Imagine you’re at the final step of an online purchase, excited to complete it, but then a confusing and slow payment process disrupts the experience. This is where effective payment gateway design comes in—it’s about more than simply processing payments. A good payment gateway design creates a smooth, secure, and intuitive checkout experience that leaves customers feeling satisfied and valued.

In this article, we’ll explore the fundamental elements of payment gateway design that contribute to seamless transactions. By focusing on intuitive layouts, quick processing, and strong security, businesses can improve customer satisfaction, build trust, and make each transaction feel easy and reliable.

FAQ

How do you design a payment gateway system?

What is the architecture of a payment gateway?

- Frontend: For user payment details

- Backend: For transaction validation and routing

- Database: For securely storing records

- Integration APIs: For connecting with banks and processors

- Security Layer: For encryption and protection

- Notifications & Logs: To track transaction status.

Which design pattern is used in a payment gateway?

How do I create a payment link gateway?

- Generate secure, unique payment links.

- Embed transaction details in each link.

- Use HTTPS and tokens for security.

- Redirect users to a payment page.

- Process and confirm payments post-completion.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

What is a payment gateway and how does it work

A payment gateway acts as the bridge between a merchant’s website and the financial institutions processing the payment. When a customer submits their payment details, the gateway securely captures, encrypts, and transmits this information to the appropriate banks and card networks for authorization. Once the customer’s bank approves the payment, the gateway communicates the success back to the merchant’s site, allowing the transaction to be completed.

The process typically unfolds in several steps: a customer initiates the payment by entering their details, the gateway encrypts and sends this information for approval, and then confirms the payment status to the merchant. In addition to facilitating transactions, payment gateways often include fraud detection, reporting tools, and multi-currency support to enhance security, accuracy, and convenience in payment processing.

Fundamentals of payment gateway design

A payment gateway is a necessary component in online transactions, serving as a secure bridge that processes payments and safeguards sensitive data. To guarantee smooth operation, effective design should incorporate both essential components and considerations for scalability, security, and user experience.

Key components and process flow

A robust payment gateway has several essential parts, each performing a specific role in the transaction lifecycle:

- User interface: The interface is the customer-facing part, collecting card details and initiating payments. It should be clear, intuitive, and responsive for all devices.

- Payment gateway: The core system that encrypts payment data, processes transactions and communicates with banks, card networks, and merchants.

- Payment processor: The processor verifies payment information and transfers funds securely between the customer’s and merchant’s banks.

- Merchant account and bank connections: A merchant account stores funds from sales, while connections to banks facilitate the movement of money across institutions.

A typical payment process flows as follows:

- Data entry: Customer enters payment info on the user interface.

- Encryption and transmission: The gateway encrypts and sends the data to the payment processor.

- Authorization: The processor verifies available funds and confirms the transaction’s validity with the customer’s bank.

- Completion and settlement: Once authorized, the gateway notifies the merchant, initiating the final settlement to the merchant account. This is followed by a fund transfer within 1-3 business days, depending on the bank.

Functional and non-functional requirements

Defining both functional and non-functional requirements is important in designing a payment gateway that effectively supports transaction processing and customer experience.

Functional requirements address the core tasks a payment gateway must perform:

- Transaction processing: The gateway should securely process payments, handle authorizations, and manage settlements.

- Data encryption: Ensure sensitive data, like card numbers, is encrypted to protect against unauthorized access.

- Fraud detection: Implement tools to identify and prevent fraudulent activities.

- Reporting and analytics: Provide transaction data and generate reports to assist in financial tracking.

- Multi-currency support: Enable processing in various currencies for global customers.

- Refund and chargeback management: Allow merchants to handle refunds and manage chargebacks efficiently.

Non-functional requirements focus on the performance and usability of the gateway:

- Scalability: Support an increasing number of transactions as the business grows without sacrificing speed.

- Reliability: Ensure high availability with minimal downtime, particularly during peak hours.

- Security compliance: Adhere to PCI-DSS and other security standards to maintain data integrity.

- User experience: Design an intuitive interface for both customers and merchants, with easy navigation and responsive design for mobile and desktop.

- Speed: Minimize transaction processing time to avoid delays and enhance user satisfaction.

Common operational models

Payment gateways can work in different ways:

- Hosted: The gateway runs the payment page on its own site.

- Integrated: The gateway fits into the seller’s website.

- API-based: Sellers can add payment features to their own apps.

Each model has its pros and cons. Hosted is easy to set up but less customizable. Integrated looks better but needs more work. API-based gives the most control but is harder to build.

