Businesses need fast, secure, and efficient ways to handle financial transactions. B2B payment gateways provide a streamlined solution by simplifying payment processing, managing invoices, and improving cash flow, making transactions between businesses smoother and more reliable. These gateways help automate payments, reduce errors, and improve security, increasing overall financial operations.

This article will explain how B2B payment gateways work, their key benefits, and what to consider when choosing one. As companies increasingly adopt digital tools, modern payment gateways offer an exciting opportunity to improve financial efficiency, strengthen client relationships, and support business growth.

FAQ

What is a B2B payment gateway?

What is the best payment method for B2B?

Is Stripe a B2B or B2C?

What is an example of a B2B payment?

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

What are B2B payment gateways?

B2B payment gateways help companies process online transactions with other businesses. These digital tools connect businesses to financial networks for secure and fast payments.

Understanding B2B payment processing

B2B payment gateways act as a bridge between businesses and banks. When a company makes a purchase, the gateway checks if the payment is valid. It then sends the money to the seller’s bank account. This process happens quickly and safely online.

B2B gateways can handle different payment types. These include credit cards, bank transfers, and digital wallets. Many also support international payments. This lets companies work with partners around the world.

Some gateways offer extra features. These might include fraud protection or tools to manage invoices. Companies can pick a gateway that fits their needs and budget.

Difference between B2B and B2C payments

B2B payments are different from B2C (business-to-consumer) payments in several ways. B2B transactions are often larger and more complex. They may involve bulk orders or ongoing contracts.

B2B payments usually take longer to process. This is because they need more checks and approvals. B2C payments, like buying a shirt online, are faster and simpler.

B2B gateways must handle more payment methods. These might include checks or wire transfers. B2C gateways focus more on credit cards and digital wallets.

Security is important for both, but B2B gateways need extra features. These might include multi-user accounts or detailed transaction reports.

Key features of b2b payment gateways

B2B payment gateways have unique features that set them apart from regular payment systems. These features help businesses handle large transactions, complex billing, and global payments.

Security protocols

B2B payment gateways use strong security measures to protect sensitive data. They use encryption to scramble payment info during transmission. This makes it hard for hackers to steal data.

Many gateways follow PCI DSS rules. These are security standards for handling credit card data. They also use two-factor authentication. This adds an extra step to verify users’ identity.

Fraud detection tools are common in B2B gateways. These tools look for odd patterns in transactions. They can flag or block suspicious activity in real-time.

Some gateways offer virtual credit cards for extra security. These are one-time use cards that protect the main account details.

Payment processing times

Fast payment processing is key for B2B transactions. Many gateways offer same-day or next-day settlements. This helps businesses manage cash flow better.

Some gateways use ACH transfers for quicker domestic payments. For international payments, SWIFT networks are often used. These can take 1-5 business days.

Real-time payments are becoming more common. They allow instant transfers between banks. This is great for urgent payments or time-sensitive deals.

Batch processing is useful for handling many invoices at once. It can speed up payment for large orders or repeat customers.

Multi-currency support

B2B gateways often support many currencies. This is important for companies doing business globally. They can accept payments in local currencies from international clients.

Good gateways offer real-time exchange rates. This helps businesses price their goods fairly across markets. Some gateways also let you hold funds in different currencies.

Currency conversion fees are important to consider. Look for gateways with low fees to save money on international sales.

Some gateways integrate with accounting software. This makes it easier to track sales and expenses in various currencies.

Integration capabilities

Easy integration with existing systems is necessary for B2B gateways. Many offer APIs that let developers add payment features to websites or apps.

Look for gateways that work with your current tools. This includes ERP systems, CRM software, and accounting platforms. Good integration saves time and reduces errors.

Some gateways offer plugins for popular ecommerce platforms. These can make setup quick and easy for online stores.

Custom workflows are often possible with B2B gateways. This lets you tailor the payment process to your specific needs. For example, you might need multi-level approvals for large transactions.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Choosing the right B2B payment gateway

Picking a good B2B payment gateway is key for your business. You need to look at a few important things to find the best fit.

Compliance standards

Payment gateways must follow rules to keep data safe. PCI DSS is a big one – it sets rules for handling credit card info. You want a gateway that meets these standards.

Some gateways go further with extra security. They might use encryption or tokenization to protect sensitive data. This can give you and your customers more peace of mind.

Check if the gateway follows laws in your area too. Different places have different rules about payments and data. A good gateway will keep up with these changes.

Ease of use

A simple gateway makes life easier for you and your customers. Look for one with a clear interface and smooth checkout process.

Some key features to check:

- Easy setup

- Clear reporting tools

- Good customer support

Test the gateway yourself if you can. See how it feels to use. Think about how your customers will see it too.

Integration with your current systems matters. A gateway that works well with your accounting software can save you time.

Customization options

Your business is unique. Your payment gateway should fit your needs. Look for options to change how it looks and works.

