The life insurance market is witnessing significant growth and transformation, particularly with the increasing adoption of online platforms. This article will cover the strategies and tips to sell life insurance online successfully.

Selling life insurance online offers numerous opportunities for financial gain and business expansion. The convenience of digital platforms, coupled with targeted marketing and specialized policy segments, creates an exciting landscape for insurers to reach a broader audience and meet diverse client needs effectively.

FAQ

How profitable is it to sell life insurance online?

Selling life insurance can be highly profitable due to the recurring commissions from policy renewals. With dedication, you can build a substantial income over time, especially by leveraging online platforms like WordPress for creating professional websites and WooCommerce for managing transactions.

How do you succeed in selling life insurance?

Success in selling life insurance requires a strong online presence, excellent customer service, and effective use of marketing strategies. Utilize WordPress to build an informative website, engage with clients through social media, and use SEO and content marketing to attract leads. Consistent follow-up and personalized service also play crucial roles.

Is selling your life insurance policy a good idea?

Selling your life insurance policy, also known as a life settlement, can be a good idea if you need immediate cash or no longer need the policy. However, it’s important to consider the potential tax implications and compare offers to ensure you get the best value.

Is selling life insurance a side hustle?

Yes, selling life insurance can be a side hustle. It offers flexible hours and the potential for high earnings with part-time commitment. Using tools like WooCommerce to manage sales and client interactions can help streamline your workflow and maximize efficiency.

How long does it take to start making money selling life insurance?

The time it takes to start making money can vary. Typically, it takes a few months to obtain your license and build a client base. Initial sales might take a while, but with effective online marketing and consistent effort, you can start seeing returns relatively quickly.

What is the most lucrative insurance to sell?

Life insurance is considered one of the most lucrative types of insurance to sell due to its high commission rates and recurring income from policy renewals. Additionally, selling online through platforms like WordPress and WooCommerce can expand your reach and increase your potential earnings.

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Current online life insurance selling market

The market to sell life insurance online is growing rapidly, driven by consumer demand and technological advancements.

Key trends include a surge in digital sales, financial projections indicating market growth, and specialization in various segments catering to unique needs.

Trends within the market

The life insurance industry is embracing online platforms more than ever. Digital interfaces and virtual consultations allow you to reach a larger audience.

With more people working remotely, there’s a growing comfort with purchasing significant items, like life insurance, online.

Shifts towards online sales have also been beneficial during moments of terminal illness or for those exploring accelerated death benefits. Additionally, the rise in online traffic and targeted marketing strategies is key.

Key trends include:

- Increased digital interface usage

- Virtual consultations and sales

- Targeted online marketing strategies

Financial projections of the market

The financial future of online life insurance looks promising.

In 2021 alone, U.S.-based life insurance policies saw spending of approximately $635.8 billion, a figure projected to grow steadily.

This uptrend is partly fueled by convenience and the broadening appeal of online platforms. The National Association of Insurance Commissioners plays a crucial role in ensuring market stability and consumer protection.

Financial highlights:

- $635.8 billion in U.S.-based policies in 2021

- Growing market due to online adoption

- Role of the National Association of Insurance Commissioners in market regulation

Specialized segments of the market

Different segments of the online life insurance market cater to specific consumer needs.

Policies that include accelerated death benefits or specific terms for beneficiaries are seeing increased interest.

Specialized segments address eligibility concerns and offer tailor-made solutions for diverse demographics. Whether it’s a basic term policy or a comprehensive one, these specialized offerings meet various client needs.

Engaging with the online life insurance market requires adapting your approach to stay ahead of these trends and financial projections. Tailoring your offerings to specialized segments can significantly boost your success.

How to sell life insurance online

To sell life insurance online, you must become licensed, build a brand, and choose the right tools and platforms to reach your audience.

You also need to conduct proper market research, write a comprehensive business plan, and develop an ecommerce website. Start with the basics, and ensure that you have a good foundation of professional education and certification.

Licensing and education

All professional licensing and certification bodies tend to have a few steps in common.

- Complete pre-licensing education: Most states require you to complete a pre-licensing course.

- Pass the licensing exam: After education, schedule and pass the state licensing exam.

- Background check: Submit to a background check and fingerprinting.

- Apply for license: Apply for the license through your state’s insurance department.

Online courses and certifications

- Consider online courses from reputable sources like LOMA and NAIFA.

- Stay certified with relevant badges and courses provided by industry organizations.

Regularly attend industry events and participate in the industry’s online community to stay up to date.

- Participate in webinars, conferences, and workshops.

- Subscribe to industry journals and newsletters to stay on top of the latest changes and developments.

Compliance and regulations

You must comply with all state and federal regulations, stay aware of mandatory continuing education, and ensure your practices align with the law.

Regularly review changes in insurance law and ensure your online practices comply with both state and federal laws.

Creating your insurance sales brand

- Logo and tagline: Craft a memorable logo and tagline that represent your services and business name.

- Website design: Design an easy-to-navigate website that reflects your brand colors and ethos.

- Content strategy: Develop informative content like blog posts and videos that address common questions about life insurance.

- Social media presence: Be active on platforms like Facebook, LinkedIn, and Twitter to connect with potential clients.

Vision for a trustworthy reputation

Your vision should emphasize providing clients with tailored life insurance that meets their financial goals. Aim to build trust and long-term relationships by offering excellent customer service.

Market research to sell life insurance online

To sell life insurance online successfully, you must understand your target audience’s needs and preferences.

Use tools like Google Analytics and surveys to gather data. Study competitors to identify gaps and opportunities in the market.

Writing a business plan

There are some special considerations for drafting a business plan for life insurance sales.

Executive summary

Outline your mission, vision, and goals.

Market analysis

Detail your target market and competition.

Marketing strategy

Include online marketing tactics like social media campaigns, email newsletters, and SEO.

