An open-source payment gateway is a customizable, cost-effective way to manage online transactions. This article dives into the workings of open-source payment gateways, covering their advantages, setup, integration with ecommerce platforms, and essential security considerations.

Open-source payment gateways provide a unique opportunity for businesses to tailor payment systems to fit specific needs while avoiding licensing fees. There is control and flexibility in regard to these solutions, which empowers businesses to optimize their online transaction process and deliver a simplified customer experience.

Open-source payment gateways

Open source payment gateway is a flexible way to handle online transactions. They allow you a flexible, cost-effective solution for handling online transactions. Their openly accessible code allows businesses to modify the gateway to suit specific needs, supporting a variety of payment methods, including cryptocurrencies. This adaptability makes them a flexible choice compared to proprietary solutions.

The main ideas behind open-source gateways are:

- Freedom to use and change the code

- No licensing fees

- Community support and updates

- Transparency in how it works

Open-source gateways follow open standards. This helps them work with many payment types and banking systems.

Advantages of open-source payment gateway solutions

Open-source payment gateways suggest many benefits for businesses. Here are some of the most common advantages:

- Cost savings: Open-source solutions eliminate the need for high licensing fees and per-transaction costs, making them an economical choice, especially for businesses focused on managing costs as they scale.

- Customization: With the flexibility to adapt the code, businesses can introduce features specific to their operations, creating a payment gateway that better aligns with their goals and customer expectations.

- Security: The open nature of the code means it’s reviewed by a wide community of developers, who actively identify and address vulnerabilities, providing a level of security that often meets or exceeds that of proprietary systems.

- No vendor lock-in: Open-source gateways offer independence from single providers, so businesses can adapt or change their infrastructure without being restricted by a specific vendor’s ecosystem.

- Community support: A large community of developers and users backs these solutions, fostering a collaborative environment where troubleshooting, best practices, and innovative improvements are readily shared.

- Greater control over data: Open-source gateways allow businesses to maintain full control of their transaction data, including the option to host the system on their servers, offering enhanced data privacy and easier regulatory compliance.

Common features of open-source payment gateways

Most open-source payment gateways offer a robust set of features to support various business needs. These include essential tools for processing payments, enhancing security, and managing customer transactions efficiently.

Below are some of the most common features you’ll find in open-source gateways:

Credit card processing

Credit card processing is an invaluable feature. It lets businesses accept major credit and debit cards directly on their websites. Open-source gateways often support a variety of card networks providing compatibility with customers’ preferred payment methods. This feature is essential for capturing a broad customer base, as credit card payments remain one of the most popular options for online transactions worldwide.

Support for multiple currencies

Global commerce requires flexibility and open-source gateways typically support transactions in multiple currencies. This feature helps businesses expand their reach internationally, allowing customers to pay in their local currency, which can reduce conversion friction and improve the customer experience. Multiple currency support also allows businesses to present prices transparently and avoid surprises in currency exchange fees for international shoppers.

Fraud detection tools

With the rise of online transactions comes the need for advanced fraud prevention. Open-source payment gateways often include tools for detecting suspicious activity, such as tracking abnormal transaction patterns or setting up rules to block high-risk transactions. Some even offer integration with third-party fraud detection services, adding an extra layer of security and helping businesses safeguard both their revenue and their customers’ sensitive information.

Recurring billing options

For businesses offering subscription services, recurring billing options are crucial. Many open-source gateways allow for automated billing at set intervals, supporting various subscription models, from monthly to yearly plans. This feature simplifies revenue generation from memberships, streaming services, and other subscription-based models, enabling businesses to build predictable revenue streams while offering convenience to their customers.

Integration with shopping carts

Open-source gateways are typically designed to integrate with popular shopping cart software so that ecommerce businesses can easily manage product purchases and payments in a unified system. This compatibility ensures a simplified checkout process, reducing friction for customers and supporting a cohesive shopping experience. Many gateways offer plugins or modules that connect to major ecommerce platforms, such as WooCommerce and Magento.

Beyond these core features, open-source payment gateways often provide additional functionalities that improve flexibility and control over the payment system. Those additional features include:

- Mobile payment support: Many open-source payment gateways are optimized for mobile use so that customers can pay directly from their smartphones or tablets. This feature includes support for various mobile payment methods, such as Apple Pay and Google Pay.

- Digital wallet connections: Digital wallets like PayPal and Venmo offer convenience and security for online shoppers. Many open-source payment gateways support these digital wallet connections, reaching customers who prefer these methods over traditional card payments.