Gateways may also offer extra tools. These can include things like:

- Recurring billing

- Multi-currency support

- Mobile payments

- Refund handling

Custom vs embedded payment systems

Custom payment gateways can be tricky to build. They cost a lot of money and take a long time to make. You have to handle things like:

- Compliance rules

- Data storage

- Security

- Tech issues

Embedded payment platforms are different. They’re already built into the software you use. This makes payments easier to set up.

Some good things about embedded systems:

- Quick to start using

- Work with your current software

- Handle security for you

- Often cheaper than custom options

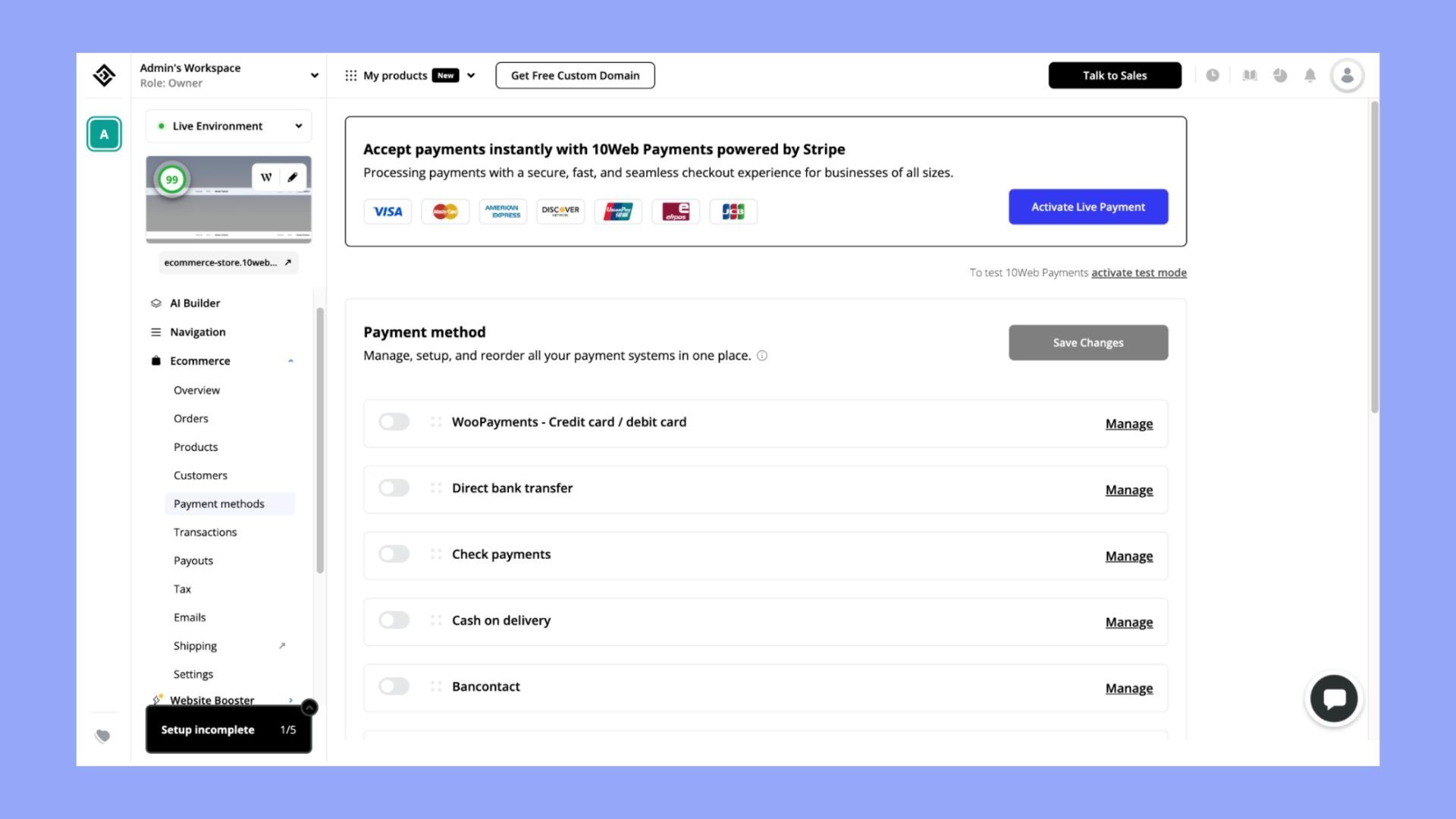

So, for example, if you use 10Web to manage your ecommerce website, you will get access to 10Web Payments on your dashboard which is powered by Stripe. 10Web Payments allows users to set up numerous payment methods which improves customer satisfaction. This allows you to have a quick and easy payment management system for your business and guarantees that the payments are secured.