Operational plan

Explain your daily operations and sales strategies.

Financial plan

Provide projections and budgeting for expenses like platform fees and marketing costs.

Best platforms for selling life insurance online

Finding the right combination of platforms and tools is crucial to sell life insurance online.

- Insurance comparison websites: Platforms like Policygenius and NerdWallet can help you reach a wide audience by comparing policies.

- Your own website: Creating your own website gives you control over branding and customer experience.

- Social media: Use Facebook and LinkedIn to create targeted ads and connect with potential buyers.

- Email marketing tools: Tools like Mailchimp help in sending personalized insurance quotes and information to prospects.

Choose a sales platform

Focus on what best fits your strategy to sell life insurance online. Look for features like:

- User-friendly interface: Simple navigation and robust performance for clients.

- Analytics: Track performance and customer behavior.

- Security: Advanced security for handling confidential customer data.

Consider platforms like HubSpot CRM for integrated sales tools or WordPress with ecommerce plugins.

Creating an ecommerce website to sell life insurance online

Creating a user-friendly and efficient website with 10Web can help boost your online presence to sell life insurance online. The AI Ecommerce Website Builder generates an ecommerce-ready website based on your needs. Then, take full control of your website’s appearance and functionality with the 10Web Builder’s drag-and-drop interface.

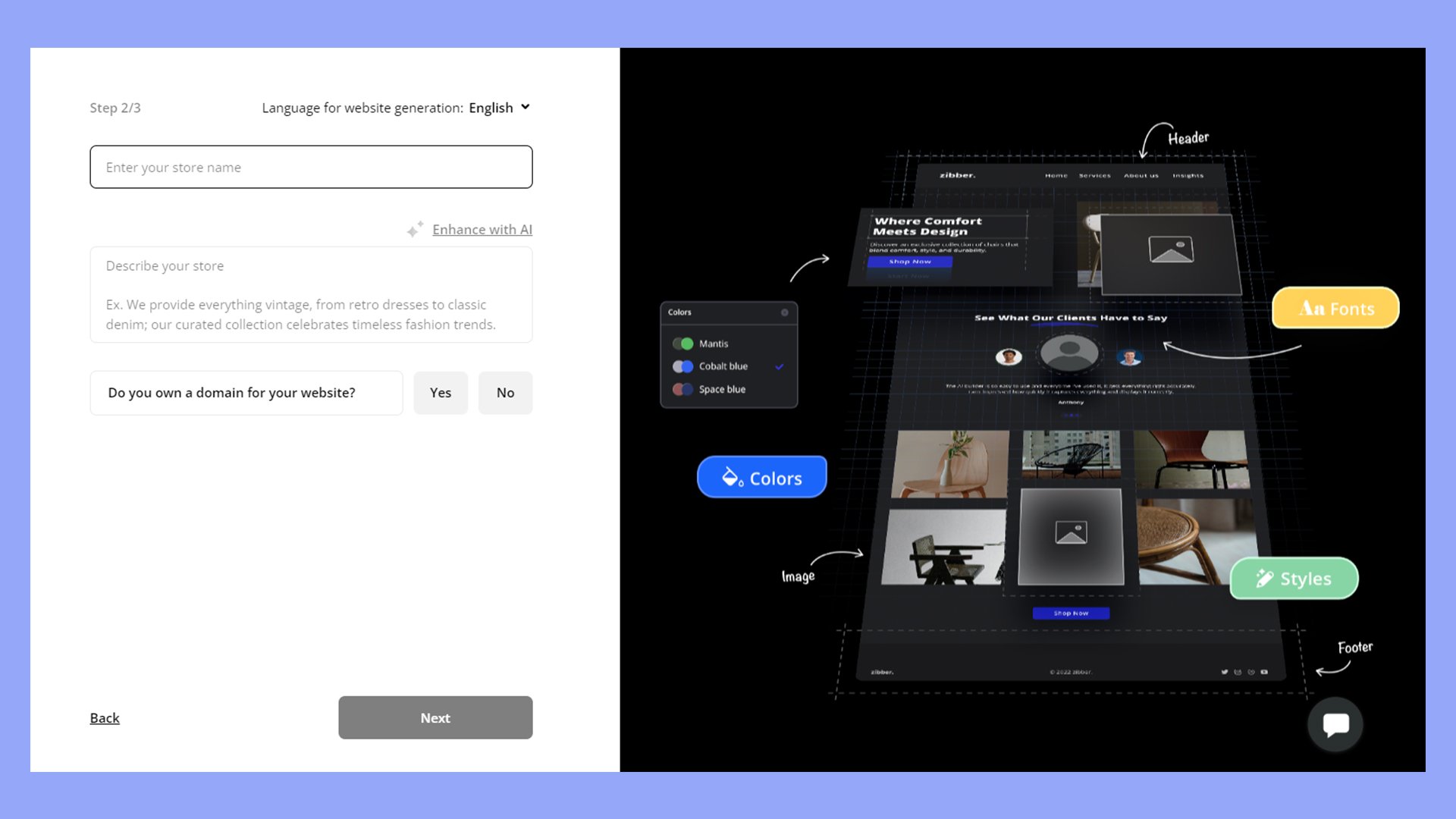

- Start by visiting the AI Ecommerce Website Builder, then select Generate Your Website.

