Are you running a WordPress-based ecommerce store? Then you need the right payment gateway for simplified transactions, customer trust, and new sales opportunities. This guide discusses WordPress payment gateways and the best options for 2025, covering everything from integration to essential security features and pricing to help you make the ideal choice for your business.

With more businesses moving online, a reliable payment gateway doesn’t just support growth—it can improve customer satisfaction and simplify operations, whether you’re a freelancer or a large retailer, creating exciting opportunities to scale your WordPress site effectively.

FAQ

Does WordPress provide a payment gateway?

What is the best payment gateway for WordPress?

How much does it cost to integrate a payment gateway on WordPress?

Can you accept payments through WordPress?

Which gateways integrate with WooCommerce?

How to set up Stripe for WordPress?

Can PayPal be used with WordPress?

How to implement recurring payments?

What security measures should be considered?

Understanding WordPress payment gateways

WordPress payment gateways let you take money on your ecommerce website. They connect your store to banks and credit cards so customers can buy from you easily.

What is a payment gateway?

A payment gateway is a service that handles online payments. It’s like a digital cash register for your website. When a customer clicks Buy, the gateway steps in. It checks the customer’s card info and makes sure they have enough money. Then it moves the cash from the customer to you.

Payment gateways keep your customers’ data safe. They use special codes to protect credit card numbers. This helps stop unauthorized access to sensitive information.

Role in ecommerce

Payment gateways are super important for online stores. They make it possible to sell things on the internet. Without them, you’d have to ask customers to mail you checks. That would be slow and annoying.

Good gateways make buying quick and easy. Customers can pay with credit cards, debit cards, or digital wallets. Some even let people split payments or pay later. This can help you sell more. Gateways also help with bookkeeping. They keep track of all your sales. This makes it easier to do taxes and see how your business is doing.

Benefits of integrating payment gateway in WordPress

Besides simplifying your sales process and boosting customer trust, adding a payment gateway to your WordPress site has many more benefits. Let’s discuss some of them:

- Quick start for selling: Get your online store up and running fast without needing to build a complex system from scratch.

- Easy integration with WordPress plugins: Many popular gateways are compatible with WordPress plugins like WooCommerce, allowing for easy setup—often just a few clicks.

- Professionalism: Using a trusted payment gateway adds credibility to your site, increasing customer confidence and potentially boosting sales.

- Built-in fraud protection: Payment gateways often include tools to detect and prevent suspicious transactions, helping to safeguard your business from scams.

Essentials for a payment gateway

Payment gateways handle online transactions for WordPress sites. They protect your customers’ data and make checkout smooth. Good gateways also work well with WordPress and follow key security rules. Here is a detailed list of the essential features a payment gateway should have.

Security features

Payment gateways use many tools to keep data safe. Encryption turns card numbers into code that hackers can’t read. Tokenization replaces sensitive info with random tokens. This means your site never stores actual card details.

Two-factor authentication adds an extra step to log in. This could be a text message code or fingerprint scan. It stops thieves from using stolen passwords. Fraud detection systems look for odd buying patterns. They might flag orders from new countries or unusually large purchases. Some gateways let you set your own fraud rules too.

PCI DSS guidelines

PCI DSS stands for Payment Card Industry Data Security Standard. It’s a set of rules for anyone who takes card payments. Following PCI DSS helps prevent data breaches and fraud.

The rules cover how you handle, store, and send payment data. They also say how to build and maintain secure networks. There are 12 main requirements, split into six groups.

Some key points:

- Use strong passwords and change them often

- Protect stored cardholder data

- Encrypt data sent across public networks

- Use and update anti-virus software

- Restrict access to cardholder data

- Test security systems regularly

SSL certificates

SSL (Secure Sockets Layer) certificates are must-haves for online stores. They create a safe link between a website and a visitor’s browser. This keeps data private as it moves between them. When you have an SSL certificate, your site URL starts with https instead of http. Browsers show a padlock icon too. This tells shoppers your site is secure.

