label payment gateways allow businesses to offer online payment processing under their brand using a customizable, ready-made solution. These pre-built systems handle essential tasks, such as accepting credit cards and transferring funds between buyers and sellers, while allowing companies to rebrand the platform with their logos and colors to make it appear as their product.

Key features include:

- Customizable branding and design

- Support for many payment types

- Security and fraud protection

- Reporting tools

- Integration with shopping carts and websites

Companies can customize the gateway with their logo, colors, and name, allowing them to offer branded payment services without starting from scratch.

Benefits of using white-label payment gateways

White-label payment gateways offer a range of advantages, making them a compelling choice for businesses looking to implement payment solutions quickly and cost-effectively. With a white-label solution, companies save time and resources while benefiting from reliable and secure payment systems managed by experts. Here’s a closer look at the primary benefits:

Faster launch time

White-label gateways allow businesses to go to market faster, bypassing the need to develop and maintain complex payment infrastructures from scratch. This enables companies to start processing payments promptly, meeting customer needs without extensive setup delays.

Lower upfront costs

A white-label solution reduces initial costs since businesses avoid the expenses associated with developing a custom payment platform. With lower entry costs, more resources are available for other business-critical activities.

Built-in security and compliance

White-label gateways come with industry-standard security features and are designed to comply with payment regulations, reducing risks for businesses. The gateway provider ensures the system stays up-to-date with the latest security protocols, which alleviates the burden of compliance from in-house teams.

Ongoing updates and support

Payment gateway providers offer continuous updates and dedicated support, allowing businesses to focus on growth rather than technical maintenance. This support structure also helps companies keep their systems current, enhancing reliability and performance.

Multiple payment methods support

A white-label gateway that supports multiple payment methods can provide businesses with a flexible, convenient payment experience, boosting customer satisfaction and conversion rates. By accommodating major credit and debit cards like Visa, Mastercard, and American Express, along with local networks, businesses can reach a wider audience. Security features such as encryption, PCI DSS compliance, saved card info, automatic card updates, and fraud detection enhance data safety and ensure reliable transactions.

Benefits for merchants and resellers

White-label gateways deliver distinct advantages for both merchants and resellers for their individual needs.

For merchants: enhanced brand cohesion

Merchants benefit from a branded checkout experience that easily aligns with their website’s design, creating a smooth, trust-building interaction for customers. This cohesive experience helps increase shopper confidence and boost conversions.

For resellers: new revenue streams

Resellers can offer payment solutions under their brand, providing clients with a personalized payment service that adds value and generates additional income. It also enables resellers to compete with larger companies by delivering a professional, reliable payment experience.

White-label payment gateways allow both merchants and resellers to focus on their core business while maintaining a competitive edge with a polished, effective payment solution that rivals major retailers.

Top 6 white-label payment solution providers

Before we pass to discussing how to set up a white-label payment solution, let’s take a look at some top options:

Stripe Connect

Stripe Connect is a flexible white-label solution for online payments. It works for marketplaces, platforms, and software as a service company.

Stripe Connect handles complex payment flows. You can split payments between multiple parties. It supports over 135 currencies.

The platform offers tools to prevent fraud. It also helps with regulatory compliance. Stripe Connect integrates with many ecommerce systems.

Pricing is pay-as-you-go. You pay a fee per transaction. There are no setup or monthly fees. Large volume discounts are available.

Adyen for Platforms

Adyen for Platforms is a complete payment solution. It works for marketplaces and platforms of all sizes. The system handles payments in over 150 currencies. It accepts many payment methods. These include credit cards, digital wallets, and local options.

Adyen offers strong fraud protection. It uses machine learning to spot risks. The platform also helps with regulatory compliance.

You can customize the checkout experience. Adyen provides APIs and SDKs for easy integration. Pricing is based on transaction volume.

PayPal Braintree

Braintree is PayPal’s white-label payment platform. It’s good for online and mobile businesses. The system accepts major credit cards. It also takes digital wallets like PayPal, Venmo, and Apple Pay. Braintree works in over 45 countries. You can customize the checkout flow. Braintree offers tools to reduce fraud. It also helps with PCI compliance.

The platform integrates with many ecommerce systems. Pricing is simple. You pay a fee per transaction. There are no monthly fees.

Square

Square offers white-label payment solutions for in-person and online sales. It’s popular with small to medium businesses. The system includes point-of-sale hardware and software. You can take payments via cards, mobile wallets, and contactless methods.

Square provides tools for inventory management. It also offers features for appointments, invoicing, and staff management. The platform integrates with many business tools. Pricing is straightforward. You pay a flat rate per transaction. There are no long-term contracts.