- Reporting and analytics: With reporting and analytics tools businesses can track and analyze payment data, providing insights into transaction volumes, revenue trends, and customer behavior. These insights enable more informed decision-making based on sales patterns and operational performance, which supports better financial planning and resource allocation.

Top open-source payment gateway projects

Open-source payment gateways give businesses more control over their payment systems. They let you customize features and add new payment methods. Here are some top options for popular e-commerce platforms.

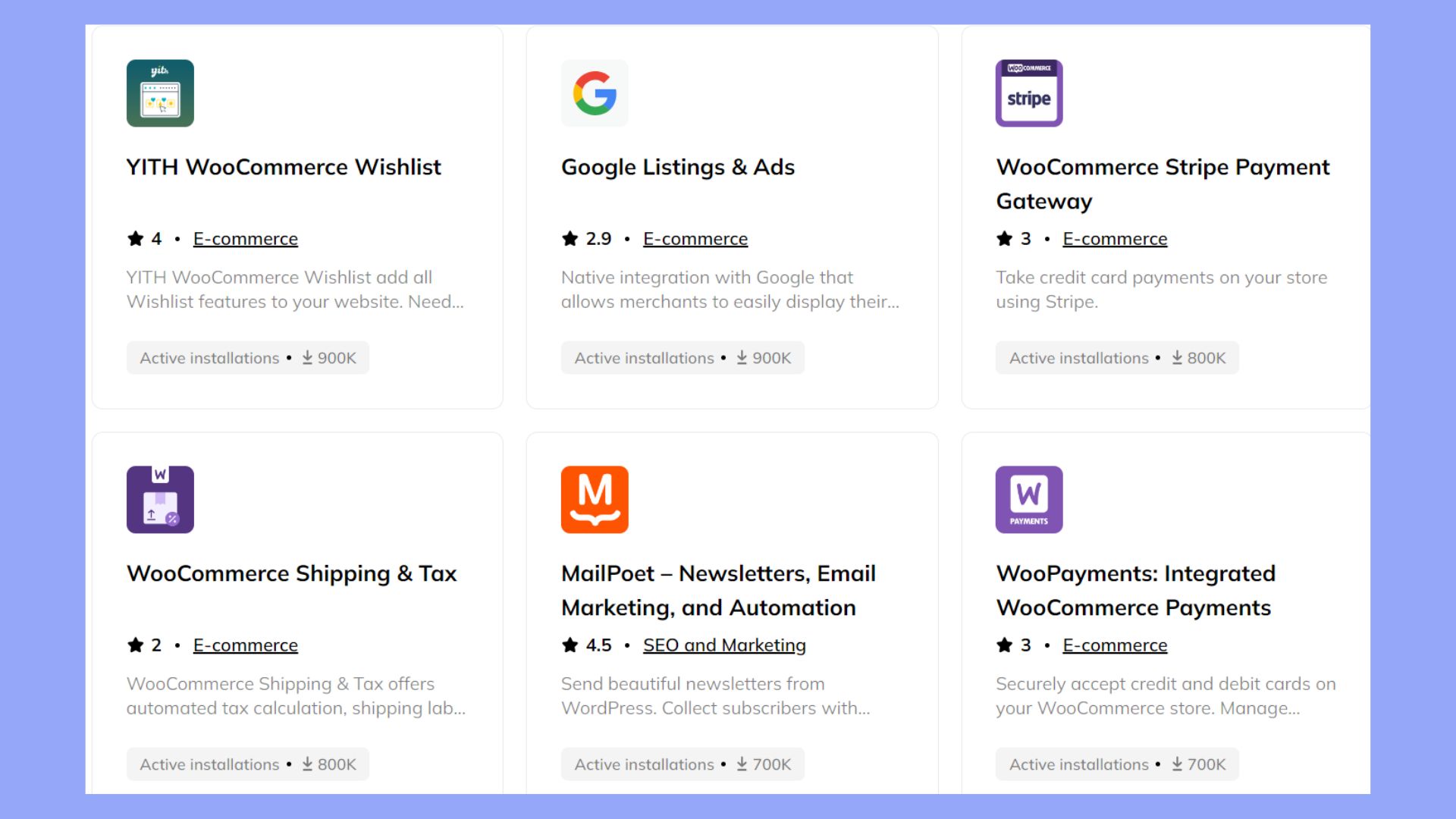

WooCommerce

WooCommerce has several open-source payment gateway plugins. WooCommerce Stripe Payment Gateway is a popular choice. It’s free and works with major credit cards. You can also accept Apple Pay and Google Pay.