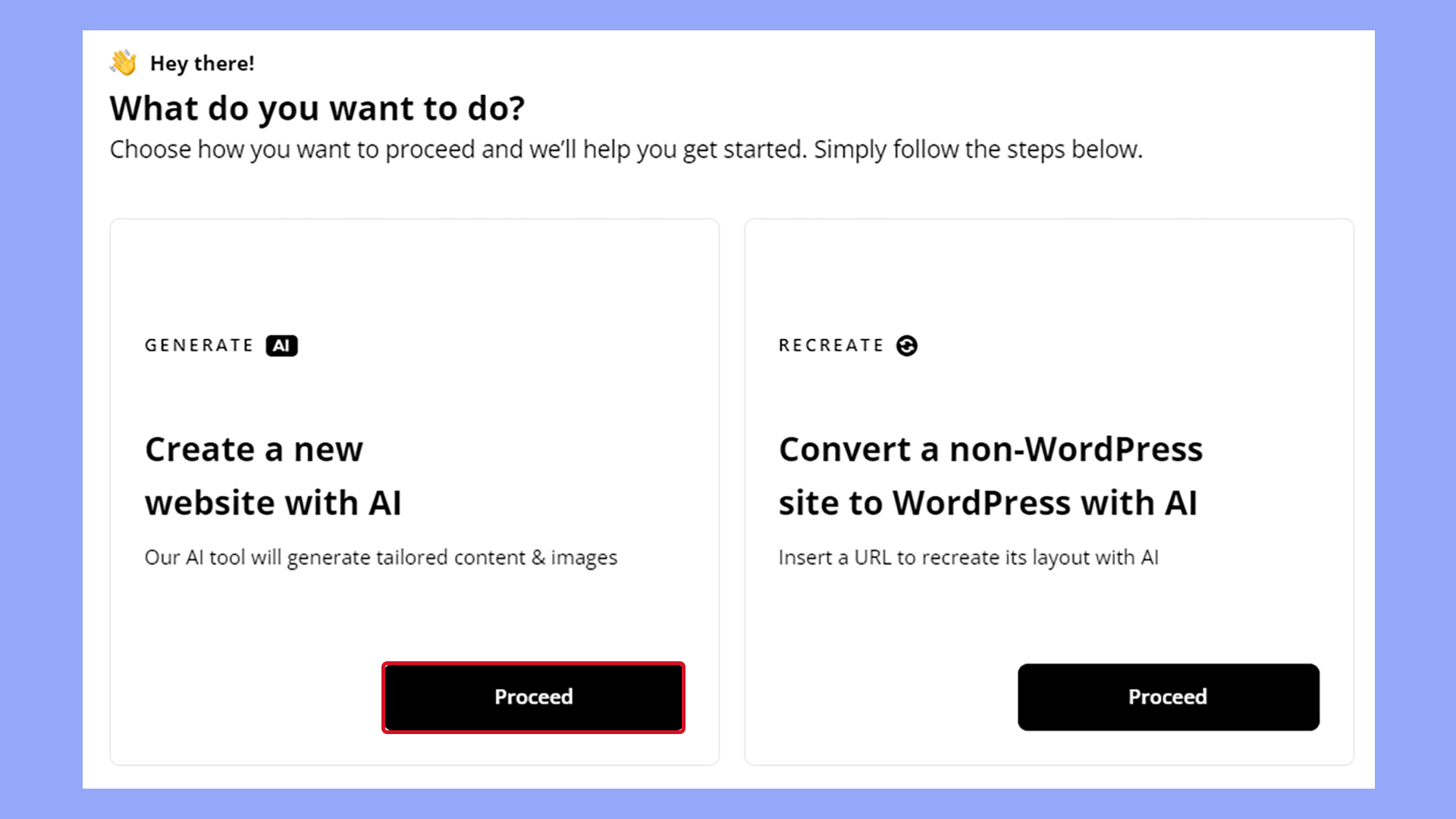

- The AI Ecommerce Website Builder offers two ways to generate a website. If you have something specific in mind, the AI can convert any existing website to a customizable WordPress template. If you’re just getting started, let the AI generate a website tailored to your description and needs by selecting the option to Create a new website with AI.