SSL certificates come in different types:

- Domain Validated (DV): Basic and cheap

- Organization Validated (OV): More trusted, shows company info

- Extended Validation (EV): Highest level, shows green address bar

Many payment gateways require SSL certificates. They’re also good for SEO and customer trust.

Transaction speed

Fast transactions keep customers happy and boost sales. Good payment gateways process payments in seconds. This means less waiting at checkout and fewer abandoned carts.

Factors that affect speed:

- Server location

- Payment method

- Gateway’s processing power

- Internet connection

Some gateways use distributed servers to speed things up. This means they have computers in different places to handle payments faster. Real-time processing is key for digital products. Customers expect instant access after paying. For physical goods, same-day processing helps you ship orders quickly.

Ease of integration

The best payment gateways for WordPress are easy to set up. Many offer plugins that you can install with a few clicks. These plugins handle all the tech stuff for you. Look for gateways with clear docs and setup guides. Good customer support is also key if you get stuck. Some gateways offer demo accounts so you can test things out first.

API access lets you customize how the gateway works on your site. This is great if you need special features. But it does require some coding skills.

Ask these questions when choosing:

- Does it work with your WordPress theme?

- Can you customize the checkout page?

- How easy is it to add new payment methods?

Compatibility with WordPress

WordPress powers many online stores. So, top payment gateways work well with it. They often have special plugins for popular ecommerce platforms like WooCommerce.

Key things to check:

- Official WordPress plugin

- Updates and bug fixes

- Works with your WordPress version

Some gateways let you take payments right on your site. Others send customers to a separate page. Both can work well, but keeping customers on your site often leads to more sales. Make sure the gateway fits your needs. If you sell subscriptions, check that it handles recurring payments. For digital downloads, look for instant delivery options.

Assessing payment processing fees

Payment processing fees can affect your overall profitability. It’s important to understand how they work before comparing options.

The cost structure

Payment gateways charge different types of fees. You’ll typically see per-transaction fees and monthly fees. Per-transaction fees are a small percentage plus a fixed amount for each sale. For example, 2.9% + $0.30 per transaction. Monthly fees are flat rates you pay regardless of sales volume.

Some gateways have setup fees or annual fees. Others may charge for extras like fraud protection or recurring billing. Read the fine print to catch all potential costs. Fees can vary based on your sales volume, industry, and card types accepted. Higher-risk businesses often pay more. International transactions may have additional fees.

Pricing models comparison

Payment gateways use several pricing models:

- Flat rate: One set percentage for all transactions

- Interchange plus: Base rate + markup

- Tiered: Rates grouped by transaction type

- Subscription: Monthly fee + lower per-transaction costs

Flat rate is simple but may cost more for high-volume sellers. Interchange Plus is often the cheapest for larger businesses. Tiered can be confusing but works for some. Subscription models reward higher sales volumes.

To compare, calculate your total costs with each model. Factor in your average transaction size and monthly sales. Don’t forget about hidden fees or contract terms. The cheapest option depends on your specific business needs.

Popular WordPress payment gateway providers

WordPress offers many payment gateway options for online businesses. These providers let you accept payments on your site safely and easily. Let’s look at some top choices you can implement for your WordPress-based ecommerce website.

Paypal

PayPal is a well-known payment gateway. It works with most WordPress sites. You can add PayPal buttons to your pages or use it with shopping carts. PayPal lets customers pay with credit cards or their PayPal accounts. The setup is quick. You don’t need much tech know-how.

Fees are about 2.9% plus $0.30 per sale for US transactions. Rates may differ for other countries. PayPal is good for small to medium businesses. It’s trusted by many online shoppers.

| Payment Option | Pros | Cons |

|---|---|---|

| Paypal | Widely recognized | Higher fees |

| Easy integration | Not as customizable |

Stripe

Stripe is popular for its easy setup and use. It works with many WordPress plugins. Stripe handles credit card payments on your site. You can take payments in over 135 currencies. Stripe offers extras like subscriptions and invoicing. Their fees are like PayPal’s – 2.9% plus $0.30 per successful charge.