Many companies use a mix of both. They might use embedded payments for simple tasks. Then they add custom parts for special needs.

When picking a system, think about:

- What features you need

- Your budget

- How fast you need it running

- Your tech skills

No perfect choice exists for everyone. Look at your business needs to decide what’s best for you.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Payment processing flow design

Payment gateways handle complex steps to move money securely between buyers and sellers. Let’s look at how transactions flow through the system, from initial authorization to final settlement.

Transaction lifecycle

When you make a purchase, the payment gateway kicks into action. It starts by encrypting your card details and sending them to the bank. The bank checks if you have enough funds and if the transaction seems legit. If all looks good, they give a thumbs-up.

Next, the gateway tells the store your payment went through. The store can now ship your item. But the money isn’t in their account yet. That comes later in a process called settlement.

The gateway keeps track of all these steps. It logs each action in a special book called a ledger. This helps catch any issues and makes sure no one loses money by mistake.

Authorization and capture process

The authorization step happens fast – usually in seconds. Here’s how it works:

- You enter your card info on the store’s website

- The gateway encrypts your data

- It sends this info to your bank

- The bank checks your balance for any red flags

- The bank sends back a yes or no

If it’s a yes, the store can capture the payment. This means they’re ready to take the money. But they might wait until they ship your item.

Sometimes things go wrong. Maybe the internet cuts out or a server crashes. Good gateways have backup plans. They might try again or use a different route to get your payment through.

Settlement and funding

After the store ships your item, they tell the gateway to finish the payment. This starts the settlement process:

- The gateway bundles up all the day’s approved sales

- It sends this info to the card networks (like Visa or Mastercard)

- The networks tell the banks to move the money

- Banks transfer funds to the store’s account

This usually takes 1-3 business days. The exact time depends on banks and card types.

The gateway’s ledger system keeps careful track of all these money moves. It makes sure the right amount goes to the right place. This helps solve any mix-ups and keeps everything fair for buyers and sellers.

Payment system security

Payment gateways need strong security to keep money and data safe. Encryption is a key part of this. It turns sensitive info like card numbers into unreadable code. Only the right systems can decode it.

Tokenization adds another layer of protection. It replaces card data with random tokens. These tokens are useless to hackers if stolen.

Two-factor authentication helps stop fraud. It asks for a second proof of identity besides a password. This could be:

- A code sent by text

- A fingerprint scan

- Face recognition

Firewalls block suspicious traffic to payment systems. They act like guards, keeping bad actors out.

Regular security tests find weak spots before criminals do. Fixing these gaps quickly is vital.

PCI DSS rules set standards for handling card data. Following them is a must for any payment system.

Monitoring transactions can catch odd patterns. This helps spot and stop fraud attempts fast.

Secure coding practices prevent flaws in the system itself. Developers need to be trained in these methods.

Keeping software up-to-date patches known security holes. This should be done often to stay safe.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

User experience considerations

Good payment gateway design focuses on making things easy for customers. Two key areas matter most: how smoothly checkout works and how well it fits different devices.

Checkout flow optimization

A simple checkout process keeps customers happy. Break it into clear steps. Ask only for needed info. Use progress bars to show how far along people are. Auto-fill forms when possible. Let guests check out without making accounts.

Give clear error messages if something goes wrong. Explain how to fix issues. Show accepted payment methods upfront. Use trust badges to make people feel safe. Make buttons big and easy to tap.

Mobile and responsive design

More people shop on phones now. Your payment system needs to work well on all screen sizes. Make forms fit phone screens without zooming. Use big buttons that are easy to tap.

Space out from fields so fat fingers don’t hit the wrong thing. Let people scan credit cards or use mobile wallets. Make sure the text is big enough to read. Test on many devices to catch issues. A good mobile experience can boost sales a lot.

Payment methods support

Payment gateways work with many types of payments. This helps businesses reach more customers and increase sales. Let’s look at the main payment options gateways should handle.

Credit and debit card processing

Credit and debit cards are still very popular for online shopping. Payment gateways must be able to process major card brands like Visa, Mastercard, and American Express. They should also support newer card tech like EMV chip cards and contactless payments.

Gateways need strong security for card data. This includes encryption and tokenization to protect sensitive info. They should follow PCI DSS rules to keep card data safe.