The plugin is easy to set up. You just have to connect your Stripe account and you’re ready to go. It handles refunds right from the WooCommerce dashboard. For security, it uses Stripe’s strong encryption.

There’s also WooCommerce PayPal Payments. It lets customers pay with PayPal, Venmo, and credit cards. The checkout is quick and happens on your site. You can customize the look of your buttons too.

Magento payment module

Magento has built-in payment options, but you can add more with open-source modules. One standout is Stripe Payments for Magento 2. It’s free and packs a lot of features.

The module supports over 135 currencies. You can take payments through credit cards, Apple Pay, and Google Pay. It also works with Stripe’s subscription billing.

Another good choice is the PayPal module for Magento 2. It’s made by PayPal and connects easily to your account. Your customers can use PayPal, PayPal Credit, and Venmo. The module is always up to date with PayPal’s latest features.

Prestashop payment addon

PrestaShop has many open-source payment addons. The PayPal Official addon is a top pick. It’s free and made by PayPal. You can accept PayPal, credit cards, and local payment methods.

The setup is quick. Just enter your PayPal email to get started. The addon handles different currencies and languages. It also lets you do partial refunds.

For more options, try the Stripe Official addon. It’s also free and works with over 135 currencies. You can take payments via cards, Apple Pay, and Google Pay. The add-on keeps your customers on your site during checkout.

OpenCart payment extension

When setting up an online store with OpenCart, you have a variety of payment gateway options. OpenCart offers flexibility by allowing different payment extensions.

One popular free option is the Stripe Payments extension. This is an open-source solution that integrates Stripe’s services into OpenCart. It is user-friendly and licensed under the MIT license, so you can freely use and modify it.

The begateway extension is another OpenCart option. To install it, you need to back up your website contents and database. After that, you upload the begateway file using the Extensions menu.

The CryptAPI Payment Gateway extension is ideal if you want to accept cryptocurrencies. In the Extensions menu, you can activate and choose which cryptocurrencies to accept.

OpenCart’s own Core payment methods offer various simple solutions like bank transfers or other online gateways. These can be activated directly from the OpenCart interface without extra downloads.

Using these extensions, you can customize your OpenCart store’s payment options to suit your business needs.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

How to install and configure an open-source gateway?

Setting up an open-source payment gateway involves a few key steps. Open-source payment gateways can work with many online stores. They connect through APIs, plugins, or custom code. You’ll need to meet some basic system requirements, follow a setup process, and implement important security measures. Let’s look at those requirements before discussing the setup.

System requirements

To install an open-source payment gateway, you’ll need:

- A web server (Apache or Nginx)

- PHP 7.4 or higher

- MySQL 5.7 or MariaDB 10.2+

- 2GB RAM minimum

- 20GB disk space

- SSL certificate

Make sure your server meets these specs before starting. Check with your host if unsure.

Step-by-step setup

- Download the payment gateway files

- Upload them to your web server

- Create a new MySQL database

- Run the installation script

- Configure your settings in the admin panel

- Set up your payment processor accounts

- Test transactions in sandbox mode

Follow the docs for your chosen gateway. Most use a web installer to guide you through these steps.

Security configurations

Proper security is vital for handling payments. Key steps:

- Use HTTPS/SSL for all pages

- Enable two-factor auth for admin access

- Set strong password requirements

- Limit login attempts

- Keep all software updated

- Use a web application firewall

- Encrypt sensitive data at rest

- Conduct regular security scans

Review PCI compliance guidelines as well. Work with a security expert if needed.

API-based integration

API integration lets your store talk directly to the payment gateway. You’ll need to get API keys from the gateway. Then you can use their code library to add payments to your checkout. Most gateways have clear docs to help you set things up. You’ll send customer and order details to the gateway. It will handle the payment and send back a result.

This method gives you more control over how payments work. But it takes more tech skills to set up. You may need a developer to help if you’re not familiar with coding.

Plugin-based integration

Plugins make it easy to add payment gateways to your store. Many ecommerce platforms have pre-made plugins for popular gateways.

To use a plugin:

- Find it in your platform’s app store

- Install it on your site

- Enter your gateway account details

- Set up payment options in your store settings

Plugins are quick to set up and don’t need much tech know-how. But they may have fewer features than API integrations.