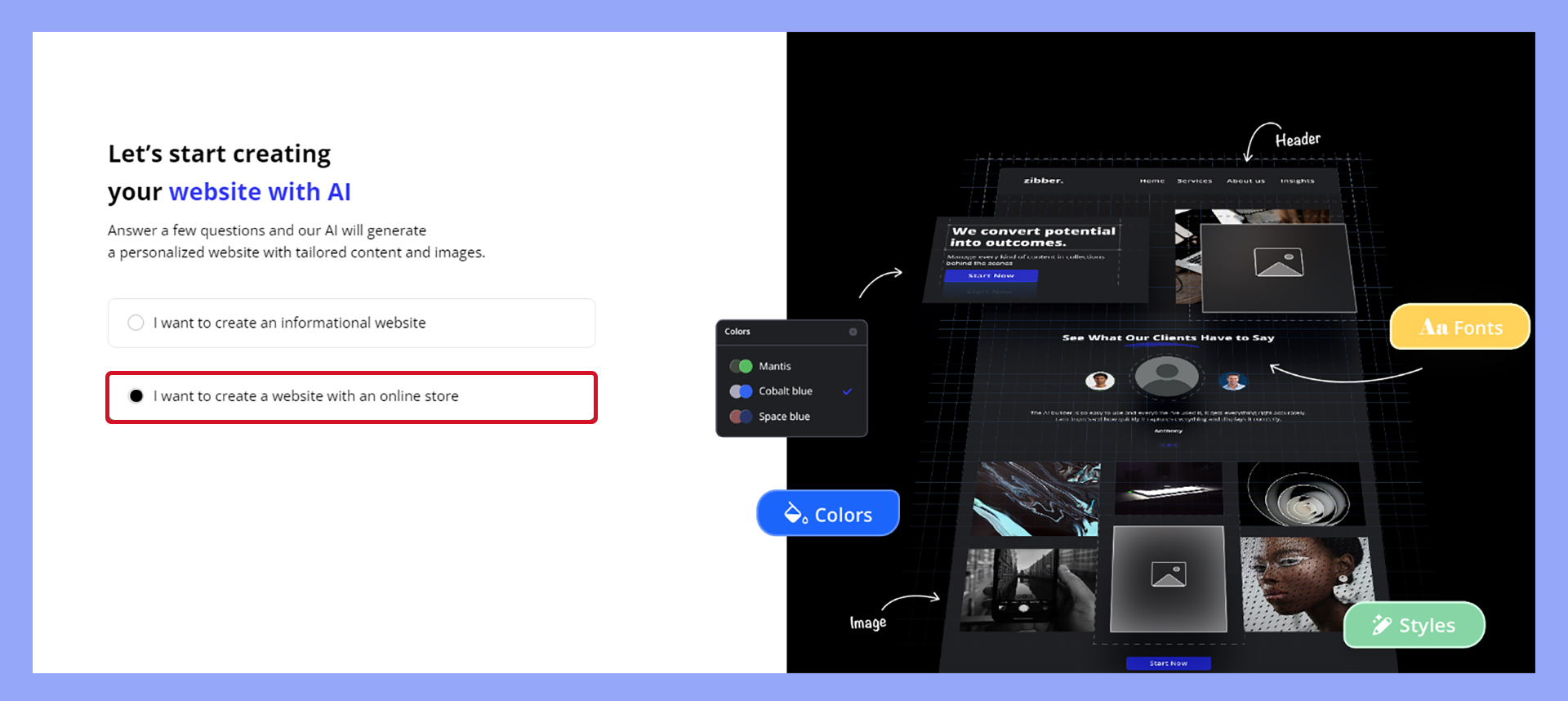

- For an ecommerce-ready website, select the option to Create a website with an online store.

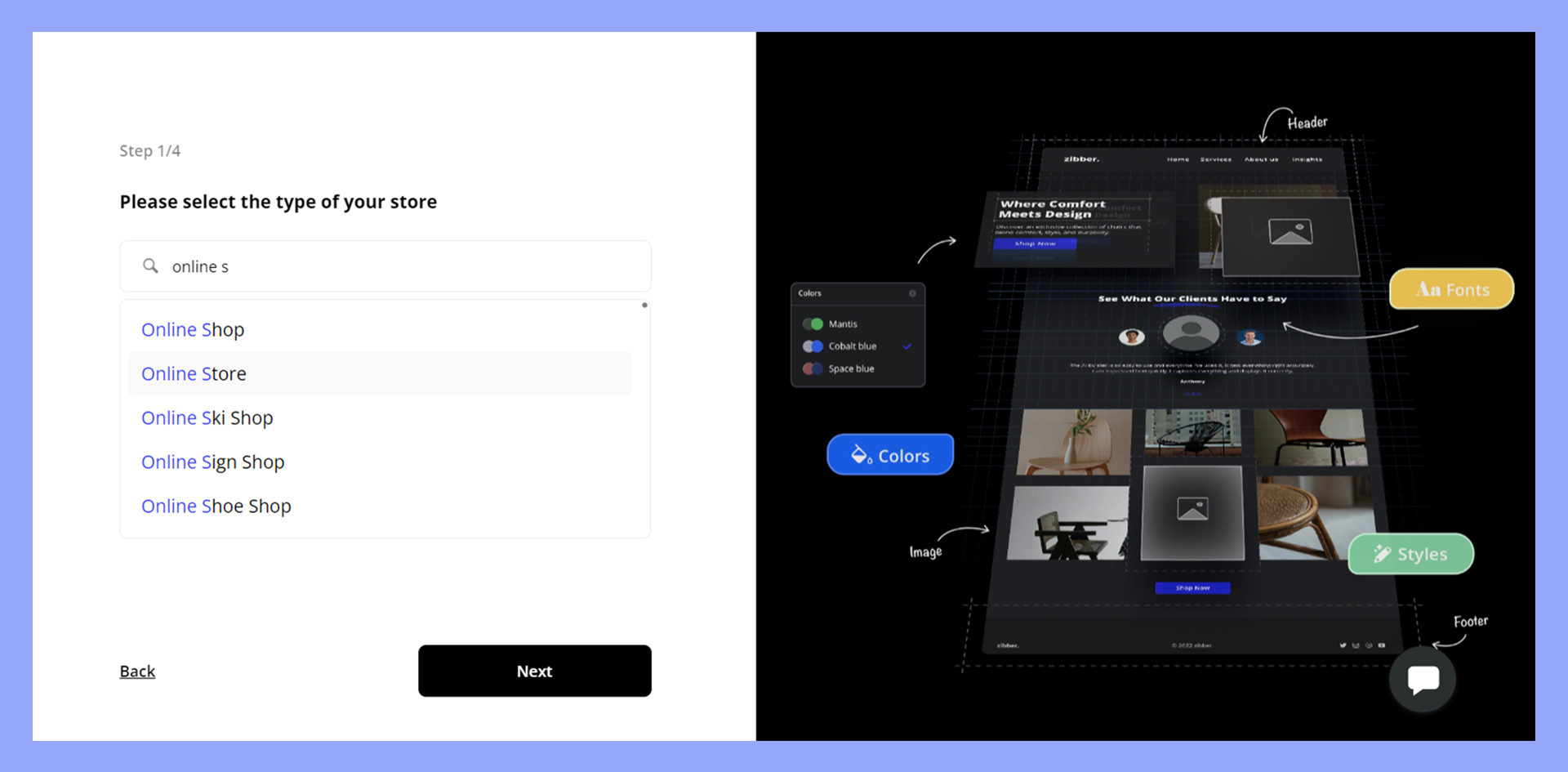

- Use the dropdown menu to select your type of store.

- Here’s where you can tell the AI Website Builder about the type of website you need. Enter your life insurance store’s name and a description of your store.

Consider including specifics about what you’ll sell so the AI can generate pre-filled products and categories to help you set up your store. - Review and adapt the suggested products and categories as needed, then click Generate.