Stripe is known for its strong security. They follow strict rules to keep payment data safe. Stripe works well for all business sizes.

| Payment Option | Pros | Cons |

|---|---|---|

| Stripe | Developer-friendly | Requires technical setup |

| Highly customizable | May not support all countries |

Authorize.net

Authorize.net is a long-standing payment gateway. This gateway works in the US, Canada, the UK, Europe, and Australia. It lets you take credit cards and e-checks. Authorize.net has fraud protection tools. These help keep your business safe from bad transactions.

Fees start at 2.9% plus $0.30 per transaction. There’s also a $25 monthly fee. Authorize.net is good for medium to large businesses that want lots of features.

| Payment Option | Pros | Cons |

|---|---|---|

| Authorize.net | Supports various payment methods | Monthly fees |

| Strong security features | Complex setup for beginners |

Square

Square is known for in-person payments. But it also works great for online stores. It’s easy to set up with WordPress sites. Square has no monthly fees. You pay 2.9% plus $0.30 for each online sale. Pricing is clear and simple. Square offers tools like inventory tracking and sales reports. It’s a good choice for businesses that sell both online and in stores, letting you manage all sales in one place.

| Payment Option | Pros | Cons |

|---|---|---|

| Square | No monthly fees | Limited international support |

| Easy integration with POS systems | Transaction fees may be high for some businesses |

Jetpack

Jetpack is made by the WordPress.com team. It offers many tools, including payments. Jetpack Payments uses WooCommerce Payments or Stripe. You can take one-time payments or subscriptions. Jetpack works with most WordPress themes. It’s good if you want an all-in-one tool for your site. Fees depend on which payment system you use. Jetpack itself is free, but some features cost extra.

| Payment Option | Pros | Cons |

|---|---|---|

| Jetpack | Integrates seamlessly with WordPress | Limited to WordPress |

| Includes security features | Additional fees for advanced features |

Gravity Forms

Gravity Forms is a form builder for WordPress. It has payment add-ons for many gateways. You can use it with PayPal, Stripe, Square, and others. This tool is great for making custom payment forms. You can collect information and take payments in one step. It’s useful for donations, product orders, or services. Gravity Forms isn’t free. Plans start at $59 per year. You also pay fees to the payment gateway you choose.

| Payment Option | Pros | Cons |

|---|---|---|

| Gravity Forms | Customizable form builder | Requires paid license |

| Integrates with many payment gateways | Limited to WordPress |

WP simple pay

WP Simple Pay is a plugin just for Stripe payments. It’s made to be easy to use. You can add payment forms to your site quickly. The plugin lets you take one-time payments or subscriptions. You can make custom forms without coding. WP Simple Pay works with many WordPress themes. There’s a free version with basic features. Paid plans start at $49.50 per year. You still pay Stripe’s usual fees for each payment.

| Payment Option | Pros | Cons |

|---|---|---|

| WP Simple Pay | Easy to set up | Limited features in the free version |

| No coding required | Focused only on Stripe integration |

GetPaid

GetPaid is a free invoicing plugin for WordPress. It works with many payment gateways. You can use it for invoices, estimates, and payments. The plugin lets you make nice-looking invoices. Clients can pay them online. GetPaid works well for freelancers and small businesses. You can use GetPaid with PayPal, Stripe, and other gateways. Each gateway has its own fees. The plugin itself doesn’t charge extra.

| Payment Option | Pros | Cons |

|---|---|---|

| GetPaid | No transaction fees | Limited integrations |

| Customizable invoice management | May require additional plugins for advanced features |

PeachPay

PeachPay is newer than some other options. It aims to make checkout super fast. PeachPay works with WooCommerce stores. The plugin adds a quick checkout button to product pages. Shoppers can pay in just one click. This can help reduce cart abandonment. PeachPay is free to use. You pay the usual fees for whatever payment method customers choose. It supports PayPal, Stripe, and Square.