Rapyd

Rapyd is a global payment platform. It offers white-label solutions for businesses of all sizes. The system supports over 900 payment methods. It works in more than 100 countries. Rapyd handles both online and in-person payments.

You can use Rapyd for payouts as well as collections. The platform offers tools for fraud prevention. It also helps with compliance. Rapyd provides APIs for easy integration. Pricing varies based on services used and transaction volume.

Authorize.Net

Authorize.Net is a long-standing payment gateway provider. It offers white-label solutions for many types of businesses. The platform accepts all major credit cards. It also takes digital wallets and e-checks. Authorize.Net works for online, mobile, and in-person sales.

You get tools to prevent fraud. The system helps with PCI compliance. It also offers features like recurring billing and invoicing. Authorize.Net integrates with many shopping carts and business systems. Pricing includes a monthly fee plus per-transaction costs.

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Create your online store in minutes!

How to set up a white-label payment gateway?

For an ecommerce business, setting up a white-label payment gateway involves several key steps. You’ll need to consider technical requirements, choose the right provider, and customize the gateway to match your brand.

Technical requirements

To set up a white-label payment gateway, you’ll need some basic tech infrastructure. This includes a secure web server to host the gateway and handle transactions. You’ll also need SSL certificates to encrypt data. Make sure you have a database to store transaction info and customer data safely.

Your system should be able to handle different payment methods like credit cards, debit cards, and bank transfers. It’s smart to use APIs to connect with banks and card networks. This lets you process payments smoothly.

Don’t forget about security. Use strong firewalls and follow PCI DSS rules to keep payment data safe. Regular security audits are a must to spot and fix any weak points in your system.

Choosing a provider

When picking a white-label payment gateway provider, look at a few key things. Check what payment types they support. Make sure they can handle the currencies and countries you need. Compare fees and pricing plans to find one that fits your budget.

Look into the provider’s reputation and track record. Read reviews from other businesses. Ask about their uptime and how they handle tech issues. Good customer support is important too, so see what kind of help they offer.

Integration is another big factor. Pick a provider with easy-to-use APIs and clear documentation. This will make it simpler to add the gateway to your website or app. Some providers offer extra tools like fraud detection or recurring billing. Think about which features you might need.

Customization and branding

Once you’ve chosen a provider, it’s time to make the gateway your own. Many providers let you tweak the checkout page design. This helps create a smooth experience for your customers. Here is what you can do:

- Add your logo and colors: Start with basics like adding your logo and adjusting colors to match your brand.

- Customize the checkout page design: Many providers allow you to tweak the checkout page to create a seamless experience.

- Edit text and buttons: Adjust these elements to align with your brand’s style.

- Add custom fields: Some providers let you add fields to gather extra information from customers. Be mindful of balancing data collection with a quick checkout process.

- Optimize for different devices: Ensure the gateway works well on phones and tablets, not just desktops.

- Add convenient features: Consider options like saved payment info or one-click purchasing to enhance ease for repeat customers.

Pricing models for white-label payment solutions

White-label payment gateways come with different pricing structures. The two main types are subscription fees and transaction fees. These models affect how much you’ll pay to use the service. Here is a breakdown of those two:

Subscription fees

Some white-label payment providers charge a monthly or yearly fee. This fee covers access to their platform and tools. You might pay a setup cost when you first start using the service. The amount can change based on what features you need.

Subscription fees can be good if you process a lot of payments. You know exactly how much you’ll pay each month. This makes it easier to budget for your payment gateway costs.

Some providers offer different tiers of service. Basic plans might have fewer features but cost less. More expensive plans often include extra tools and support.

Transaction fees

Many white-label gateways charge a small fee for each payment they process. This fee is usually a percentage of the sale amount, plus a fixed cost. For example, you might pay 2.9% + $0.30 per transaction.

Transaction fees can be better for businesses with lower sales volumes. You only pay when you make a sale. This can help keep costs down when you’re just starting out.

Some providers offer lower rates if you process more payments. This can save you money as your business grows. It’s important to compare different fee structures to find the best deal for your needs.