Custom integration techniques

Custom integration lets you build a unique payment setup. You might do this if you need special features or want to change how the gateway works.

Some ways to customize:

- Mix APIs and plugins

- Write your own plugin

- Create a custom checkout process

This takes more work and coding skills. But it gives you full control over how payments work in your store. You’ll need to know the gateway’s API well. And you should test a lot to make sure everything is secure and works right.

Payment processing workflow

Payment gateways handle online transactions through a series of steps. These steps move money from buyers to sellers while keeping data safe. Let’s look at how payments work, what to do when things go wrong, and how systems talk to each other.

Transaction lifecycle

When you buy something online, a lot happens behind the scenes. First, you enter your card details. The payment gateway checks this info and sends it to the bank. The bank looks at your account to see if you have enough money. If you do, they approve the payment.

Next, the money moves from your account to the seller’s account. This can take a few days. During this time, the payment is “pending.” Once the money arrives, the payment is “settled.”

The gateway keeps track of all these steps. It tells the seller when the payment is approved and when the money arrives. This helps sellers know when to ship items or give access to services.

Handling payment errors

Sometimes payments don’t work. This can happen for many reasons. Your card might be expired, or you might not have enough money. The bank’s systems could be down, or there might be a problem with the internet.

When an error happens, the payment gateway sends a message. This message tells what went wrong. For example, it might say “card expired” or “not enough funds.” The gateway shows this message to you so you can fix the problem.

Good payment systems help you try again. They might ask for a different card or suggest another way to pay. This makes it easier for you to complete your purchase. It also helps sellers avoid losing sales due to payment problems.

Multi-currency support

In a global economy, supporting multiple currencies is important. An open-source payment gateway allows you to handle transactions in different currencies, attracting a wider customer base. Currency conversion is essential, as it helps convert payments from the customer’s currency to your preferred currency.

The gateway communicates with banks and payment processors to provide real-time exchange rates. Fee calculation is another factor, as handling multi-currency payments may involve transaction fees. By supporting multiple currencies, your business can expand internationally, making it easier for customers to pay in their own currency. This builds trust and satisfaction with your global audience.

Asynchronous and synchronous responses

Payment gateways use two main ways to talk to other systems: synchronous and asynchronous.

Synchronous means the gateway waits for an answer before moving on. This is like making a phone call. You stay on the line until you get a response. This is good for quick checks, like seeing if a card is valid.

Asynchronous means the gateway doesn’t wait. It’s more like sending a text message. You send it and can do other things while waiting for a reply. This works well for longer processes, like waiting for money to move between banks.

Most payment systems use both types. They use synchronous for fast checks and asynchronous for slower steps. This helps keep things moving smoothly, even when some parts take more time.

Customization and extension

Open-source payment gateways give you lots of ways to change how they work. You can add new payment options, improve core features, and update the look and feel.

Creating custom payment methods

You can add new ways for customers to pay through your gateway. This lets you work with more payment providers and types of transactions. To make a custom payment method:

- Create a new folder for your code

- Set up the basic info and settings

- Write the code to process payments

- Test it thoroughly

Some gateways have tools to help you build new payment options. These might include pre-made templates or guides. You can also look at how other custom methods are built to learn.

Extending core functions

You can add new features to make the gateway work better for your needs. Some ways to do this:

- Create plugins to add extra tools

- Improve security measures

- Add support for more currencies

- Make the checkout process faster

Look for developer docs to learn how to extend the core code. You might need to know languages like PHP or JavaScript. Test any changes carefully to avoid breaking things.

Theme and UI customization

You can change how the payment pages look to match your site. This helps give customers a smooth experience. Here are some ways to customize the look:

- Edit CSS files to change colors and fonts

- Update page layouts

- Add your logo and branding

- Make forms easier to use on phones

Many gateways have settings to change basic design elements. For bigger changes, you might need to edit theme files directly. Always test your changes on different devices to make sure they work well.

Conclusion

Օpen-source payment gateways offer a customizable, and cost-effective solution for businesses looking to streamline their ecommerce transactions. With no licensing fees, extensive customization options, and community support, these gateways help businesses build a payment process specific to their unique needs. By using open-source solutions, businesses gain the flexibility to integrate multiple payment methods, enhance security measures, and provide a seamless, user-friendly checkout experience that aligns with their brand. Whether through API or plugin integration, open-source gateways can be adapted to evolving market demands, making them a valuable asset for growing online businesses.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.