Some key features for card processing:

- Real-time authorizations

- Fraud checks

- Recurring billing

- Refunds and chargebacks

Alternative payment methods

Many shoppers now use other ways to pay besides cards. Payment gateways should support these too:

- Digital wallets: Apple Pay, Google Pay, PayPal

- Bank transfers: ACH, wire transfers

- Buy now, pay later: Affirm, Klarna, Afterpay

- Crypto: Bitcoin and other digital currencies

Gateways can also handle local payment methods in different countries. Examples are iDEAL in the Netherlands and Boleto in Brazil.

Supporting many payment types helps businesses:

- Reach more customers

- Boost sales

- Cut payment costs

- Expand to new markets

Multi-currency and internationalization

Payment gateways need to work smoothly for customers around the world. This means handling different currencies and matching local payment habits.

Currency conversion

When you sell things online to other countries, you need to show prices in the buyer’s currency. This helps them understand costs better. Your payment system should change prices automatically based on current exchange rates.

Make sure to update these rates often. Buyers like seeing the final price in their money right away. This stops surprises at checkout.

Some payment tools let you set your own exchange rates. This can help cover fees or make a bit more profit. But be careful not to set rates too high, or buyers may go elsewhere.

Local payment preferences

People in different places like to pay in different ways. In some countries, credit cards are popular. In others, bank transfers or digital wallets are common.

Your payment system should offer methods that fit each country. For example:

- Europe: SEPA bank transfers

- China: Alipay and WeChat Pay

- India: UPI payments

Showing local options makes buyers more likely to complete their purchase. It also builds trust in your business.

Remember to follow the rules for each payment type. Some may need extra security steps or have limits on transaction sizes.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

PSP Integration and reconciliation

With the growing number of payment service providers (PSPs), businesses need efficient systems to integrate multiple payment methods while guaranteeing consistent transaction records. PSP integration allows companies to connect various payment options into one unified system, improving customer satisfaction and broadening market reach. However, effective reconciliation is equally necessary to ensure accurate financial tracking and prevent discrepancies across transactions.

Streamlining PSP integration

Integrating PSPs into your payment gateway involves connecting with external providers like Stripe, PayPal, or Square. This integration process allows businesses to support multiple payment methods from a single platform. Some essential steps for successful PSP integration include:

- API connectivity: Securely connect with each PSP using API integrations that allow seamless data exchange. Each PSP typically provides its API, which should be integrated carefully to align with your payment system’s structure.

- Data synchronization: Secure real-time data synchronization between your platform and PSPs. This helps prevent transaction delays and ensures that all transaction records are up-to-date.

- User-friendly interface: A streamlined interface allows for easy configuration of different PSPs, so your payment gateway remains versatile and adaptable.

Supporting multiple PSPs can expand payment options for customers, ultimately increasing sales. However, it’s important to test each integration thoroughly to avoid compatibility issues that could disrupt the payment process.

Reconciliation processes for transaction accuracy

Reconciliation is the process of verifying that the data between your payment gateway and PSP records match. This guarantees that all transactions are recorded accurately, which is important for maintaining financial consistency. Here are the key steps in effective reconciliation:

- Automated reconciliation: Use automated tools to compare transaction records from your PSPs with your internal database. Automated reconciliation helps reduce human error and accelerates the process.

- Daily record verification: Conduct daily checks on high-volume transaction days to guarantee consistency across all records. Daily verification minimizes the chance of errors that could accumulate over time.

- Exception handling: Develop a protocol for handling discrepancies in transaction records. This can include flagging discrepancies for review, enabling fast resolution, and maintaining clean transaction records.

Benefits of PSP integration and reconciliation

Integrating PSPs and maintaining thorough reconciliation procedures offer several advantages for your business:

- Improved financial accuracy: Reconciliation ensures every transaction is accounted for, preventing financial discrepancies and promoting trust with stakeholders.

- Enhanced reporting: With consistent data from all payment methods, your financial reports become more accurate, aiding in strategic decision-making.

- Operational efficiency: Automation of reconciliation and integration simplifies transaction management, reducing the time and resources required for manual checks.

By focusing on seamless PSP integration and rigorous reconciliation processes, businesses can enhance transaction transparency, reduce errors, and ultimately improve the reliability of their payment systems.

How to handle payment processing challenges

Payment systems can face many issues. Here are some ways to deal with common problems:

- Delays in processing: Set up alerts to spot slow transactions. Have backup payment providers ready. Tell customers about delays quickly.

- Failed payments: Try payments again after short waits. Send customers clear messages about why payments failed. Give them easy ways to fix issues or try again.

- Service breakdowns: Build your system to work even if parts go down. Use multiple servers in different places. Test often to find weak spots.

- Data security: Use strong encryption for all payment data. Follow rules like PCI DSS. Train staff on security best practices.

- Fraud prevention: Use tools to check for odd buying patterns. Ask for extra proof of identity when needed. Keep lists of known bad actors.