Some things you might want to customize:

- Checkout page design

- Payment methods offered

- Billing cycles for recurring payments

Check if you can add your logo or change colors. This helps the gateway match your brand.

API access is useful for deeper changes. It lets you build custom features if you need them.

Remember that more customization often means more work to set up. Balance your needs with the time and skills you have.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

The role of merchant accounts in B2B transactions

Merchant accounts play a key part in B2B payments. They let businesses accept credit card payments from other companies. When you set up a merchant account, you can take payments online or in person.

These accounts work with payment gateways. The gateway sends info to the bank that issued the customer’s card. It checks if the payment is okay and sends back an answer.

Merchant accounts have some perks for B2B:

- Faster payments

- Better cash flow

- More payment choices for customers

- Easier to track sales

But there are some things to think about:

- Fees for each sale

- Monthly account costs

- Extra steps to set up

To pick a good merchant account, look at:

- The types of cards it takes

- How much it costs

- How fast you get your money

- If it works with your other tools

B2B sales often involve big amounts. Make sure your account can handle large payments. Also check if it has good security to keep data safe.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Payment methods supported by B2B gateways

B2B payment gateways handle several types of transactions to meet business needs. They process credit cards, ACH transfers, and wire transfers.

Credit card processing

Credit cards are a popular payment method for B2B transactions. Gateways let businesses accept major credit cards like Visa, Mastercard, and American Express. They handle authorizations and settle funds to the merchant’s bank account.

Credit card processing involves fees, often a percentage of the transaction plus a flat fee. For B2B, these fees may be lower due to higher transaction amounts. Some gateways offer Level 2 and Level 3 processing, which can reduce fees for qualifying transactions.

Gateways may also support virtual credit cards. These are one-time use numbers that add security for online payments.

ACH transactions

ACH (Automated Clearing House) is a way to move money between bank accounts in the US. It’s cheaper than credit cards for large payments. ACH works well for recurring billing.

There are two types of ACH:

- ACH debit: The merchant pulls funds from the customer’s account

- ACH credit: The customer pushes funds to the merchant’s account

ACH takes 3-5 business days to clear. Some gateways offer same-day ACH for faster processing. Fees for ACH are usually lower than credit cards, often a flat fee per transaction.

Wire transfers

Wire transfers move money directly between bank accounts. They’re good for large, time-sensitive payments. Wires can be domestic or international.

Wire transfers are fast and secure. Domestic wires often clear the same day. International wires may take 1-5 business days.

Fees for wire transfers can be high, often $15-$50 per transaction. Both the sender and receiver may pay fees. Some B2B gateways integrate with banks to streamline wire transfers and reduce costs.

Wire transfers are final once sent. This makes them risky for new business relationships.

The impact of B2B payment gateways on cash flow

B2B payment gateways can help your business get paid faster. When you use online payments, you don’t have to wait for checks in the mail. The money goes right into your bank account.

These gateways make it easy for your customers to pay. They can click a button and send money quickly. This means you don’t have to chase down late payments as much.

You can see your money coming in real-time. Payment gateways show you when customers pay and how much. This helps you know how much cash you have on hand.

Some benefits of B2B payment gateways for cash flow:

- Faster payment cycles

- Less time spent on manual tasks

- Better visibility into incoming funds

- Fewer late payments to follow up on

Many businesses find that online payments improve their cash flow. When money comes in faster, you can pay your own bills on time. You might also have extra cash to grow your business.

Payment gateways can cut down on errors too. There’s less chance of typos or lost invoices. This means fewer payment delays that could hurt your cash flow.

Remember, happy customers often pay faster. A smooth payment process can increase customer satisfaction. This may lead to quicker payments and better cash flow over time.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

B2B payment gateway pricing structures

B2B payment gateways use different pricing models. You’ll want to compare them carefully before choosing one. Here are some common pricing structures:

- Flat rate: You pay the same fee for every transaction

- Tiered pricing: Fees change based on transaction volume or type

- Interchange-plus: Gateway fee plus card network fees

- Subscription: Monthly fee for unlimited transactions

Some gateways charge extra fees on top of these basic models:

- Setup fees

- Monthly or annual fees

- PCI compliance fees

- Chargeback fees

To find the best deal, look at your typical transaction sizes and volumes. A flat rate might work well for low volumes. Higher volumes could benefit from tiered or interchange-plus pricing.

Ask providers for a detailed breakdown of all fees. Watch out for hidden costs. Some gateways offer volume discounts or custom pricing for big businesses.

Remember that the cheapest option isn’t always best. Think about features and security too. A slightly pricier gateway with better tools could save you money in the long run.

Security and compliance in B2B payment transactions

B2B payment gateways need strong security and must follow rules. This keeps money and data safe when businesses pay each other.