After generating your website, you’ll find access to everything you need to manage your life insurance website in the 10Web dashboard. Start by customizing your website in the 10Web Builder.

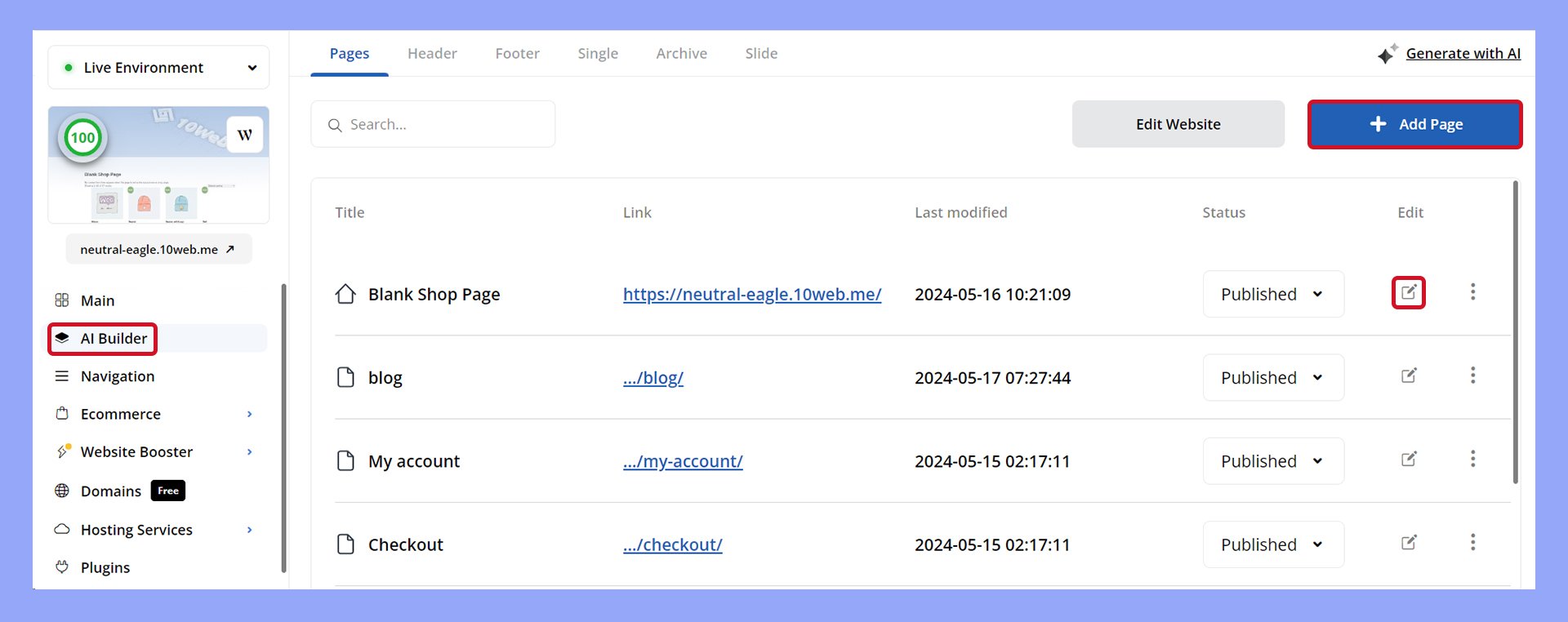

Adding and editing website pages

Navigate to the dashboard’s AI Builder section to manage your website’s pages. Here, you can access the 10Web Builder’s drag-and-drop interface.

- Select a page’s pencil icon, or click Add Page to create a new page.

- The 10Web Builder gives you the ability to customize any elements of your page’s appearance or functionality.

- Easily add WooCommerce features and content with the Builder’s premium widgets.

- Use generative AI tools to update content and media quickly.