- High traffic times: Plan for big sales days. Add more server power when you expect lots of buyers. Test your system with fake high loads.

By planning for these issues, you can build a payment system that works well even when things go wrong.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Customer support and dispute resolution

Good customer support and fair dispute handling are key for any payment gateway. Users need help when issues come up with payments.

Chargeback handling

Chargebacks happen when a customer asks their bank to reverse a charge. As a payment gateway, you need a system to handle these. First, set up a way to get notified about new chargebacks quickly. Then gather proof that the charge was valid, like receipts or shipping info. Send this to the customer’s bank within their time limit.

Train your team on chargeback rules. They should know which cases you can fight and which to accept. Keep track of your chargeback rate. If it gets too high, card networks may fine you.

Some tips to avoid chargebacks:

- Use clear billing descriptors

- Send order confirmations

- Respond fast to customer questions

User refund processes

Make refunds easy for both merchants and customers. Let merchants start refunds from their dashboard. Give clear steps on how to do this. For partial refunds, let them choose the amount.

Set rules on refund timing. Many gateways allow full refunds for 30-90 days after purchase. For partial refunds, you might set a shorter window. Be clear about any fees for refunds.

Automate where you can. For example, auto-approve refunds under a certain amount. This speeds things up for customers. But have humans check larger refunds for fraud.

Tell customers what to expect:

- How long do refunds take

- When they’ll see the money back

- Any next steps they need to take

Monitoring and analytics

Payment gateways need ways to track transactions and produce reports. This helps catch problems and make smart choices about payments.

Real-time transaction tracking

Real-time tracking lets you see payments as they happen. You can spot issues fast and fix them right away. A dashboard shows key stats like success rates and payment amounts. It also flags errors or odd transactions.

You can set up alerts for important events. These might include large payments, failed transactions, or high volumes. Alerts help you react quickly to protect your business and customers.

Some systems use AI to spot fraud patterns. This adds an extra layer of security to your payment process.

Reporting tools

Reporting tools turn transaction data into useful info. You can make charts and graphs to see trends over time. This helps you understand your payment flows better.

You can check things like:

- Which payment methods are most popular

- What times of day have the most transactions

- Which products sell best

Custom reports let you dig into specific areas. You might want to look at refund rates or compare different markets.

Many tools let you export data for deeper analysis. You can use spreadsheets or other software to crunch the numbers.

Regular reports keep you informed about your payment system’s health. They show if you’re meeting goals and where you can improve.

Create your online store in minutes!

Looking to sell online? Develop and launch your store with 10Web AI Ecommerce Website Builder.

Future prospects and innovations

As the digital landscape evolves, so do payment gateway capabilities. Emerging technologies like biometric authentication, blockchain, and AI optimization are shaping the future of payment gateway architecture. By embracing these advancements, businesses can prepare for more secure, efficient, and user-friendly payment systems.

Biometric authentication for improved security

Biometric authentication, such as fingerprint, facial, and voice recognition, introduces a new security layer to payment gateways, reducing fraud and increasing customer trust.

- Improved user experience: Biometrics simplify authentication, eliminating passwords and streamlining checkout.

- Fraud reduction: Personalized security makes unauthorized access more challenging.

- Scalability: Mobile technology advances make biometrics accessible to global businesses of all sizes.

Blockchain for transparent transactions

Blockchain improves payment security and transparency by using decentralized ledgers, providing businesses with a tamper-proof way to process transactions.

- Data integrity: Immutable records guarantee secure, transparent data, reducing unauthorized changes.

- Cross-border payments: Blockchain enables faster, cost-effective international transactions.

- Smart contracts: Automated payments under predefined conditions simplify complex transactions like subscriptions.

AI optimization for predictive analytics and personalization

AI transforms payment gateways with predictive analytics and personalized experiences, helping adapt to user behavior, optimize fraud detection, and increase operational efficiency.

- Predictive fraud detection: AI flags unusual patterns, reducing unauthorized payments in real time.

- Personalized payment experiences: AI tailors payment methods to user preferences.

- Operational efficiency: Machine learning forecasts transaction volumes, aiding resource allocation and high-traffic management.

Conclusion

A well-designed payment gateway can make all the difference between a one-time customer and a loyal one. By focusing on simplicity, speed, and security, businesses create a checkout experience that feels easy and reliable, encouraging customers to return. Thoughtful payment gateway design isn’t just about functionality; it’s about building trust and improving the customer journey from start to finish. As online shopping continues to expand, investing in seamless payment gateway design is a powerful way to strengthen customer relationships and grow long-term success.