| Payment Option | Pros | Cons |

|---|---|---|

| Easy Digital Downloads | Optimized for digital products | May require paid extensions |

| Extensive add-ons available | Limited functionality for physical products |

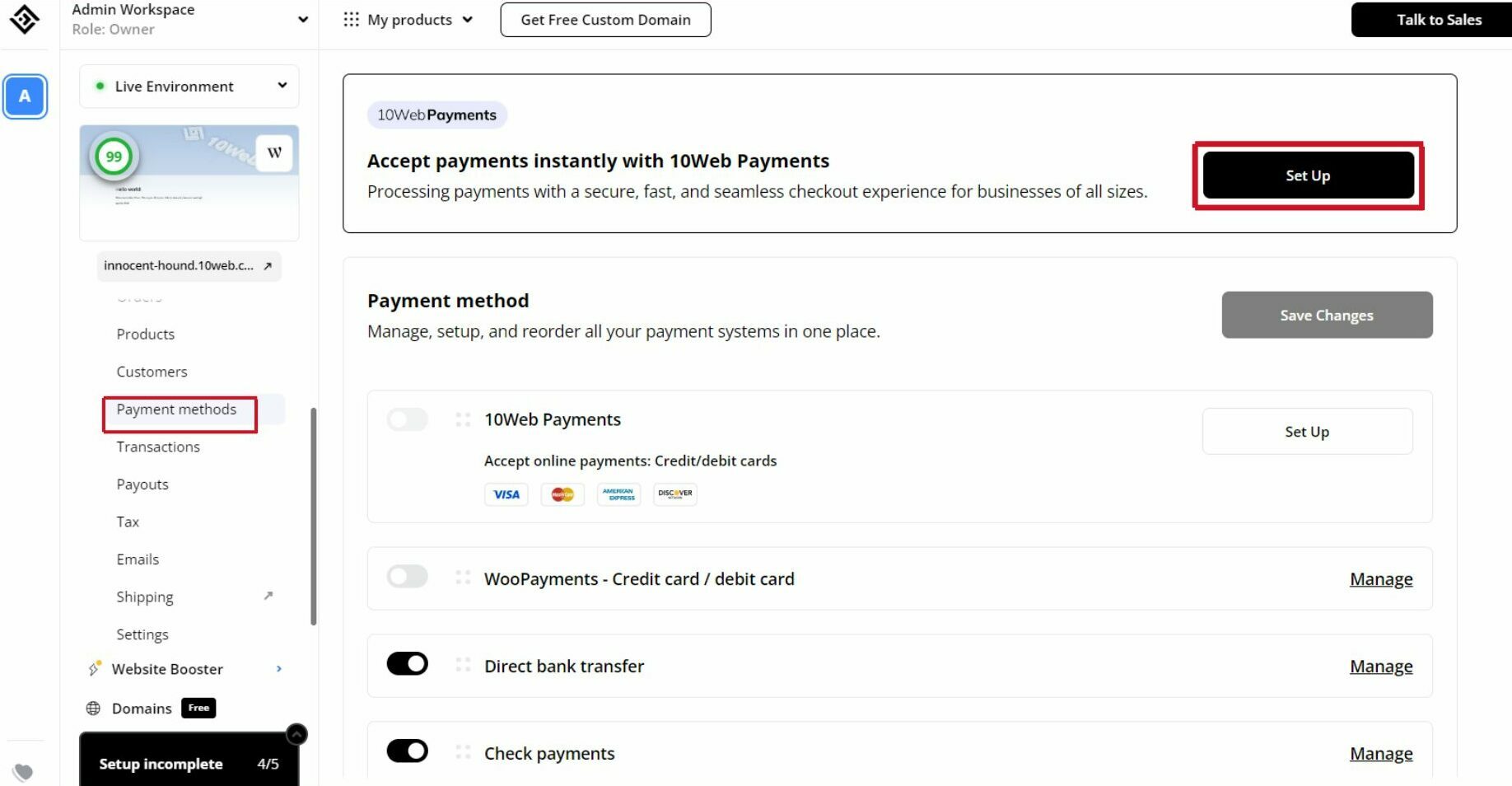

10Web Payments for websites hosted on 10Web

If your WordPress website is hosted on 10Web, managing payment integrations becomes an easy experience. 10Web integrates with popular payment gateways, enabling you to manage transactions, fees, and payments from a single dashboard. This lets you connect your preferred gateways directly, without needing multiple third-party logins or additional systems, creating a unified solution that’s accessible all in one place.

10Web’s dashboard provides a centralized view of all payment-related information, making it simple to review charges, track payments, and monitor financial performance without added complexity. Integrated with well-known gateways like PayPal and Stripe, 10Web also ensures transparent, straightforward fee management by displaying transaction details clearly within the platform. This transparency helps you maintain a clear perspective on profitability, and it avoids the setup fees or recurring subscription costs that some third-party processors often charge.

For businesses seeking efficiency, 10Web provides an optimized ecosystem for website and payment management—ideal for founders who want the convenience of handling everything in one place.

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Create your online store in minutes!

How to set up a payment gateway?

Adding a payment gateway to your WordPress site lets customers pay you easily. Here’s how to set one up and make sure it works right.

Set up the payment gateway

Here are the steps you should take for the integration process:

- Pick a payment gateway that fits your needs.