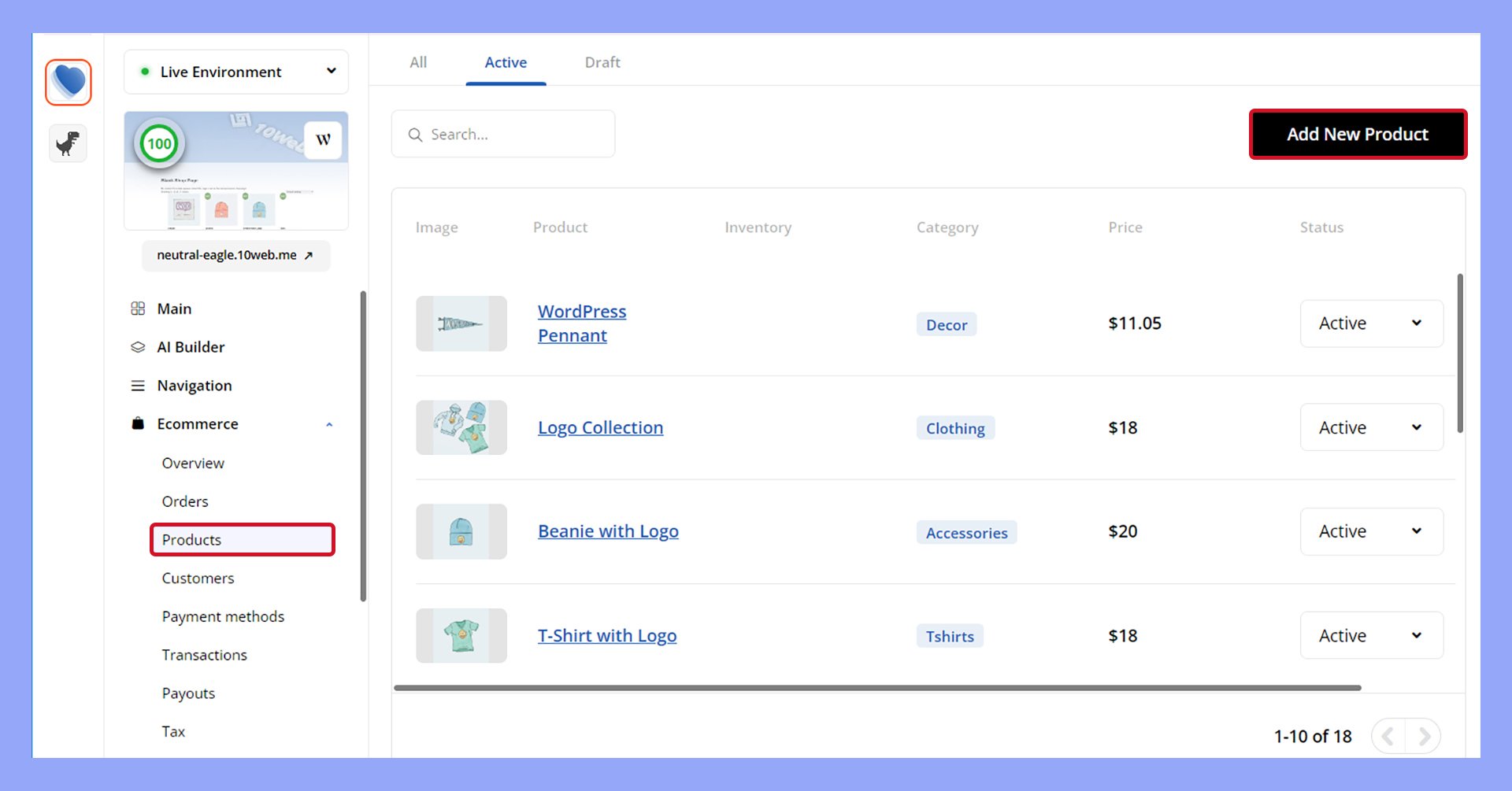

Managing products

You can manage your store’s products from the dashboard’s Products section.

- Go to Ecommerce > Products.

- Select an existing product to edit, or click Add New Product.

- Here, you can set the product’s name, description, and price, as well as add other specific information.

- Click Publish to go live with the product.