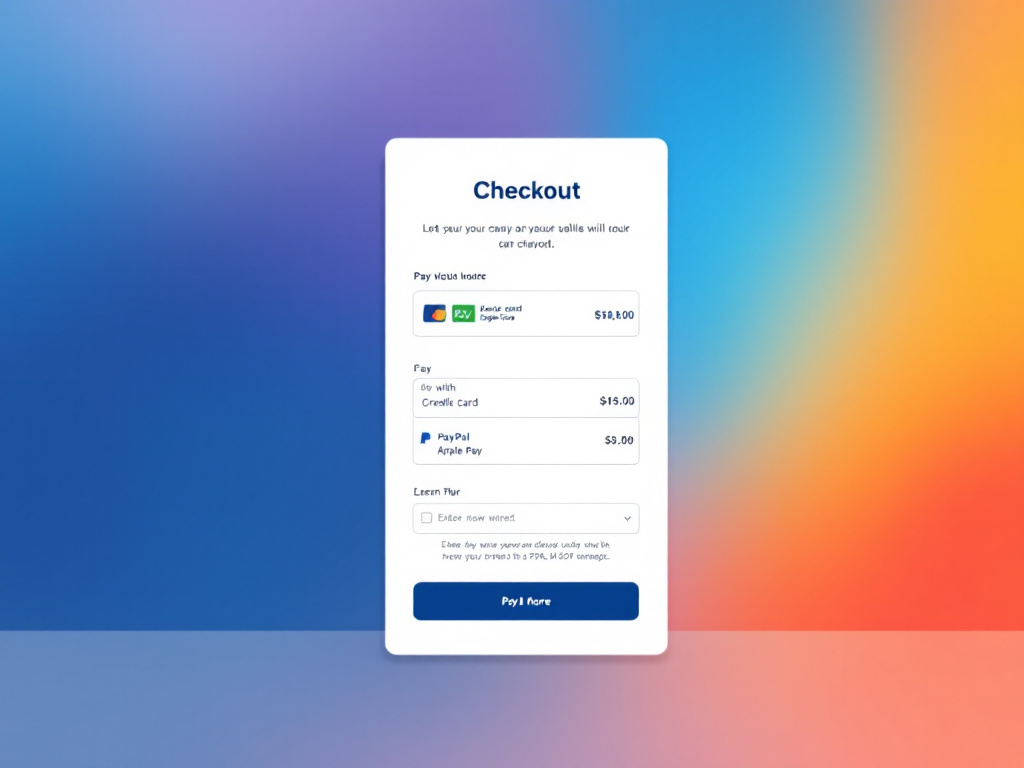

Optimize the checkout process

A straightforward checkout process is essential for online payments, as it helps reduce cart abandonment and improves the overall shopping experience for customers. White-label gateways let you create a simple flow that fits your brand. You can cut out extra steps to speed things up.

Most gateways offer one-click payments for return customers. This saves time by using stored payment information. You can also add guest checkout to let new customers pay fast.

Clear progress bars show how many steps are left. This helps customers know what to expect. You can group related fields to make forms less scary. Showing accepted payment methods upfront stops surprises later.

Error messages should be easy to spot and fix. Inline validation catches mistakes right away. This stops frustration at the end of checkout.

Conduct real-time monitoring

You can watch transactions as they happen with white-label payment gateways. This lets you spot issues fast and take action. You’ll see payment details like amounts, times, and status updates right away.

The dashboard shows charts and graphs of your daily sales. You can filter by payment type, currency, or merchant. This helps you understand trends and make smart choices.

If there’s a problem, you’ll get an alert. You can set up custom alerts for things like high-value transactions or failed payments. This helps you catch fraud and fix tech glitches before they cause big problems.

Have transaction reports

Transaction reports give you a clear picture of your payment activity. You can see details like transaction amounts, dates, and payment methods. Many white-label gateways let you filter reports by date range, customer, or product. This makes it easy to find specific information.

Some key data points in transaction reports include:

- Successful payments

- Failed transactions

- Refunds

- Chargebacks

These reports help you spot trends and address any issues quickly. You can also use them for accounting and reconciliation tasks.

Check growth and performance metrics

Growth and performance metrics show how well your payment system is working. These numbers can guide your business strategy and help you set goals.

Common metrics to track include:

- Total transaction volume

- Average order value

- Conversion rate

- Payment method breakdown

You can use these metrics to:

- Identify your most popular products

- Find out which payment methods your customers prefer

- Spot seasonal trends in sales

Many white-label gateways offer customizable dashboards. This lets you see your most important metrics at a glance. Some also provide tools to create custom reports tailored to your needs.

Conclusion

A white-label payment gateway is an effective way for ecommerce businesses to simplify payment processing while maintaining brand consistency and control. With a white-label solution, companies can provide an easy and branded payment experience, build trust with customers, and enjoy a streamlined payment setup without the technical challenges of creating a custom gateway from scratch.

With features like easy design customization, support for various payment methods, strong security, and helpful performance tracking, white-label gateways enable businesses to offer secure, professional payment options that improve customer satisfaction and boost sales. Whether you’re a merchant wanting a consistent brand experience or a reseller looking to create new revenue, white-label payment gateways offer the tools you need to stay competitive in today’s fast-paced ecommerce world.

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Create your online store in minutes!