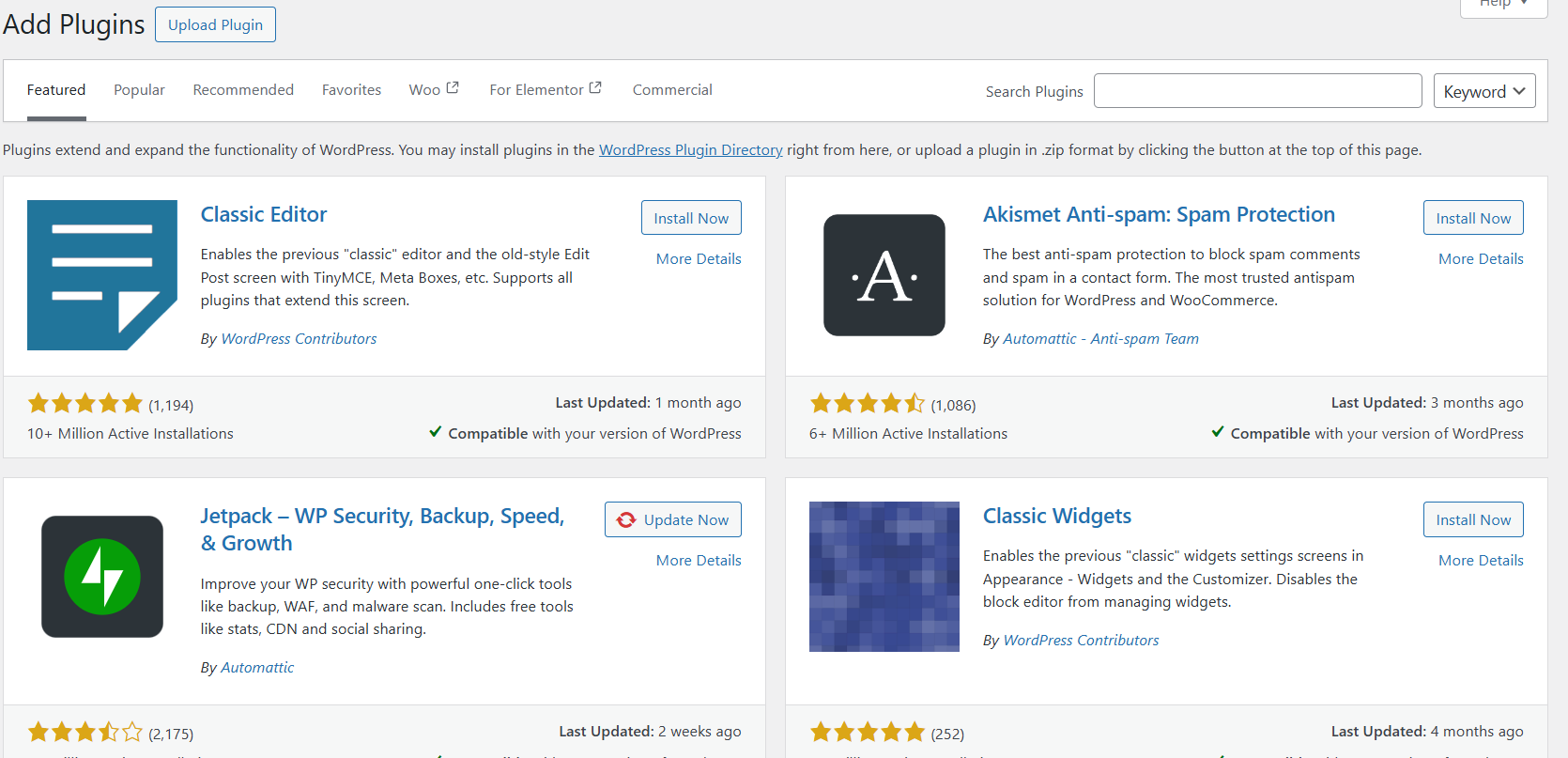

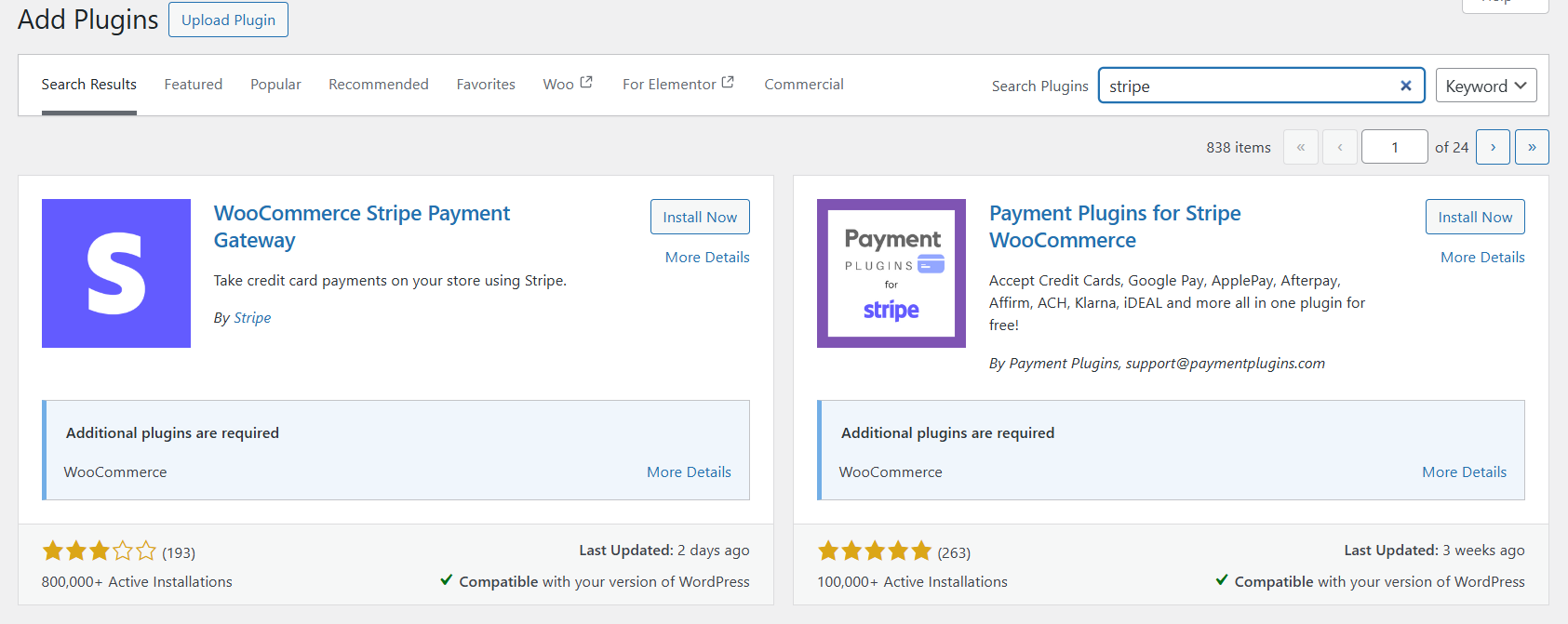

- Go to your WordPress dashboard and click on Plugins > Add New.

- Search for your chosen payment gateway plugin and click Install Now.

- After installation, click Activate to turn on the plugin.

- Find the plugin settings in your WordPress menu. It might be under WooCommerce if you’re using WooCommerce.

- Enter your payment gateway account details. You’ll need things like your API keys or merchant ID.

- Set up your payment options. Choose which cards to accept and any extra features you want.

- Save your changes and you’re ready to go!

Test the payment gateway

Before you start taking real payments, it’s smart to test your setup. Most payment gateways have a test mode. Turn this on in your plugin settings. Make a fake purchase on your site. Go through the whole process as if you were a customer. Check that the order shows up in your WordPress admin area.

Look at your payment gateway account to see if the test transaction is there. If everything looks good, switch off test mode. Your payment gateway is now live and ready for real customers. It’s important to test again after any big changes to your site or payment settings.

Optimize checkout process

To make checkout design simple and the process faster, there are a few things to follow:

- Use a single page for all steps.

- Put forms in a logical order.

- Ask only for needed information.

- Auto-fill fields when possible.

- Show clear error messages.

- Use big, easy-to-tap buttons.

- Give shoppers different ways to pay.

- Display trust badges and SSL certificates.

Make the checkout mobile responsive

With more people shopping on their phones, your checkout process needs to work smoothly on small screens. Imagine a customer ready to buy on their phone—they need an easy, clear experience. Start with big buttons and readable text, so it’s simple to tap the right things.

Make sure each field has enough space to avoid mistakes, and check that text and images are resized correctly for any screen. Use dropdown menus instead of long lists, and break big forms into smaller steps. Offer time-saving options like credit card scanning or Apple Pay, so customers don’t have to type a lot on tiny keyboards.

Finally, test your mobile checkout on different devices to spot any issues. A smooth phone checkout means happy customers and more sales.

Provide payment security

Payment security is essential for WordPress sites handling transactions, ensuring protection for both merchants and customers against fraud and data breaches. To safeguard transactions, use a secure payment gateway that adheres to PCI DSS standards, enabling address verification and CVV checks to confirm cardholder information and setting purchase limits to catch unusual activity.

Strengthen security by encrypting sensitive data like credit card details, using SSL certificates for secure data transmission, and keeping your WordPress and plugins updated to patch vulnerabilities. Limit access to customer data through strong passwords and two-factor authentication, granting permissions only as needed, and implement a firewall for additional protection.

Train your staff on data security best practices, such as spotting phishing attempts, and have a response plan ready in case of a breach to promptly address and inform customers if necessary.

Conclusion

The WordPress payment gateway you choose can make a big difference for your online business, helping with effortless operations and better customer experiences. Top gateways today offer quick setup, essential security, and flexible payment options to meet various business needs.

As we discusses options for 2025, think about which gateway best supports your goals—whether you’re a freelancer looking for simplicity or a larger retailer needing more advanced features. With the right choice, you’ll make payments easier, build customer trust, and set your WordPress store up for long-term success.

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Create your online store in minutes!