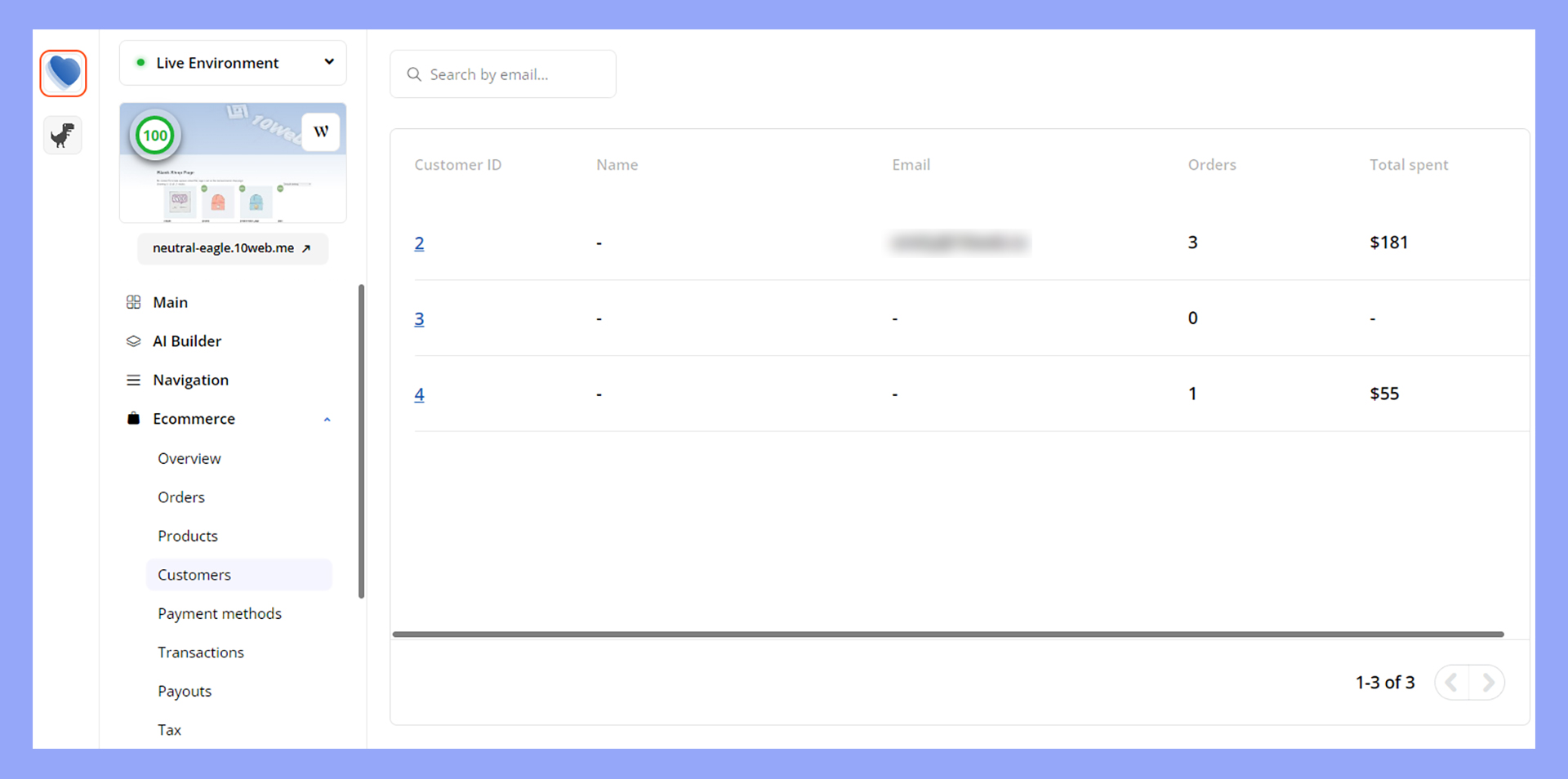

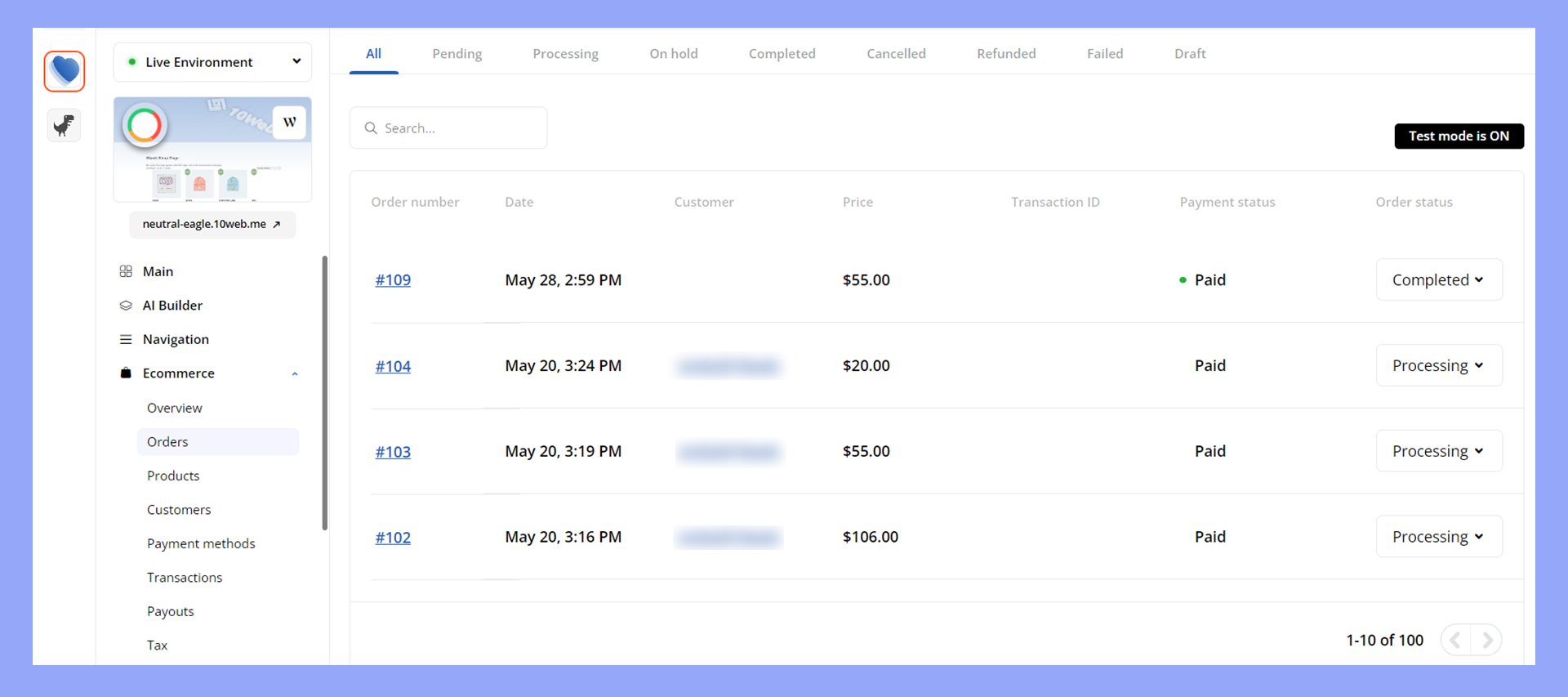

Managing customers and orders

You can access orders and customer information in the dashboard.

- Go to Ecommerce > Customers to see a list of customers.

- Clicking on a customer displays their details and order history.

- Go to Ecommerce > Orders to see a list of orders.

- Here, you can update an order’s status, process orders, and track shipments.