PCI DSS compliance

PCI DSS sets rules for handling credit card data. B2B payment gateways must follow these rules:

- Use firewalls to protect systems

- Encrypt card data when sending it

- Limit access to card info

- Test security systems often

- Have a policy for info security

Gateways that follow PCI DSS are safer for businesses to use. It helps stop hackers and keeps customer data private.

Data encryption standards

Encryption turns data into code to keep it safe. B2B gateways use these methods:

- SSL/TLS: Protects data sent online

- Tokenization: Replaces card numbers with tokens

- End-to-end encryption: Keeps data secret from sender to receiver

Good encryption stops thieves from stealing payment info. It also builds trust between businesses that work together.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Technical integration of B2B payment gateways

B2B payment gateways need careful setup to work well with your business systems. Getting the tech part right lets you process payments smoothly and keep your data in sync.

APIs and developer tools

APIs are key for connecting payment gateways to your other business software. They let different programs talk to each other and share data. Many gateways offer API docs and code samples to help your tech team. Some common API features include:

- Sending transaction details

- Checking payment status

- Pulling reports

Developer tools like SDKs can speed up integration. These kits have pre-built code for common tasks. Testing tools let you try out payments without real money. This helps catch bugs before you go live.

Third-party integration support

Most B2B gateways can link up with popular business software. This includes:

- Accounting systems

- CRM platforms

- ERP software

- Ecommerce websites

Look for pre-built plugins or apps for your software. These can make setup much faster. Some gateways also work with payment services like PayPal or Stripe.

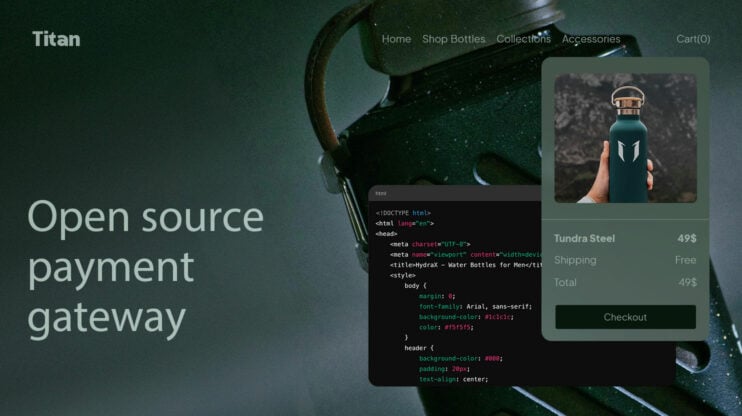

If you are planning on creating an ecommerce website for your business, the 10Web Ecommerce AI Builder offers 10Web Payments for seamlessly integrating payment systems within your 10Web dashboard and allows you to have an effortless payment processing system.

Good support is important for tricky integrations. Check if the gateway offers:

- Tech docs

- Integration guides

- Developer forums

- Direct support channels

Analyzing and reporting features of payment gateways

Payment gateways offer tools to help you track and understand your business transactions. These features let you see how money moves in and out of your accounts.

Most gateways have dashboards where you can view your sales data. You can often filter this info by date, product, or customer. This helps you spot trends and make smart choices for your business.

Many gateways also create reports for you. These might show:

- Total sales

- Number of transactions

- Average order value

- Top-selling products

Some gateways go further with their reporting. They might offer:

- Charts and graphs to visualize your data

- Real-time updates on your sales

- Alerts for unusual activity

You can often export these reports to use in other programs. This is handy for sharing with your team or accountant.

Some advanced gateways even use AI to give you business insights. They might suggest ways to increase sales or cut costs based on your data.

Remember, good reporting helps you make better choices for your business. When picking a gateway, look at what kind of data it offers and how easy it is to use.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Customer support and service in B2B payment platforms

Good customer support is key for B2B payment platforms. When you have issues with payments, you need help fast. Many platforms offer phone, email, and chat support. This lets you get help in the way that works best for you.

Some platforms have special support teams for big business clients. These teams know your account well and can solve problems quickly. They may even have a direct phone line just for you.

Response times are important too. The best platforms aim to answer quickly, often within minutes for urgent issues. For less urgent questions, you might get an answer in a few hours or a day.

Self-help tools can also be useful. Many platforms have:

- FAQ pages

- How-to guides

- Video tutorials

These can help you fix simple problems on your own, without waiting for support.

Some platforms offer extra help with setup and training. This can make it easier to start using the system. They might show you how to:

- Set up your account

- Connect to your bank

- Start taking payments

Look for platforms that offer support in your time zone and language. This makes it easier to get help when you need it.

Conclusion

By automating payments, reducing errors, and improving security, these gateways simplify the complexities of business-to-business transactions This allows companies to focus on growth and customer satisfaction. B2B payment gateways have become an important tool for businesses seeking to streamline their financial operations and improve transaction efficiency.

As digital adoption continues to rise, investing in a reliable B2B payment gateway can give businesses a competitive edge, strengthen client relationships, and drive long-term success. For companies looking to stay ahead, embracing this technology is not just an option but a strategic necessity.