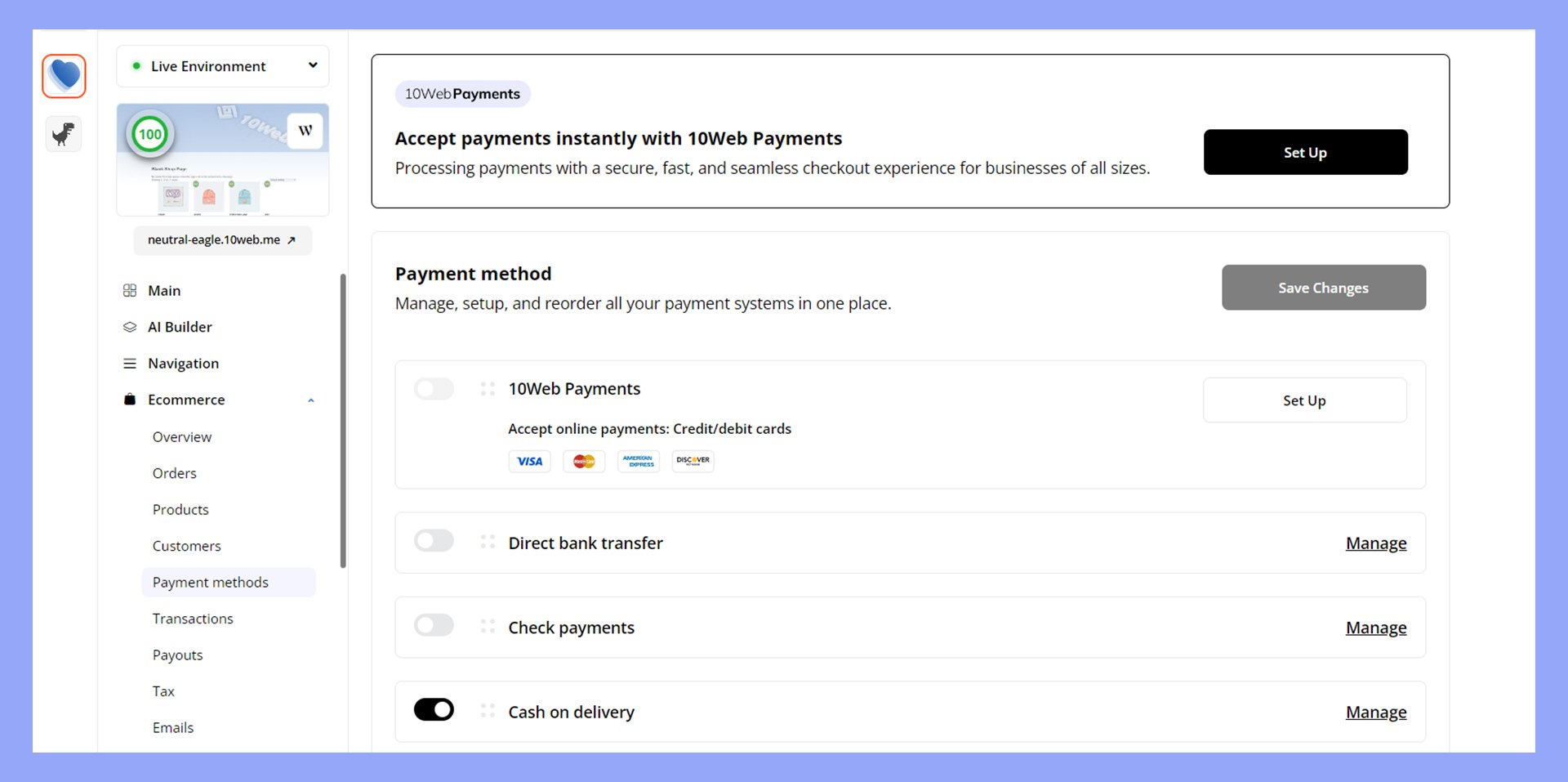

Enabling payment methods

You can choose from a variety of payment methods in the dashboard.

- Navigate to Ecommerce > Payment.

- Enable 10Web Payments, then click Set Up to configure credit card payments.

- Follow the prompts to configure the payment gateway settings.

- Test the available payment methods to ensure they’re working as intended.

Looking to sell online?

Create your custom online store in minutes with 10Web AI Ecommerce Website Builder and take your business online.

Marketing and customer engagement

Focusing on different methods to reach out to your audience and engage them is vital for success when selling life insurance online. This includes leveraging content marketing, social media, and maintaining excellent customer service to build trust and drive sales.

Diverse methods to effectively connect with your audience

To sell life insurance online, you need to use different approaches to connect with your potential clients. This might include personalized emails, virtual meetings, and chatbots on your website.

Live chat tools can answer questions instantly, while email marketing campaigns keep prospects updated.

Social media

Social media platforms offer great opportunities to connect with potential clients.

Share tips, news, and informative content on platforms like Facebook, Instagram, and LinkedIn. Run targeted ads to reach your specific audience. Engage with users by promptly responding to comments and messages.

Content marketing

Creating valuable content is crucial.

Use detailed product descriptions, FAQs, and blogs to explain life insurance terms like premiums, cash value, and death benefit. Create blog posts that address common life insurance questions and concerns. Use case studies and testimonials to show real-life benefits. Provide product comparisons and user reviews to help inform decision-making.

Make engaging videos explaining policies and terms. Ebooks and infographics are also helpful in educating your audience.

Share success stories and use statistics on financial security and the importance of life insurance to establish credibility and showcase your expertise.

Use search engine optimization (SEO) techniques to ensure your content ranks high on search engines, attracting more website visitors.

Interactive content like quizzes and polls can attract more engagement.

Building a sales funnel to sell life insurance online

Your sales funnel should leverage your content to guide prospects from awareness to purchase. This will help to sell life insurance online as an authoritative source of accurate and helpful information.

Awareness phase: Use content like blogs and videos to draw attention.

Research phase: Offer product comparisons and detailed guides.

Consideration phase: Share testimonials and case studies.

Application phase: Assist clients in completing forms and provide immediate support when needed.

Keeping your clients’ data safe

Once you have leads coming in, maintaining privacy is critical.

Use secure digital practices like password protection and antiviruses. Ensuring personal information is encrypted and using secure communication channels will build trust with your clients.

Regularly update your software and follow privacy laws to protect data.

Conducting needs analysis for clients

Understanding your client’s needs helps tailor your services.

Gather information: Collect basic details and medical records.

Financial goals: Understand their long-term and short-term financial objectives.

Current situation: Evaluate their current financial stance and protection needs.

Health history: Discuss their health background and future changes.

Effective customer service

Good customer service is essential. Be prompt in responding to inquiries via phone, email, or social media.

Virtual consultations allow for face-to-face interactions. Use CRM tools to keep track of client interactions and follow-ups.

Building rapport and addressing concerns effectively can help close sales and foster long-term relationships.

Conclusion

Selling life insurance online presents a promising avenue for new and seasoned insurance professionals. You can build a successful online life insurance business by staying abreast of market trends, obtaining the necessary licenses and education, leveraging digital platforms, and continually engaging with your audience through targeted marketing and superior customer service.

Remember, effectively selling life insurance online requires dedication, continuous learning, and adaptability. Embrace the opportunities presented by digital tools and platforms to reach a wider audience and cater to specific client needs. With determination and strategic planning, you can scale your business, achieve your financial goals, and make a meaningful impact on your clients’ lives. Stay focused, stay motivated, and the rewards will follow.